Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

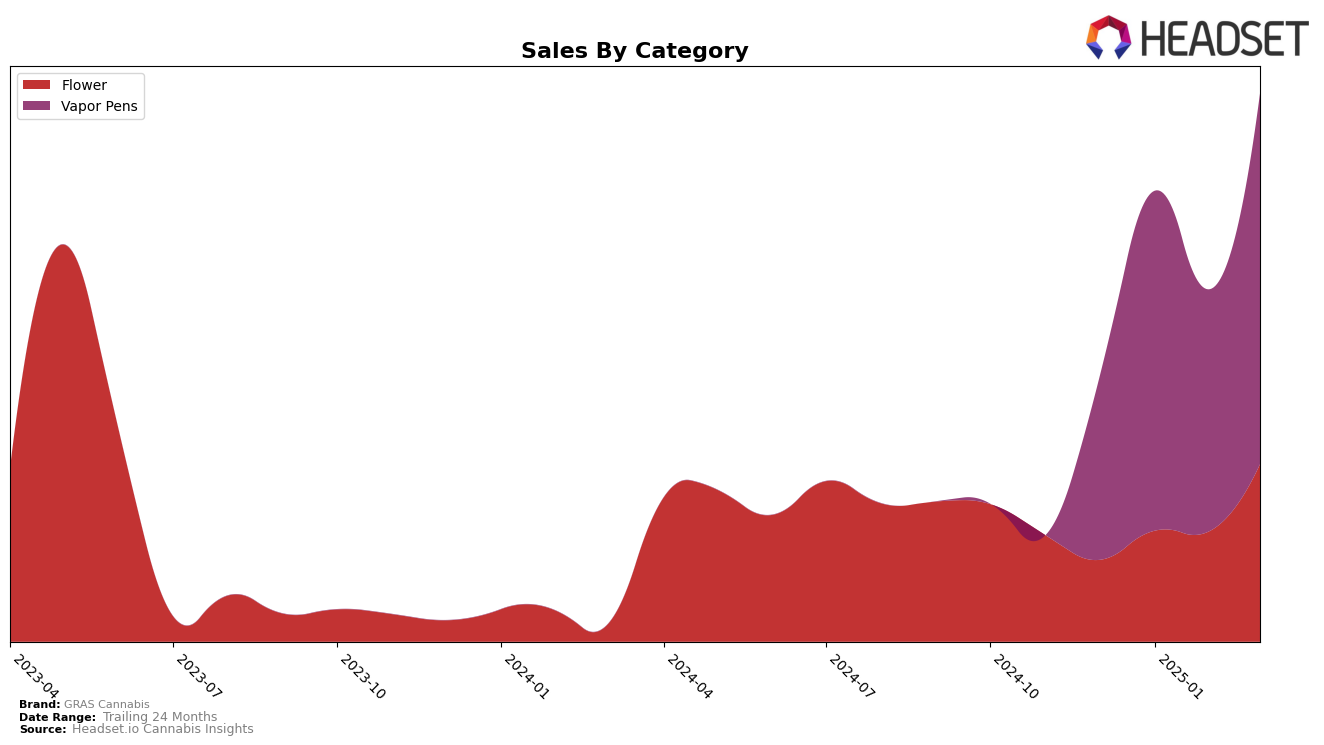

In Arizona, GRAS Cannabis has shown notable growth in the Flower category. Starting from a rank of 42 in December 2024, the brand made a significant leap to enter the top 30 by March 2025, ranking 28th. This upward trajectory is indicative of a strong market presence and increasing consumer preference. The sales figures corroborate this trend, with a marked increase from December to March, suggesting that GRAS Cannabis is effectively capturing market share in the Flower segment. Conversely, the fact that GRAS Cannabis was not in the top 30 in December highlights a competitive environment in Arizona's Flower market, making their recent climb even more impressive.

In the Vapor Pens category within Arizona, GRAS Cannabis has maintained a more consistent presence. The brand ranked 20th in December 2024 and improved to 13th by March 2025. This steady climb through the ranks suggests a robust performance and possibly an expanding product line or improved distribution strategies. The sales data reflects a healthy increase, particularly between January and March 2025, which could imply successful marketing campaigns or heightened consumer demand. The absence of GRAS Cannabis from the top 30 in some months for other categories could indicate areas for potential growth or a need for strategic adjustments to enhance their market position further.

Competitive Landscape

In the competitive landscape of Vapor Pens in Arizona, GRAS Cannabis has shown a dynamic performance over the past few months. Starting from a rank of 20 in December 2024, GRAS Cannabis improved its position to 14 in January 2025, although it slipped slightly to 16 in February before climbing back to 13 in March. This fluctuation in rank indicates a competitive market where brands like Canamo consistently maintained a higher rank, holding positions 10 and 11 across the months. Meanwhile, Flav and Sessions Cannabis Extract (OR) have also shown strong performances, with Flav moving from 16 to 12 and Sessions Cannabis Extract improving from 25 to 14. Despite these challenges, GRAS Cannabis's sales saw a notable increase in March, suggesting potential for further rank improvements if this trend continues.

```

Notable Products

In March 2025, the top-performing product for GRAS Cannabis was the 24K Gold Punch Distillate Disposable (1g) in the Vapor Pens category, which climbed to the number one position with sales of 4328 units. Blue Widow Distillate Disposable (1g) and Golden Pineapple Distillate Disposable (1g), both also in the Vapor Pens category, tied for the second spot, maintaining strong performances with sales of 4152 units each. Strainbow Distillate Disposable (1g) secured the third rank, showing consistent performance from the previous month. Lychee Dream Distillate Disposable (1g) dropped to fourth place after being the top product in January 2025. Notably, 24K Gold Punch Distillate Disposable (1g) showed a significant improvement from its fifth-place rank in February, highlighting its rising popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.