Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

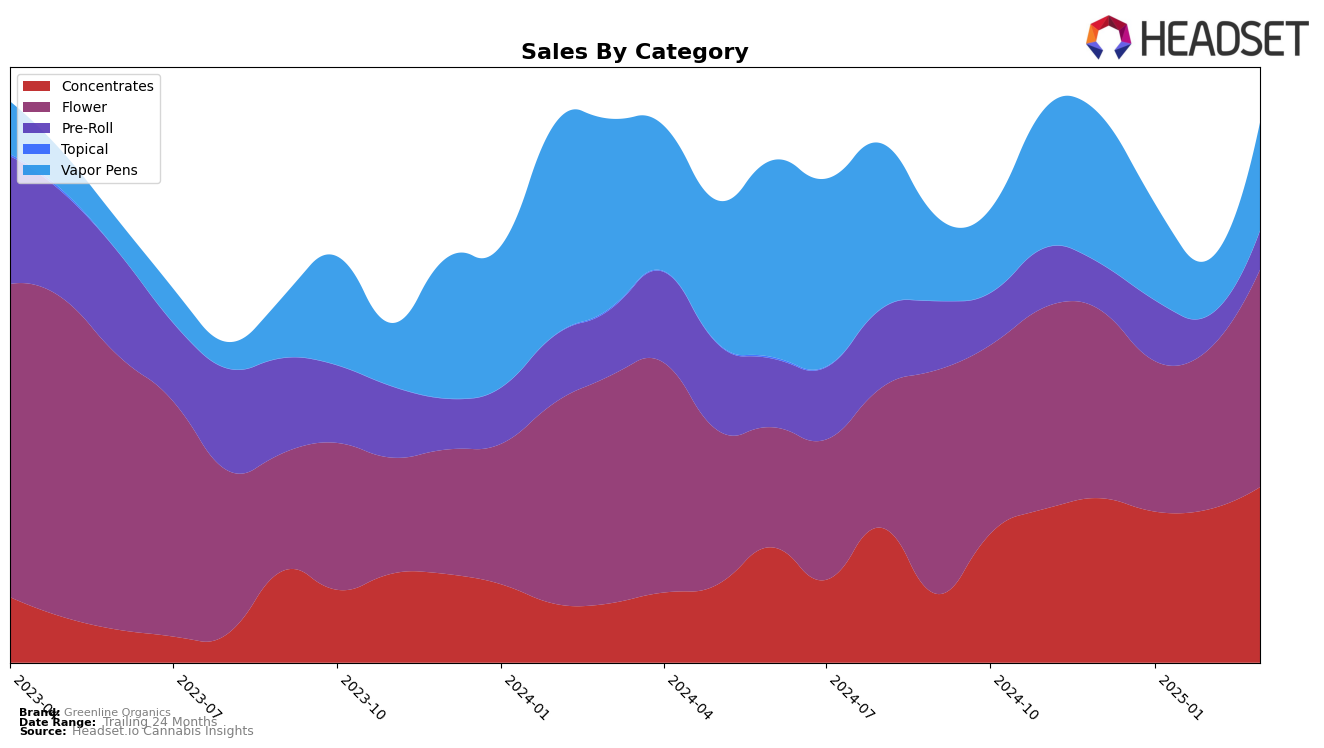

Greenline Organics has shown a consistent presence in the California concentrates market, maintaining a steady ranking of 20th place from December 2024 through February 2025, before climbing to 17th in March 2025. This upward trajectory suggests a positive reception of their products in this category. However, the vapor pens category tells a different story, with the brand dropping out of the top 30 in February 2025 after being ranked 80th and 92nd in the preceding months, only to reappear at 87th in March. This fluctuation indicates potential volatility in consumer preferences or market competition. Notably, Greenline Organics did not rank in the top 30 for flower in California until March 2025, where they debuted at 99th, which may suggest a need for strategic adjustments or increased market penetration efforts in this category.

Examining the sales data further, Greenline Organics experienced a notable increase in sales for concentrates in March 2025, reaching $175,075, up from previous months, which aligns with their improved ranking. This growth could be indicative of successful marketing strategies or product innovations that have resonated with consumers. Conversely, the vapor pens category did not exhibit a similar sales pattern, reflecting potential challenges in maintaining consumer interest or competitive positioning. The absence of ranking in the flower category until March 2025, despite having some sales, highlights an area where Greenline Organics might explore opportunities to enhance visibility and consumer engagement. Overall, while Greenline Organics shows strength in concentrates, there are opportunities for growth and stabilization in other categories within California.

Competitive Landscape

In the competitive landscape of the California flower category, Greenline Organics has faced notable challenges in maintaining its rank and sales momentum. As of March 2025, Greenline Organics was not ranked among the top 20 brands, indicating a significant drop from its December 2024 position. This decline is contrasted by the performance of competitors such as White Label / White Lvbel (NV), which improved its rank from 98th in December 2024 to 79th in January 2025, accompanied by a substantial increase in sales. Similarly, 5G (530 Grower) experienced a rank fluctuation, dropping from 82nd to 96th, yet still maintaining a competitive edge over Greenline Organics. Meanwhile, brands like TRENDI and Sun Smoke have consistently outperformed Greenline Organics in sales, suggesting a need for strategic adjustments to regain market share and improve brand visibility in this highly competitive market.

Notable Products

In March 2025, Sour Tangie Badder (1g) emerged as the top-performing product for Greenline Organics, leading the sales in the Concentrates category with a significant figure of 2192. Orange Tree (3.5g) from the Flower category held the second position, maintaining its strong presence from its top rank in February 2025. Grape Gush Badder (1g) secured the third spot, followed by Orange Fuel Badder (1g) and Holy Jammerz Badder (1g), which ranked fourth and fifth, respectively. Notably, Sour Tangie Badder (1g) made a remarkable debut in the rankings, while Orange Tree (3.5g) slightly dropped from its previous lead. The Concentrates category dominated the top five, showcasing a shift in consumer preference towards these products in March 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.