Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

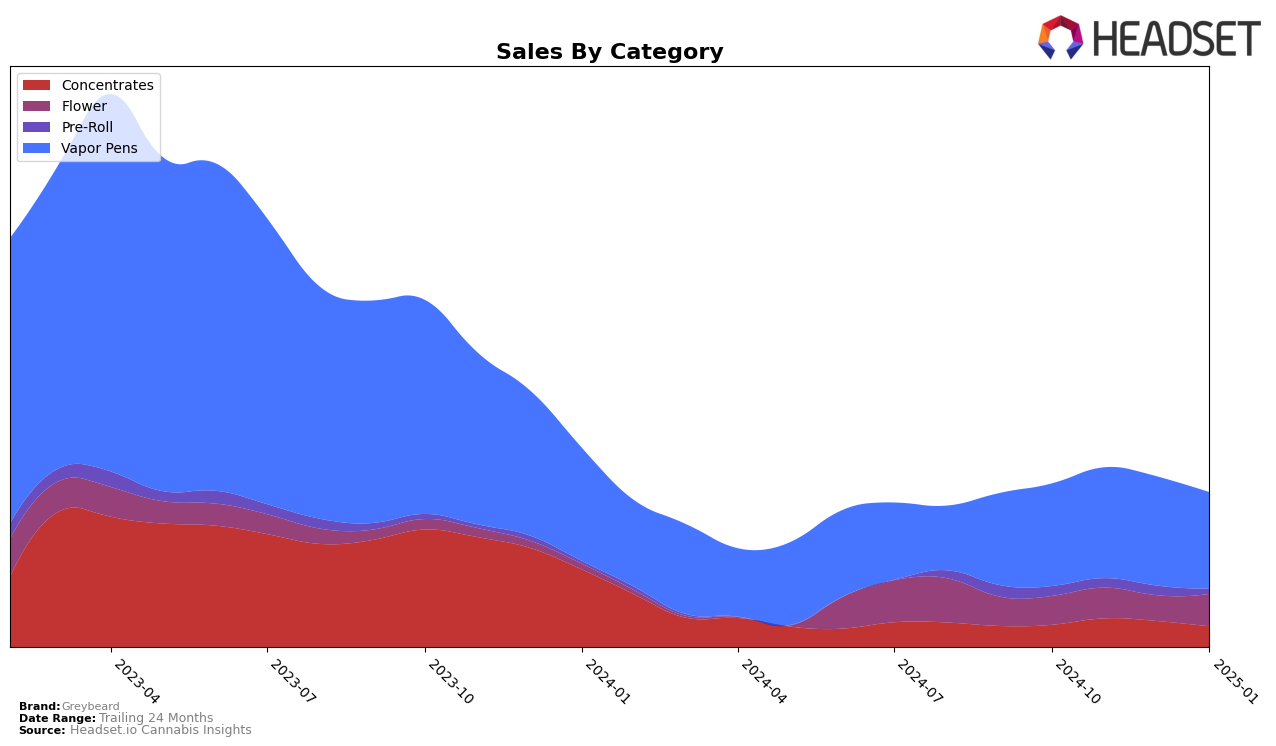

Greybeard's performance in the cannabis market has shown varied results across different provinces and product categories. In Alberta, Greybeard has seen a decline in the Concentrates category, slipping from a rank of 27 in October 2024 to 30 in January 2025, accompanied by a noticeable drop in sales. However, the brand's presence in the Flower category in Alberta has been quite limited, only appearing in the rankings from December 2024 at 99th and slightly improving to 95th by January 2025. This indicates a challenging market position in the Flower category there. Conversely, in the Vapor Pens category, Greybeard started at 30th in October 2024 but saw a decline to 41st by January 2025, reflecting a downward trend in consumer interest or competitive pressure in this segment.

In British Columbia, Greybeard's performance in the Flower category did not secure a place in the top 100 by January 2025, which could be seen as a significant area for potential improvement. However, the brand maintained a relatively stable presence in the Vapor Pens category, hovering around the 37th to 40th positions over the months, indicating a consistent consumer base or market strategy. Meanwhile, in Ontario, Greybeard's Vapor Pens have shown a positive trajectory, improving from 94th in October 2024 to 75th by January 2025, suggesting a growing market acceptance or effective promotional strategies. In Saskatchewan, Greybeard debuted in the Concentrates category at 12th in November 2024 but fell to 20th by January 2025, while in Vapor Pens, the brand remained consistently within the top 30, providing a mixed yet insightful performance across these provinces.

Competitive Landscape

In the competitive landscape of vapor pens in Alberta, Greybeard has experienced notable fluctuations in its market position, which may impact its strategic decisions moving forward. From October 2024 to January 2025, Greybeard's rank shifted from 30th to 41st, indicating a downward trend in its competitive standing. This decline is contrasted by the performance of brands like Glacial Gold, which maintained a relatively stable presence, and Dab Bods, which re-entered the top 40 in January 2025 after being absent in October and December. The sales figures for Greybeard reflect this trend, with a consistent decrease over these months, suggesting that competitors might be capturing market share. Brands such as Papa's Herb and RAD (Really Awesome Dope) also show varying degrees of volatility, but Greybeard's consistent decline in both rank and sales highlights the need for strategic adjustments to regain its competitive edge in the Alberta vapor pen market.

Notable Products

In January 2025, Critical Diesel (3.5g) emerged as the top-performing product for Greybeard, achieving the number one rank with sales reaching 1858 units. This marked a significant rise from its third-place position in December 2024. The Banana Gas Pure Live Resin Cartridge (1g), previously holding the top spot for three consecutive months, slipped to the second rank with a notable decrease in sales to 1500 units. Zour Breath Live Resin Cartridge (1g) maintained a consistent presence in the top three, securing the third rank in January. Meanwhile, the Modified Silk Live Resin Cartridge (1g) debuted in the rankings at fourth place, indicating a strong entry into the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.