Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

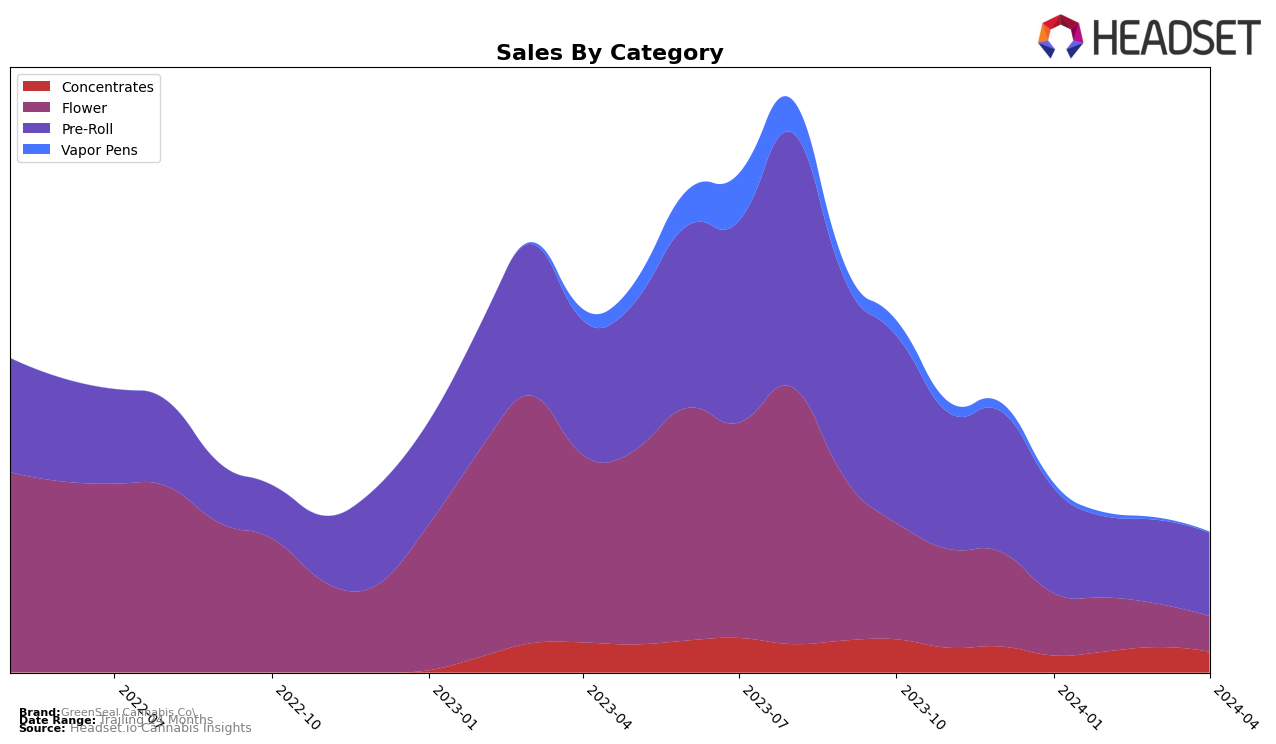

In the competitive cannabis market of Alberta, GreenSeal Cannabis Co. has shown a notable performance in the Concentrates category, improving its ranking from 37th in January 2024 to 28th by April 2024. This upward trend suggests a growing consumer preference for GreenSeal's concentrates, with sales peaking in March at 21,824 units before a slight dip in April. However, the brand has struggled to make a significant impact in the Pre-Roll category, where it has seen a decline from the 41st position in January to 62nd by April, despite an increase in sales, indicating a highly competitive market segment that may require strategic adjustments to improve rankings.

On the other hand, in Ontario, GreenSeal Cannabis Co. has faced challenges in maintaining its position within the Concentrates and Pre-Roll categories. The brand's rankings in Concentrates have slightly fluctuated, ending up at 48th in April after starting at 43rd in January, with sales showing a decline in the same period. Notably, the brand did not appear in the top 30 for the Pre-Roll category after February 2024, which could be viewed as a significant setback given the size and competitive nature of Ontario's market. This absence in the rankings could highlight areas where GreenSeal might need to focus on product innovation or marketing efforts to regain its footing in this category.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Alberta, GreenSeal Cannabis Co. has experienced fluctuations in its market position, indicating a dynamic competitive environment. Initially ranked 41st in January 2024, GreenSeal saw a dip to 54th in February, followed by a further slide to 60th in March, before slightly recovering to 62nd in April. This trajectory suggests challenges in maintaining its market share against competitors. Notably, Jonny Chronic showed remarkable resilience, bouncing back from 76th in March to 58th in April, outpacing GreenSeal with a significant sales increase. Meanwhile, 7 Acres and WINK maintained more stable but lower rankings, with 7 Acres consistently trailing just behind GreenSeal in sales. Western Cannabis, despite a drop to 80th in March, managed to climb back to 65th in April, showcasing the volatile nature of the Pre-Roll market in Alberta. GreenSeal's fluctuating rank and sales underscore the importance of strategic initiatives to bolster its market position amidst stiff competition.

Notable Products

In April 2024, GreenSeal Cannabis Co. saw the Cookie Cake Pre-Roll 10-Pack (3.5g) leading their sales with 1494 units sold, reclaiming its top position from earlier in the year. The Hybrid Live Hash (2g) followed closely in the second spot, showing a consistent performance improvement from fifth in January to second in April. The Cookie Cake (3.5g) flower product secured the third rank, despite a drop in sales, indicating a strong preference among customers for GreenSeal's flower category. Eddy's Watermelon Pre-Roll (1g) emerged as a new favorite, jumping to the fourth rank in April from being unranked in the initial months. Meanwhile, the Cookie Cake Pre-Roll (1g) experienced a slight decline, moving from the top three in the first quarter to the fifth position in April, reflecting changing consumer preferences within the Pre-Roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.