Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

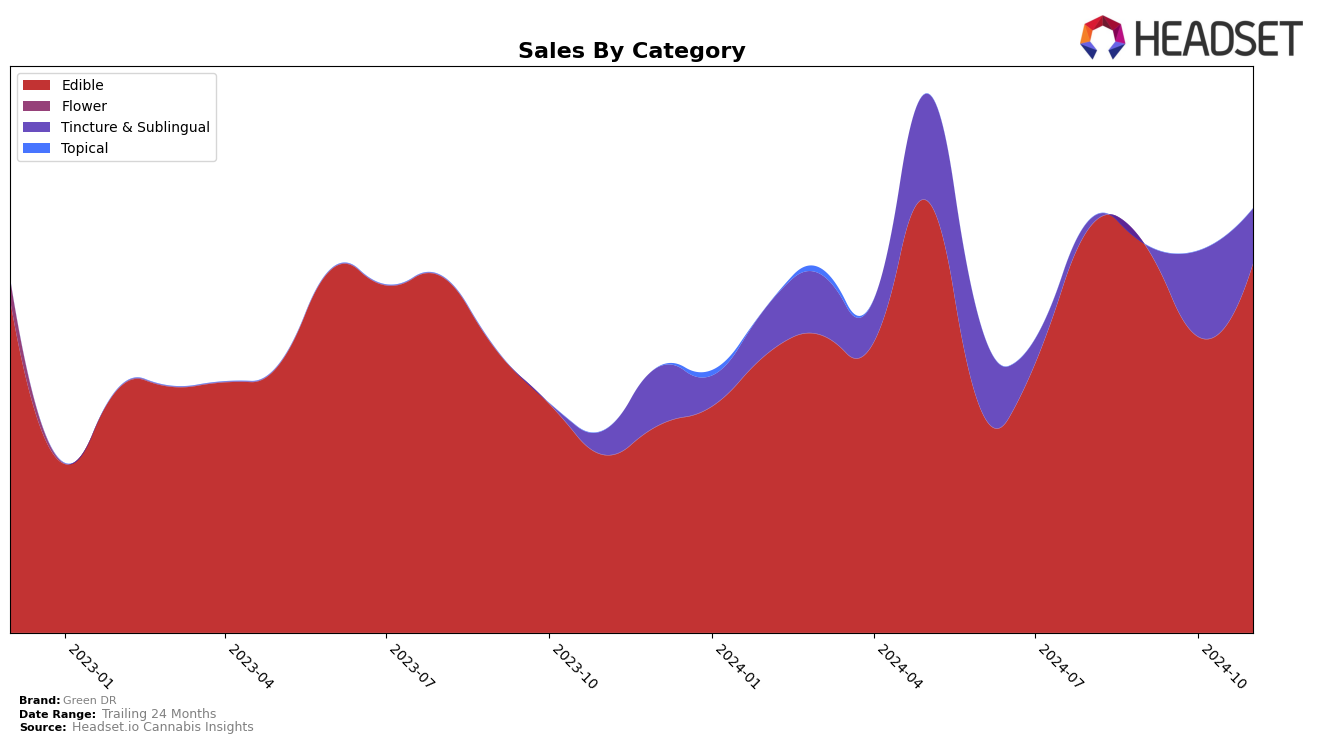

Green DR's performance across different categories and states reveals some intriguing patterns, particularly in the Edible category within Michigan. In this state, the brand has not been able to secure a spot in the top 30 rankings for August and October 2024, indicating room for improvement in their competitive standing. However, they made a slight movement in November, ranking 94th, which suggests a positive, albeit modest, trajectory. This movement might be attributed to strategic changes or seasonal demand shifts, but further analysis would be needed to pinpoint the exact cause. Despite not making it into the top 30, the fact that they improved their ranking from September to November is a noteworthy development for stakeholders to monitor.

While the brand's sales figures in Michigan for the Edible category show a slight decrease from August to November, this could be reflective of broader market trends rather than a decline in brand appeal. The November sales figure, though slightly lower than August, still represents a consistent presence in the market, which could be leveraged for strategic growth. The absence of Green DR in the top 30 rankings during certain months might be concerning, yet it also highlights potential growth opportunities if the brand can effectively address market demands and competitive pressures. Understanding these dynamics is crucial for aligning future strategies to enhance their market footprint.

Competitive Landscape

In the Michigan edible market, Green DR has experienced fluctuating rankings over the past few months, indicating a competitive landscape. In September 2024, Green DR was ranked 99th, but it improved slightly to 94th by November 2024. This upward movement, albeit modest, suggests a positive reception or strategic adjustments. However, Green DR still faces stiff competition from brands like Butter Brand, which saw a significant jump from 75th in September to 61st in October before dropping to 80th in November. Meanwhile, Just Edibles had a sporadic presence, ranking 98th in October but missing from the top 20 in other months, which could indicate inconsistent performance or supply issues. Additionally, Peachy Hash & Co. maintained a relatively stable position, hovering around the mid-80s and 70s, suggesting a steady consumer base. These dynamics highlight the need for Green DR to enhance its market strategies to climb higher in the rankings and boost sales in a highly competitive environment.

Notable Products

In November 2024, Green DR's top-performing product was the CBD/CBN/CBG Trifecta Pain Relief Gummies 10-Pack, maintaining its number one rank for four consecutive months with sales of 188 units. The CBD/CBG/CBG Trifecta Pain Relief Gummies 30-Pack and CBD/CBN Sweet Dreams Gummies 50-Pack retained their second and third positions, respectively, consistent with their rankings from previous months. The CBD Tincture (1000mg CBD, 30ml) held steady at fourth place, showing no change in its rank since August. Notably, the CBD Dog Treats 10-Pack maintained its fifth position, despite being a relatively new entry in the rankings since October. Overall, the rankings of Green DR's top products remained stable from August through November, highlighting the consistent demand for their edible offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.