Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

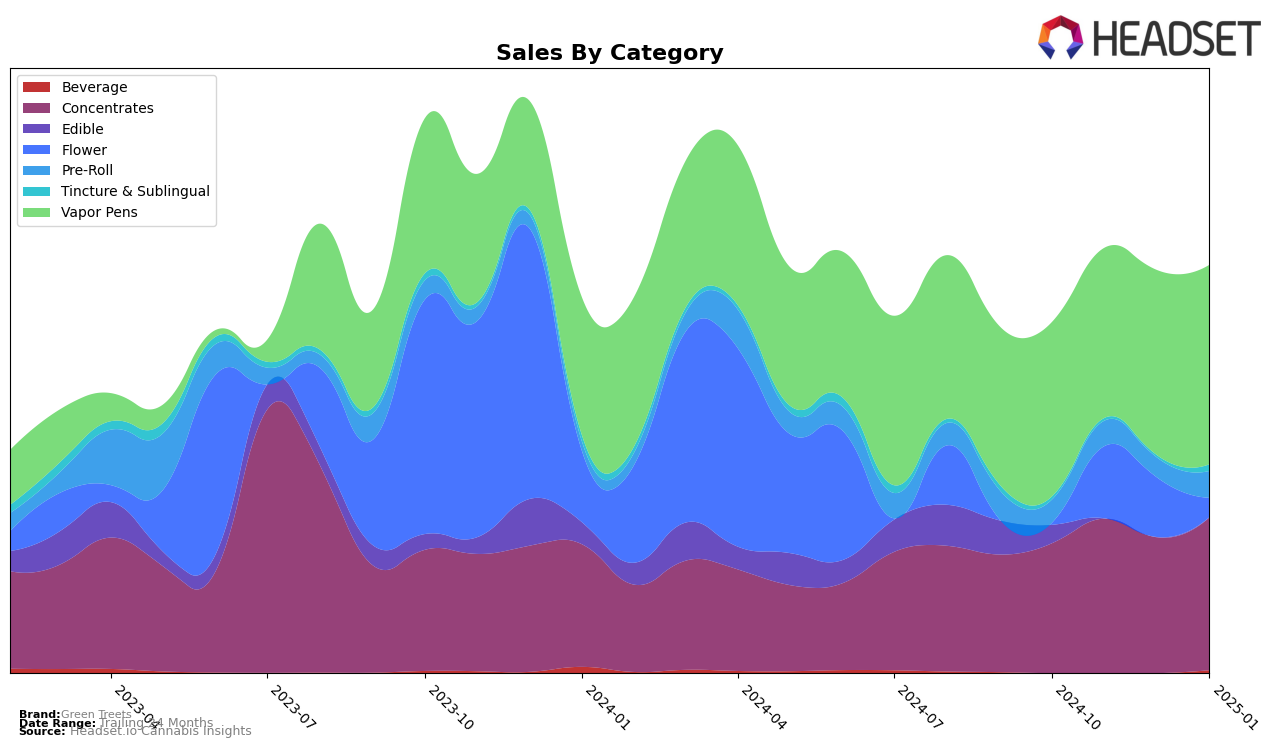

Green Treets has shown a noteworthy upward trajectory in the Colorado market, particularly within the Concentrates category. Over the span from October 2024 to January 2025, the brand improved its ranking from 39th to 27th, indicating a strong performance and increasing consumer preference. This positive movement is underscored by a consistent rise in sales figures, with a notable peak in January 2025. In contrast, Green Treets' presence in the Flower category has been less prominent, as they did not make it into the top 30 rankings, highlighting an area for potential growth or reevaluation.

In the Vapor Pens category, Green Treets maintained a stable performance, holding its position relatively steady around the mid-50s ranking, with slight improvements from October 2024 to January 2025. This suggests a solid market presence, although there is room for growth to break into higher ranks. On the other hand, the Pre-Roll category saw Green Treets absent from the top 30 in October and December 2024, but they made a comeback in January 2025, ranking at 63rd. This fluctuation indicates potential volatility or seasonal demand variations in this category. Overall, while Green Treets shows strength in certain areas, there are opportunities to bolster their market standing further across various categories.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Green Treets has demonstrated a notable upward trend in its market positioning. From October 2024 to January 2025, Green Treets improved its rank from 62nd to 52nd, indicating a positive shift in market presence. This progress is particularly significant when compared to competitors such as Concentrate Supply Co., which fluctuated between 49th and 56th, and Classix, which saw a similar pattern of volatility. Meanwhile, Revel (CO) maintained a relatively stable rank, hovering around the 50th position, and Bud Fox Supply Co experienced a decline from 43rd to 48th. This upward trajectory for Green Treets suggests a strengthening brand presence and potential for increased sales, as evidenced by their consistent sales growth over the same period, contrasting with some competitors who faced sales declines or stagnation. This data underscores the importance of strategic positioning and market adaptability in the competitive vapor pen category in Colorado.

Notable Products

In January 2025, Green Treets' top-performing product was the Pleasure Oil Cartridge (1g) in the Vapor Pens category, maintaining its rank at number one from November 2024 and achieving sales of 962. The Relieve Oil Cartridge (1g), also in the Vapor Pens category, secured the second position, consistent with its December 2024 ranking. The Focus Oil Cartridge (1g) improved its standing, moving up to third place from fifth in December 2024. The Primus Live Resin (1g) debuted in the rankings at fourth place within the Concentrates category. Lastly, the Sleep Oil Cartridge (1g) experienced a slight decline, dropping from fourth in December 2024 to fifth in January 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.