Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

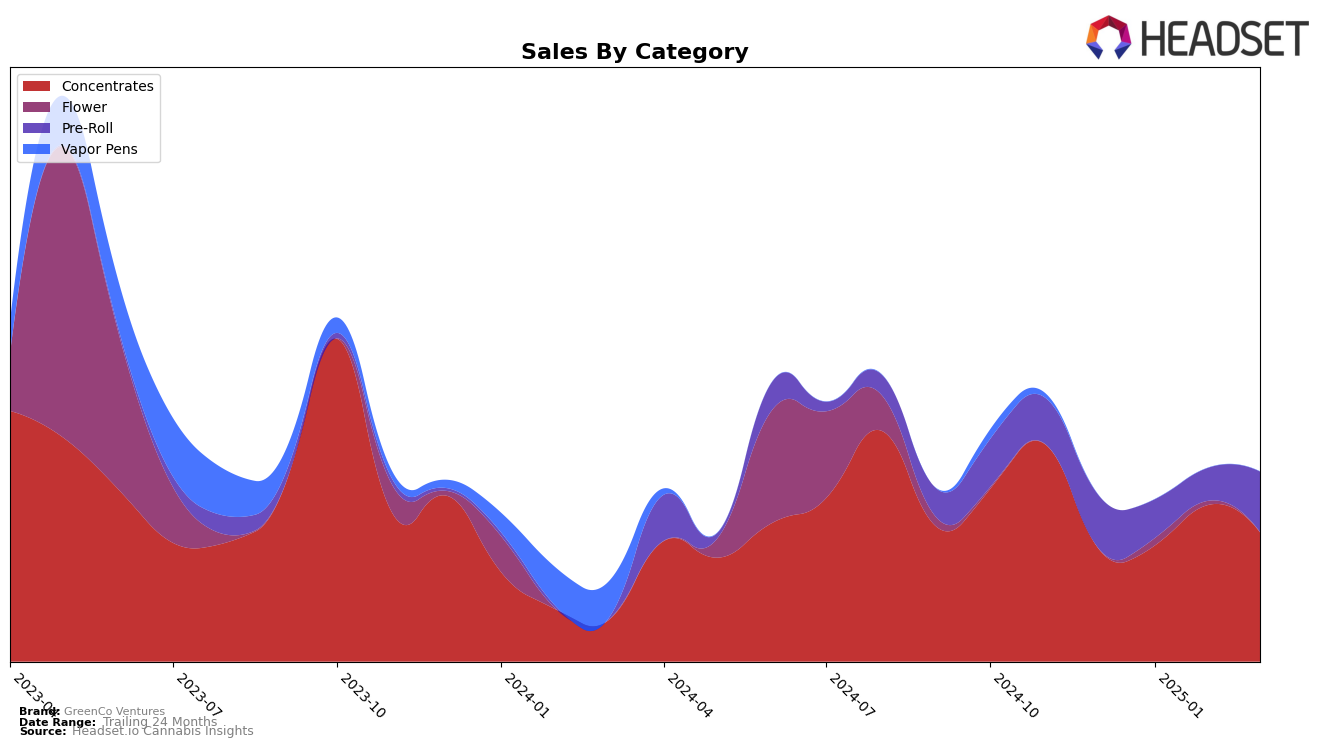

GreenCo Ventures has demonstrated a notable performance in the concentrates category in Michigan. Over the span from December 2024 to March 2025, the brand climbed from the 25th to the 20th position. This upward trend indicates a growing consumer preference for their concentrates, despite a slight dip in March after peaking in February. Such a movement suggests that the brand is gaining traction in this competitive segment, although the fluctuation in March could warrant a closer look at market dynamics or potential supply chain issues.

In contrast, GreenCo Ventures' performance in the pre-roll category in Michigan paints a different picture. The brand did not rank within the top 30, with rankings fluctuating significantly from 81st in December 2024 to 74th in March 2025. This indicates challenges in capturing market share in the pre-roll segment. Despite an improvement in March, the brand's position suggests that it may need to reassess its strategy to effectively compete with other more dominant players in this category. The substantial drop in sales from December to February, followed by a recovery in March, could reflect seasonal demand changes or the impact of new product launches by competitors.

Competitive Landscape

In the competitive landscape of Michigan's concentrates market, GreenCo Ventures has shown a dynamic performance over recent months. While GreenCo Ventures started at the 25th rank in December 2024, it improved to 18th by February 2025, before slightly dropping to 20th in March. This fluctuation indicates a competitive position, with sales peaking in February. Notably, Cloud Cover (C3) consistently outperformed GreenCo Ventures, maintaining a higher rank throughout the period, although it also experienced a dip in March. Meanwhile, Redemption showed a similar pattern of fluctuation, with a brief absence from the top 20 in February, suggesting volatility in consumer preferences. Light Sky Farms made a significant leap from 34th to 22nd, indicating a potential rising competitor. Old School Hash Co. experienced a decline from 11th to 21st, which may present an opportunity for GreenCo Ventures to capture market share from established brands facing challenges. Overall, GreenCo Ventures' trajectory suggests resilience and potential for growth amidst a competitive and shifting market landscape.

Notable Products

In March 2025, the Ice Cream Cake Infused Pre-Roll (1g) emerged as the top-performing product for GreenCo Ventures, climbing from the second position in February to secure the number one spot with sales of 13,362 units. The Chili Verde Pre-Roll (1g) slipped to second place, having previously held the top rank. The Papaya Cake Pre-Roll (1g) maintained its third-place position from December 2024 to March 2025, showing consistent performance. New to the top five, the Strawberry Runtz Pre-Roll (1g) and Biscotti Pre-Roll (1g) ranked fourth and fifth, respectively, in March. These rankings highlight a competitive shift in the Pre-Roll category, with notable sales increases among the top contenders.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.