Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

Green Revolution has demonstrated varied performance across different states and product categories. In California, the brand did not secure a spot in the top 30 for edibles from November 2025 to February 2026, indicating a potential area for growth or a highly competitive market. Conversely, in New York, Green Revolution made its mark by entering the rankings at 48th place in January 2026, suggesting an upward trajectory in this market. This movement could reflect strategic efforts to penetrate the New York market or a growing consumer interest in their products.

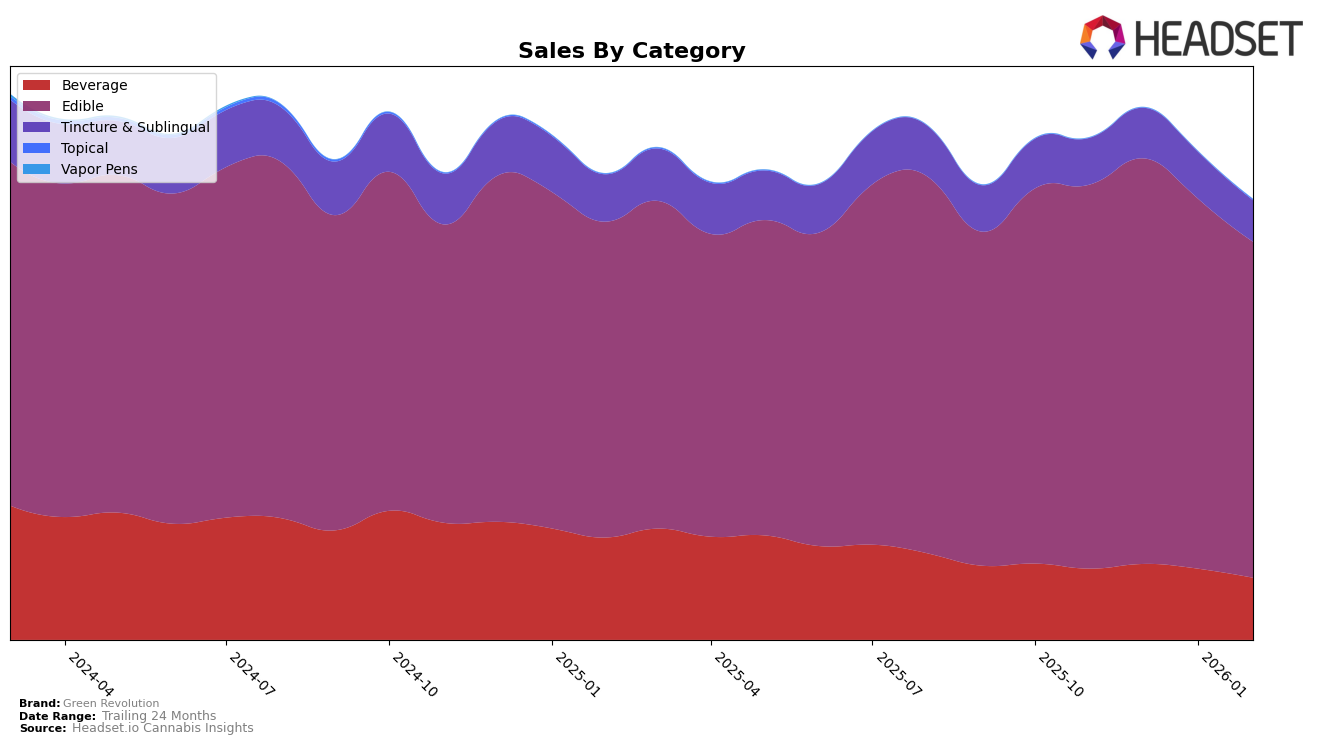

In Washington, Green Revolution has consistently maintained strong positions across multiple categories. The brand holds the number one spot in the tincture and sublingual category, demonstrating its dominance and consumer preference in this segment. Additionally, it ranks second in edibles and fourth in beverages, with sales showing a slight decline from December 2025 to February 2026. This stable performance in Washington highlights the brand's established presence and consumer loyalty, even as it faces challenges in other regions. However, the decline in beverage sales could indicate a need for strategic adjustments to maintain its competitive edge.

Competitive Landscape

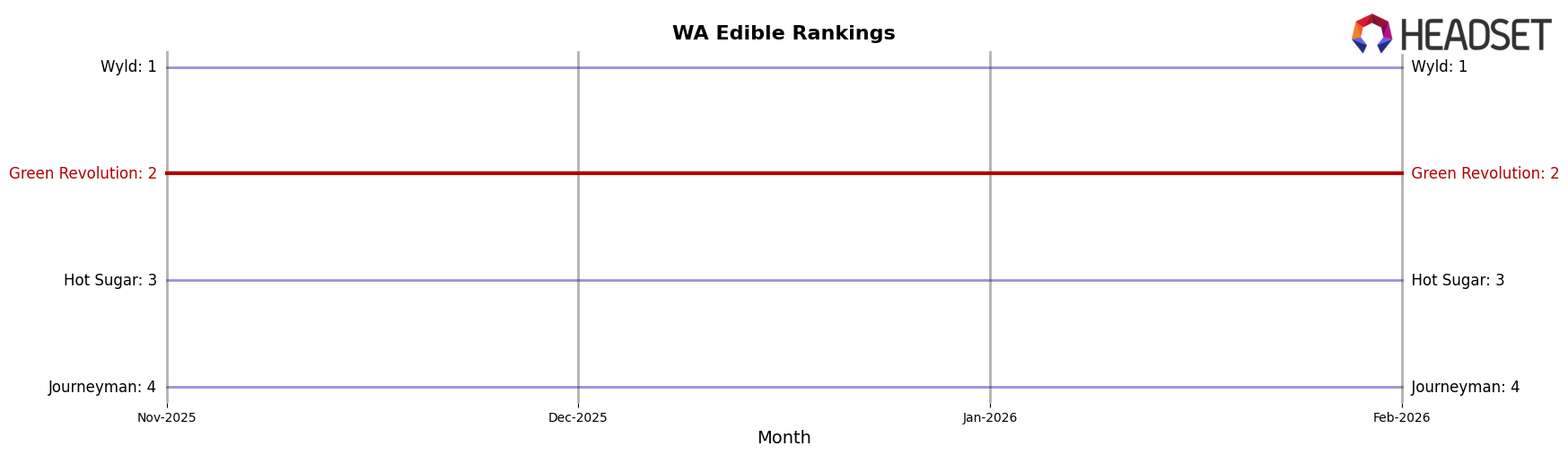

In the Washington edibles market, Green Revolution consistently maintained a strong position, holding the second rank from November 2025 through February 2026. Despite a slight decrease in sales from $1,100,974 in November 2025 to $981,706 in February 2026, Green Revolution's rank remained stable, indicating a resilient brand presence. In contrast, Wyld dominated the market, consistently securing the top position with significantly higher sales figures, suggesting a robust consumer preference. Meanwhile, Hot Sugar and Journeyman maintained their positions at third and fourth, respectively, with sales figures notably lower than Green Revolution's. This competitive landscape highlights Green Revolution's strong market positioning, though it faces a formidable challenge from Wyld, which leads the market by a considerable margin.

Notable Products

In February 2026, the top-performing product for Green Revolution remained the Nano Doozies - CBD/CBN /THC 1:1:1 Blue Raspberry Nighttime Gummies, maintaining its first-place ranking for the fourth consecutive month despite a decrease in sales to 9987. The Nano Doozies - CBD/THC 60:1 Raspberry Gummies continued to hold the second spot, recovering from a brief dip to third place in January. Doozies Chill - 3:1 CBN/THC Blackberry Punch Gummies climbed to third place, showing a positive shift from its previous fourth-place position. The Doozies - CBD/THC 60:1 Juicy Peach Gummies experienced a slight decline, moving from second place in January to fourth in February. A new entry, Doozies PLUS - CBD/THC/CBN 1:1:1 Midnight Grape Chamomile & Passion Flower Gummies, debuted at fifth place, indicating potential growth in the category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.