Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

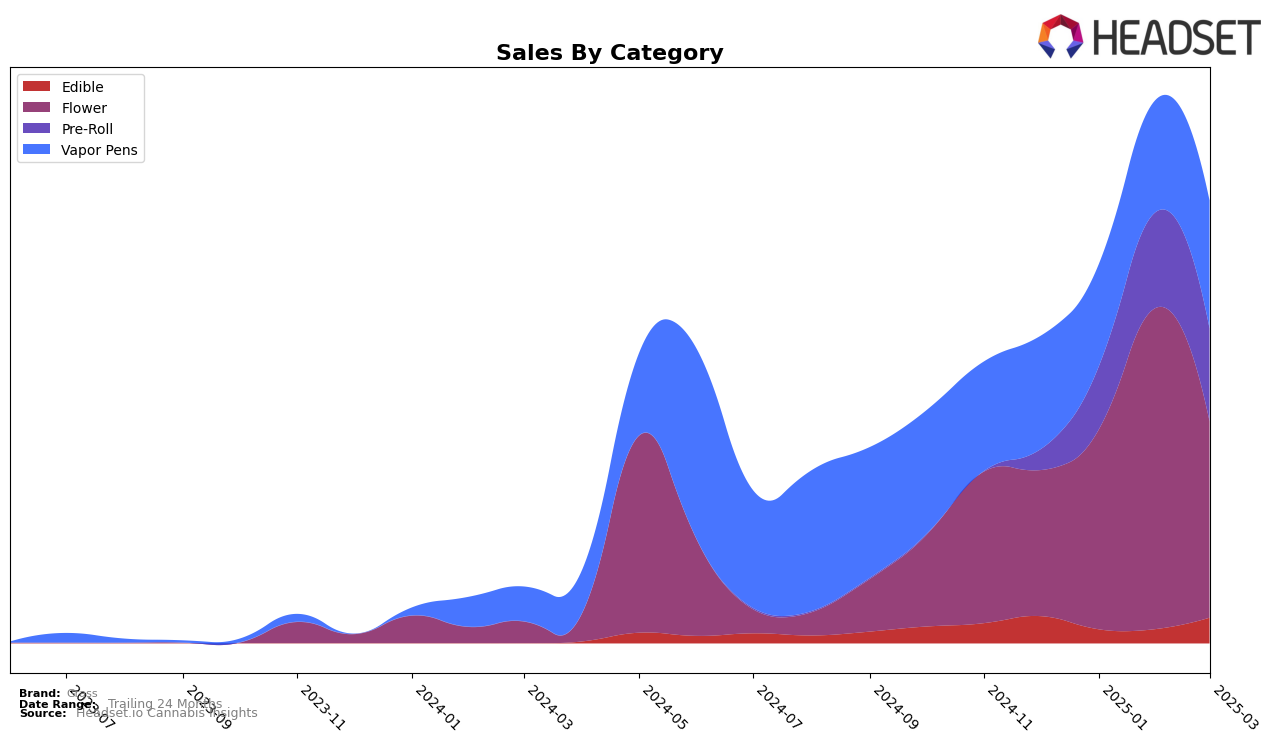

In Maryland, Grass has shown varying performance across different cannabis categories over the past few months. In the Edible category, Grass has maintained a presence within the top 30, with a slight drop to 32nd place in January 2025 but recovering to 28th by March. This indicates a potential for growth or stabilization in this segment. The Flower category has seen more fluctuation, with Grass not making it to the top 30 in December 2024 but climbing to 22nd place by February 2025, before settling at 28th in March. This movement suggests a competitive but promising market position for Grass in Flower products.

The Pre-Roll category tells a story of significant improvement for Grass in Maryland. Starting from a rank of 40 in December 2024, Grass made a remarkable leap to 18th place by February 2025, although it slightly declined to 22nd in March. This upward trend is noteworthy and could be indicative of growing consumer preference for Grass's Pre-Roll offerings. In the Vapor Pens segment, Grass's performance has been relatively stable, maintaining a position within the top 30 throughout the months, with a small dip in January but recovering by March. This consistency points to a steady demand for Grass's Vapor Pens in Maryland, although the brand has room to climb higher in the rankings.

Competitive Landscape

In the Maryland flower category, Grass has demonstrated a dynamic performance from December 2024 to March 2025. Initially ranked at 33rd in December, Grass climbed to 22nd by February, showcasing a significant improvement in its market position. However, by March, it slipped back to 28th, indicating a potential challenge in maintaining its upward trajectory. This fluctuation in rank is contrasted by competitors like Verano and Cultivar Collection, both of which showed a steady ascent in rankings, with Verano moving from 37th to 27th and Cultivar Collection from 40th to 30th over the same period. Notably, Matter. maintained a relatively stable rank, hovering around the mid-20s, which might suggest a more consistent sales strategy. Grass's sales peaked in February, aligning with its highest rank, but the subsequent decline in March sales and rank suggests a need for strategic adjustments to sustain growth amidst rising competition.

Notable Products

In March 2025, the top-performing product for Grass was Baltimore Crush Gummies 10-Pack (100mg) in the Edible category, which climbed to the number one rank with notable sales of 1864 units. Following closely, Johnny Glaze Pre-Roll 2-Pack (1g) secured the second spot, showing a slight decline from its previous first-place ranking in January 2025. Lemon Berry Tart Distillate Cartridge (1g) emerged as a strong contender, entering the rankings at third place in the Vapor Pens category. The Source Pre-Ground (14g) maintained a consistent performance, holding the fourth rank, unchanged from February 2025. Bread Stick Pre-Roll 2-Pack (1g) rounded out the top five, making its debut in the rankings this month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.