Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

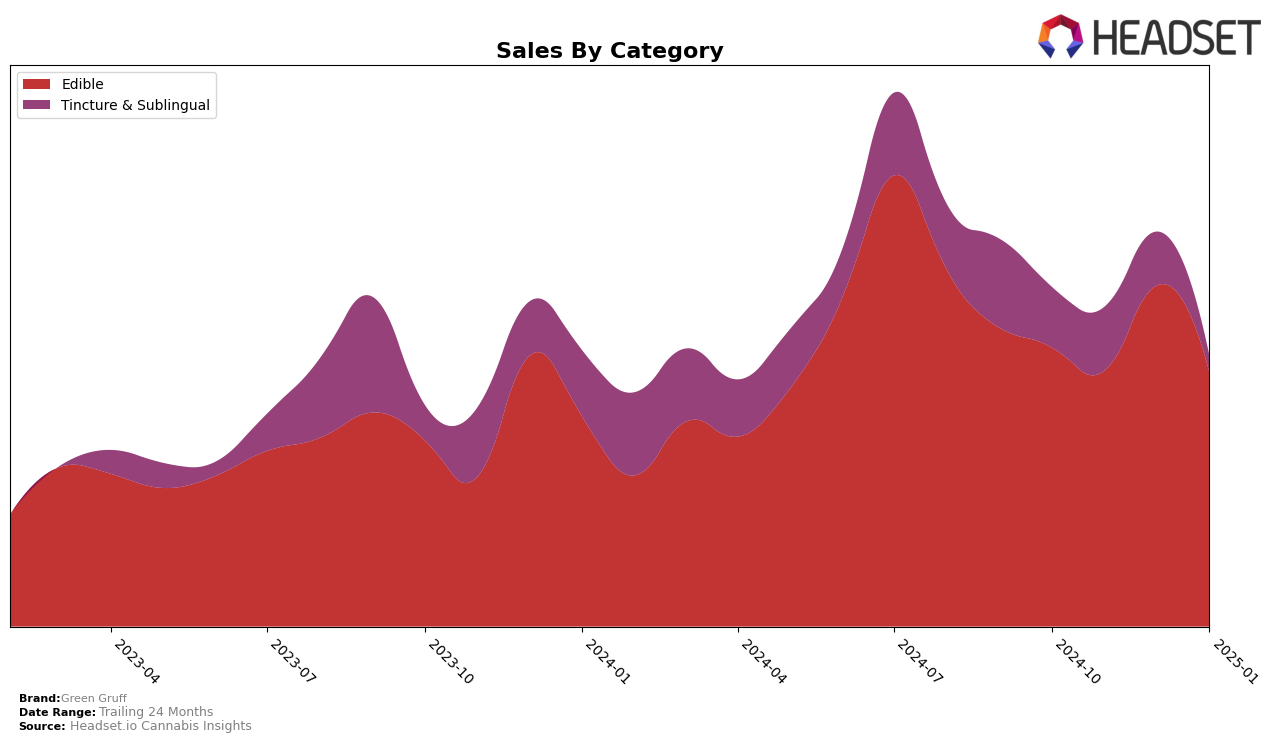

Green Gruff's performance in the Edible category within the state of Michigan has shown some notable dynamics over the past few months. Despite not being ranked within the top 30 brands in October, November, and December of 2024, the brand managed to break into the rankings in January 2025, albeit at the 99th position. This movement indicates a potential upward trajectory or increased market penetration, albeit from a lower starting point. The absence from the top 30 in the preceding months suggests that Green Gruff faced challenges in gaining significant market share during that period.

The sales figures for Green Gruff in Michigan provide additional context to their ranking journey. With recorded sales of $10,189 in October 2024, it is clear that while the brand was not a top contender, it maintained a presence in the market. The lack of ranking in the subsequent months until January 2025 suggests that while there might have been consistent sales, they were insufficient to propel the brand into a competitive position until the start of 2025. This could imply a strategic pivot or increased consumer interest that might be worth monitoring for future trends.

Competitive Landscape

In the Michigan edible cannabis market, Green Gruff has experienced fluctuations in its competitive standing, notably entering the top 100 in January 2025 with a rank of 99, after not being in the top 20 in the preceding months. This indicates a positive shift in market presence, albeit still trailing behind competitors like Smokiez Edibles, which consistently maintained a rank of around 40, and Shatter House Extracts, which showed variability but stayed within the top 100. Meanwhile, Vlasic Labs also demonstrated a similar trajectory to Green Gruff, reappearing in the rankings in December 2024 at 95. These dynamics suggest that while Green Gruff is making headway, there is significant room for growth to catch up with more established brands in terms of market penetration and sales performance.

Notable Products

In January 2025, Green Gruff's top-performing product was CBD Relax & Calming Dog Plus Chews 24-Pack (120mg CBD), maintaining its first-place rank consistently from October 2024 through January 2025, despite a decrease in sales to 109 units. The CBD Plus Ease Joint & Hip Dog Treats Chews 90-Pack (450mg CBD) held steady in the second position since its introduction in December 2024. CBD Ease Joint & Hip Coconut Pumpkin Dog Treats 24-Pack (60mg CBD) remained in third place, showing stability in its ranking over the past months. CBD Relax & Calming Dog Chews 90-Pack (180mg CBD, 6.35Oz) stayed in fourth place from November 2024 onwards, with a slight sales increase in January 2025. Notably, CBD Soothe Skin & Coat Salmon Flavor Chews 90-Pack (225mg CBD) entered the rankings in January 2025 at fifth place, marking its debut with 37 sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.