Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

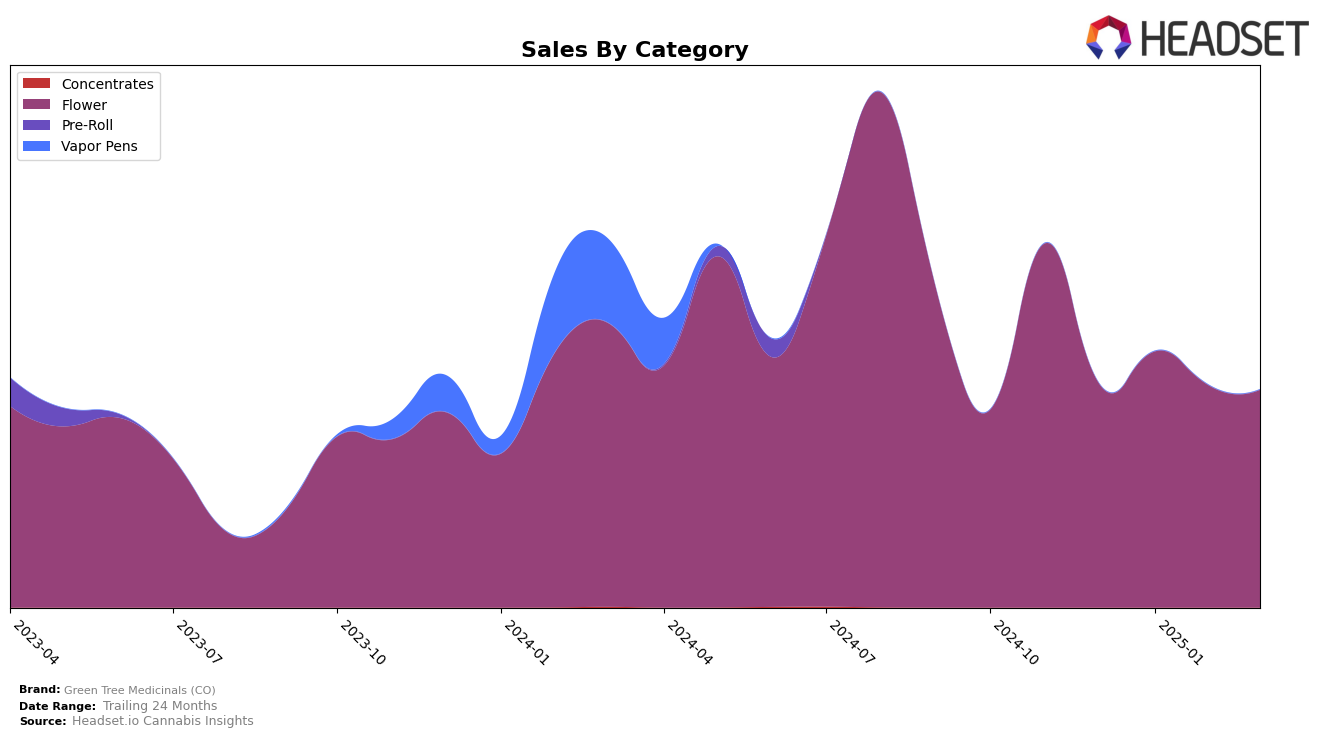

Green Tree Medicinals (CO) has shown a fluctuating performance in the Flower category within the state of Colorado. In December 2024, the brand was ranked 26th, which improved to 21st in January 2025, indicating a positive momentum. However, this upward trend was not sustained as the brand slipped to 27th in February and further declined to 30th by March 2025. This decline suggests potential challenges or increased competition within the Flower category in Colorado. Despite these fluctuations, Green Tree Medicinals maintained its presence in the top 30, which is a testament to its resilience in a competitive market.

It is noteworthy that Green Tree Medicinals (CO) did not appear in the top 30 rankings in any other state or category during this period, highlighting the brand's concentrated market presence in Colorado. The brand's sales figures reflect a similar trend to its rankings, with a notable peak in January 2025, followed by a gradual decline. This pattern suggests that while Green Tree Medicinals has the capability to capture market share effectively, it may face challenges in sustaining growth or expanding its reach beyond its current market stronghold. This performance could be indicative of the need for strategic adjustments to enhance brand positioning and competitiveness.

Competitive Landscape

In the competitive landscape of the Flower category in Colorado, Green Tree Medicinals (CO) has experienced fluctuations in its rank, indicating a dynamic market environment. Despite a strong start in December 2024 with a rank of 26, the brand saw an improvement in January 2025, climbing to 21. However, subsequent months showed a decline, with ranks of 27 in February and 30 in March. This suggests increased competition and potential challenges in maintaining market share. Notably, LoCol Love (TWG Limited) showed a significant jump from rank 33 in January to 11 in February, although it fell back to 32 in March, indicating volatility. Similarly, Nuhi improved from rank 30 in January to 16 in February, before slipping to 29 in March. Meanwhile, The Original Jack Herer made a notable leap from consistently being at rank 46 to 28 in March, suggesting a strategic shift or successful campaign. These movements highlight the competitive pressures Green Tree Medicinals (CO) faces, emphasizing the need for strategic marketing and product differentiation to sustain and improve its position in the market.

Notable Products

In March 2025, Green Tree Medicinals (CO) saw Secret Cherries (Bulk) maintain its top position in the Flower category, despite a notable drop in sales to 1138. Free MAC (Bulk) secured the second spot, consistent with its February ranking, but showed a slight decline in sales. A1 Stank Sauce (Bulk) rose to third place from fifth in January, indicating a positive sales trajectory. Holy Modo (Bulk) debuted in the rankings at fourth place, suggesting a successful product launch or increased popularity. Guptilla (Bulk), which previously held the second position in January, fell to fifth, reflecting a decrease in demand or competition from new entries.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.