Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

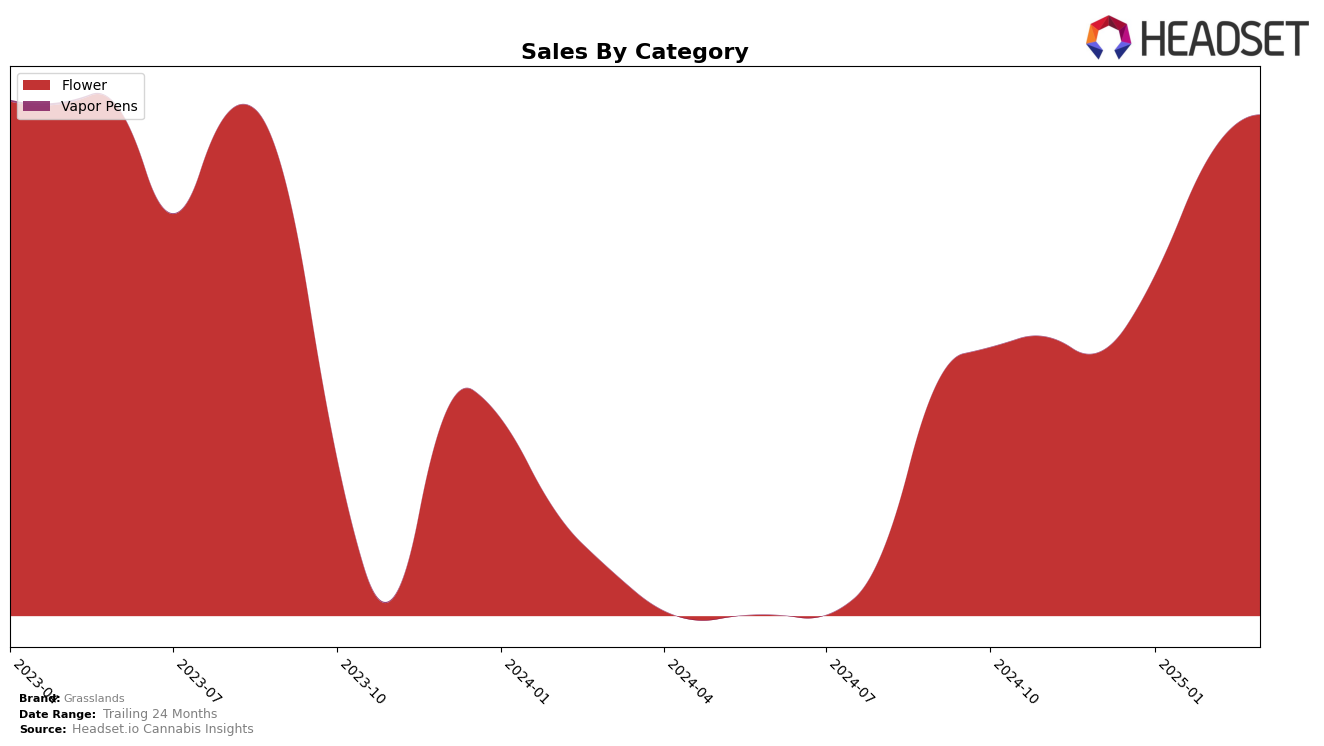

Grasslands has shown a notable performance in the British Columbia market, particularly in the Flower category. The brand climbed from the 23rd rank in December 2024 to the 16th rank by March 2025. This upward trajectory indicates a strong market presence and increasing consumer preference in the region. However, in Alberta, Grasslands did not make it into the top 30 brands for the Flower category in January 2025, which suggests potential challenges or increased competition during that period. Nevertheless, by March 2025, Grasslands improved its position to 68th, highlighting a recovery and potential growth in this market.

In terms of sales trends, Grasslands experienced a significant increase in British Columbia, with sales figures showing consistent growth from December 2024 through March 2025. This suggests a strong consumer demand and successful brand strategies in this province. Conversely, the performance in Alberta shows a more fluctuating pattern, with a notable jump in sales from February to March 2025, indicating a positive turn despite the earlier absence from the top rankings. This contrast between the two regions highlights the varying dynamics and market conditions that Grasslands navigates across different provinces.

Competitive Landscape

In the competitive landscape of the Flower category in British Columbia, Grasslands has shown a positive trajectory in terms of rank and sales over the first quarter of 2025. Starting from a rank of 23 in December 2024, Grasslands improved its position to 20 in January 2025, reaching a peak rank of 14 in February 2025, before slightly declining to 16 in March 2025. This upward movement is indicative of a strong performance, especially when compared to competitors like Spinach, which saw a decline from rank 7 in January to 15 by March, and Woody Nelson, which dropped from 12 to 18 over the same period. Meanwhile, Jonny Chronic emerged as a formidable competitor, improving significantly from rank 37 in December to 14 by March, closely matching Grasslands' performance. Despite this competitive pressure, Grasslands' consistent sales growth, particularly from January to March, positions it as a resilient player in the market, suggesting a strong brand appeal and effective market strategies.

Notable Products

In March 2025, the top-performing product for Grasslands was Sativa (28g) in the Flower category, maintaining its first position for four consecutive months with sales reaching 4206 units. Indica (28g) also continued to hold the second spot, with a notable increase in sales to 3960 units. These two products have consistently led the rankings since December 2024, showing a steady rise in demand. The consistent performance of these products suggests a strong consumer preference for these specific strains. The sales figures for March indicate a continued upward trend in the popularity of Grasslands' Flower category products.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.