Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

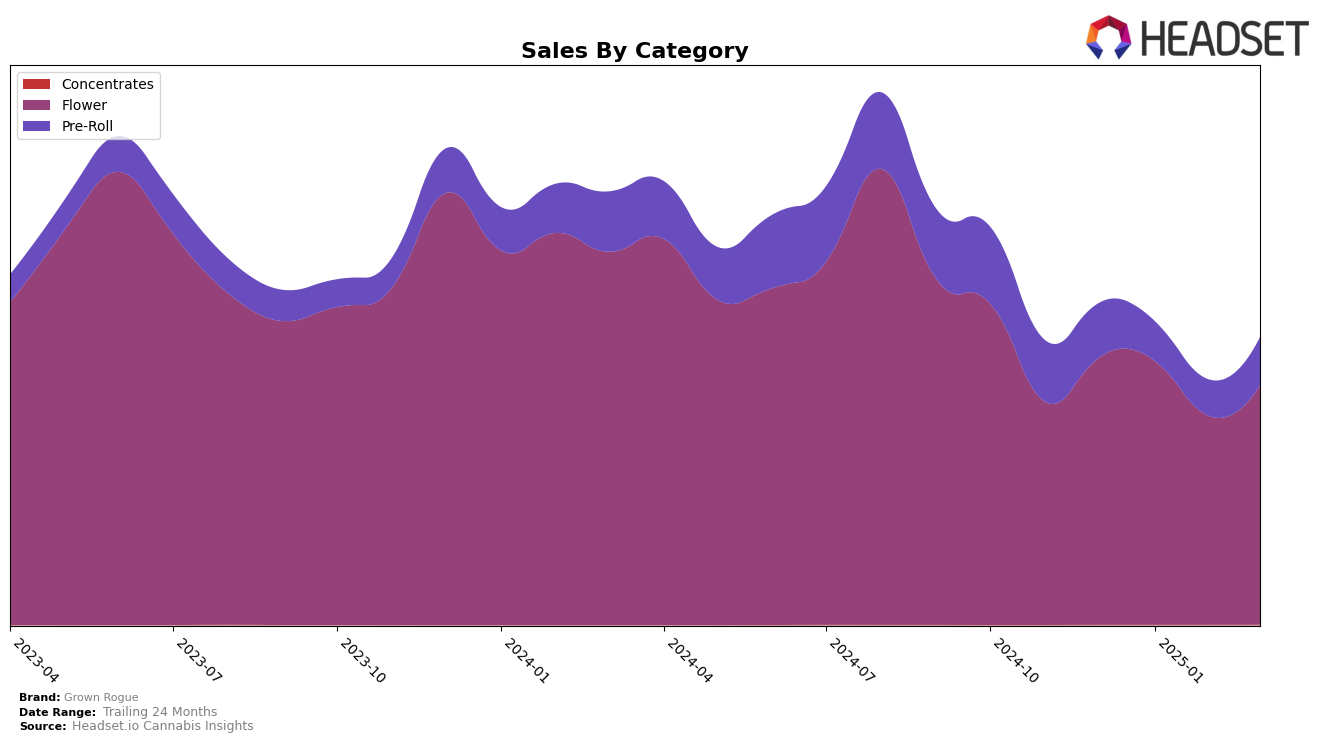

Grown Rogue has shown varied performance across different states and product categories. In Michigan, their Flower category experienced a decline in ranking from 25th in December 2024 to 33rd by March 2025, indicating a potential challenge in maintaining market presence. This trend is further mirrored in their Pre-Roll category in Michigan, where they dropped from 33rd to 44th over the same period, suggesting a consistent struggle in this market. The sales figures reflect this ranking movement, with a noticeable decrease from December to February, followed by a slight recovery in March. This could imply a need for strategic adjustments to regain their footing in Michigan.

In contrast, New Jersey presents a more optimistic picture for Grown Rogue, especially in the Flower category. Despite not being in the top 30 brands in December 2024, they climbed to 31st by March 2025, marking a steady upward trajectory. This positive trend is highlighted by their sales growth from January to March, suggesting increasing consumer acceptance and market penetration. However, the Pre-Roll category in New Jersey still shows room for improvement, as they only managed to secure a 42nd place ranking by March 2025, indicating potential growth opportunities. Meanwhile, in Oregon, Grown Rogue maintained a strong position in the Flower category, although they slipped slightly from 2nd to 7th place over the months, which still reflects a solid market presence. Their performance in the Pre-Roll category also saw fluctuations, eventually returning to the 28th position in March, hinting at a potential stabilization in the future.

Competitive Landscape

In the competitive landscape of Michigan's flower category, Grown Rogue has experienced notable fluctuations in its rank and sales over the past few months. While maintaining a steady position at rank 25 in December 2024 and January 2025, Grown Rogue saw a decline to rank 35 in February 2025 and slightly improved to rank 33 in March 2025. This downward trend in rank coincides with a decrease in sales from December 2024 to February 2025, although there was a modest recovery in March 2025. In comparison, Peninsula Cannabis showed a similar pattern, with a dip in rank from December 2024 to February 2025 but rebounded in March 2025, achieving a rank of 31. Meanwhile, Light Sky Farms demonstrated a significant improvement, climbing from rank 60 in December 2024 to 32 in March 2025, suggesting a strong upward trajectory. These shifts highlight the dynamic nature of the market, where Grown Rogue faces stiff competition, particularly from brands like Light Sky Farms, which are gaining momentum and could potentially impact Grown Rogue's market share if the current trends persist.

Notable Products

In March 2025, Grown Rogue's top-performing product was Washington Apple (Bulk) in the Flower category, securing the first rank with notable sales of 3925 units. Blue Runtz (3.5g) climbed to the second position from its previous fourth rank in January 2025, showing a strong performance with 3445 units sold. Caramel Cake (Bulk) debuted at the third rank for March, while Cadillac Rainbows (Bulk) followed closely at fourth, demonstrating competitive sales figures. Tea Time (Bulk) rounded out the top five, maintaining a consistent presence in the rankings. This month saw new entries and shifts in positions, indicating dynamic market trends for Grown Rogue's product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.