Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

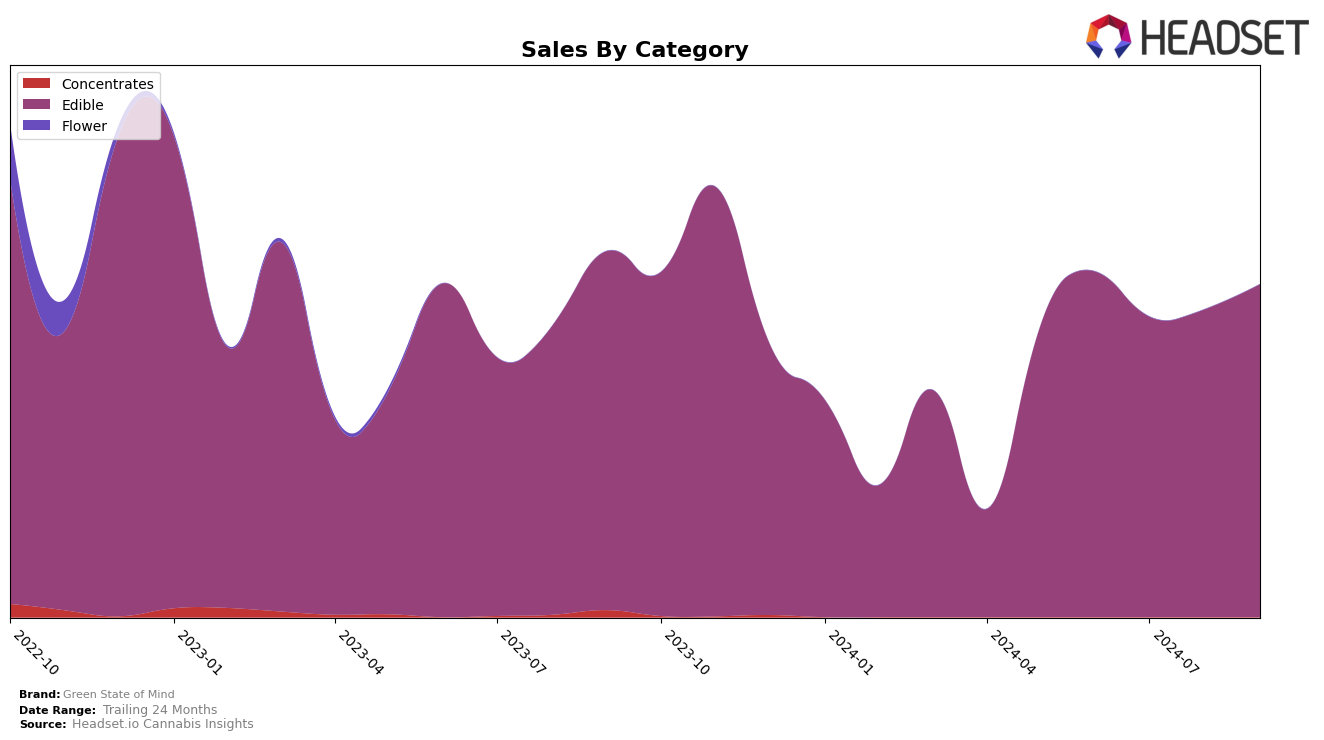

Green State of Mind has shown a dynamic performance across the states and categories in which it operates. In the Oregon edible market, the brand has experienced some fluctuations in its rankings over the past few months. Starting at 31st position in June 2024, the brand dropped to 34th in July, indicating a slight dip in its market presence. However, it managed to climb back to 29th place by September 2024, demonstrating a resilient recovery. This improvement is notable given the competitive nature of the edible category, suggesting that Green State of Mind is effectively navigating challenges and capitalizing on market opportunities.

While the brand's sales figures in Oregon reflect a positive trend with a noticeable increase from July to September, it's important to note that Green State of Mind did not make it into the top 30 brands in the state for several months. This absence from the top tier could be seen as a challenge, highlighting areas for potential growth and market penetration. The brand's ability to re-enter the top 30 by September is a promising sign, indicating that its strategies may be aligning with consumer preferences and market demands. Observing these movements provides valuable insights into the brand's adaptability and potential for future success in the cannabis industry.

Competitive Landscape

In the competitive landscape of the Oregon edible cannabis market, Green State of Mind has shown a resilient performance amidst fluctuating ranks and sales dynamics. Over the past few months, the brand has improved its rank from 34th in July 2024 to 29th in September 2024, indicating a positive trend in market presence. This upward movement is particularly noteworthy given the decline of competitors such as Concrete Jungle, which fell from 21st in June 2024 to 33rd by September 2024, and Willamette Valley Alchemy, which experienced a steady decline in sales despite maintaining a relatively stable rank. Meanwhile, SugarTop Buddery and Crop Circle Co have shown inconsistent rankings, with SugarTop Buddery dropping from 31st in July to 30th in September, and Crop Circle Co re-entering the top 20 in September after missing out in July. These shifts highlight Green State of Mind's ability to capitalize on market opportunities and improve its competitive standing, suggesting a strategic positioning that could attract more consumer interest and potentially boost sales further.

Notable Products

In September 2024, the top-performing product from Green State of Mind was Bitz - Indica Berry Gummies 10-Pack (100mg) in the Edible category, reclaiming its number one rank from June and leading with sales of 804 units. Bitz - Sativa Tropical Gummies 10-Pack (100mg) followed closely, dropping to the second position after being the top seller in August. Bitz - Tropical Gummies 10-Pack (50mg) maintained a consistent third-place ranking for three consecutive months. The Hybrid Sour Bitz Gummies 20-Pack (100mg) made a notable entry into the top ranks, tying for third place in September after being unranked in August. Botz - Marionberry Gummy (50mg) secured the fourth position, marking its entry into the rankings for the first time in September.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.