Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

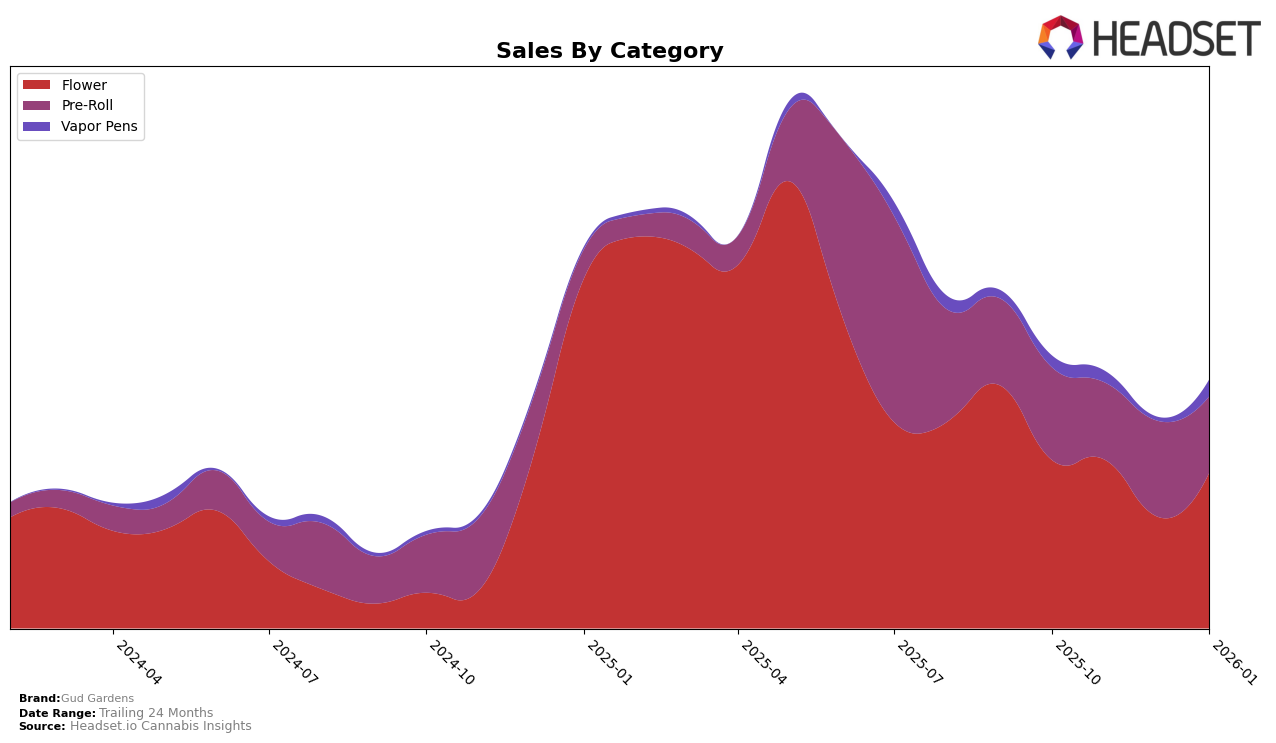

In the competitive cannabis market of Oregon, Gud Gardens has shown varied performance across different product categories. In the Flower category, the brand experienced fluctuations in its rankings, starting at 21st place in October 2025 and dropping to 33rd in December before climbing back to 24th in January 2026. This movement indicates a possible recovery after a dip in sales, as reflected by the sales figures which decreased significantly in December but showed improvement in January. Such fluctuations could be indicative of market volatility or seasonal demand changes, which are critical for stakeholders to monitor.

For Pre-Rolls, Gud Gardens maintained a relatively stable presence within the top 30, with minor rank shifts from 27th in October to 28th in January. Despite a slight dip in sales from November to January, the brand managed to stay competitive. However, the Vapor Pens category tells a different story, where Gud Gardens did not make it into the top 30 in December 2025, a potential area of concern that might suggest the need for strategic adjustments in this segment. Nevertheless, the brand's re-entry into the rankings at 69th place in January 2026 could signal a positive turn. Such insights into category-specific performance can be crucial for brands aiming to optimize their market strategy and resource allocation.

Competitive Landscape

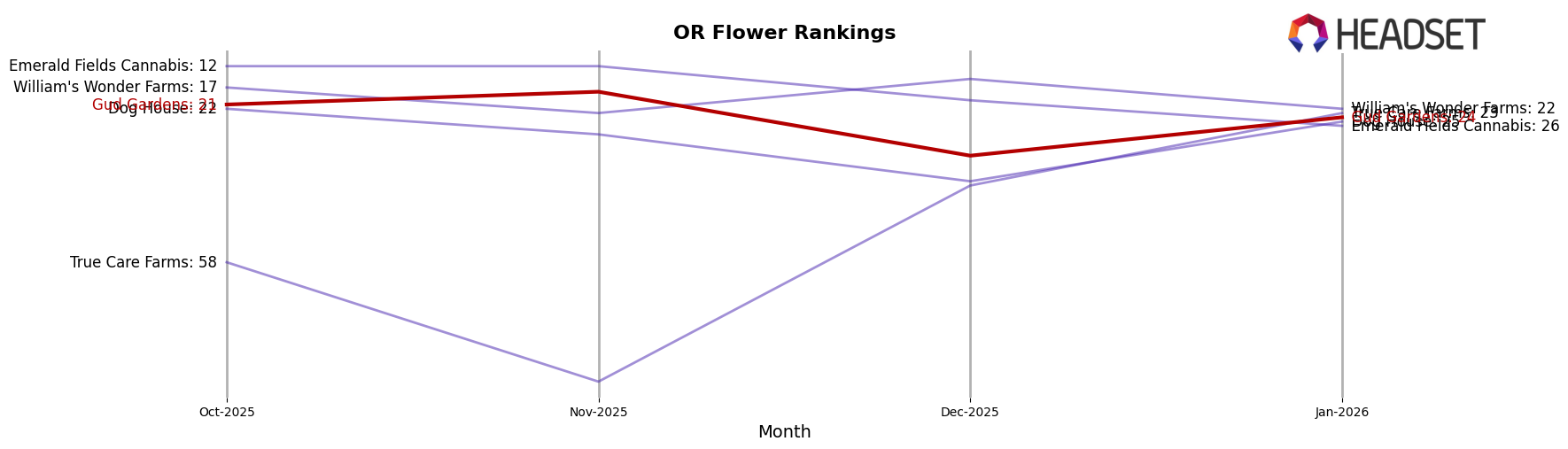

In the competitive landscape of the Flower category in Oregon, Gud Gardens has experienced notable fluctuations in its market positioning over the recent months. In October 2025, Gud Gardens held the 21st rank, showing a promising improvement to 18th in November, but then dropping to 33rd in December before recovering slightly to 24th in January 2026. This pattern suggests a volatile market presence, potentially impacted by seasonal demand or competitive pressures. Notably, Emerald Fields Cannabis consistently outperformed Gud Gardens, maintaining a higher rank until January 2026, when it fell to 26th, just below Gud Gardens. Meanwhile, William's Wonder Farms and True Care Farms also showed competitive dynamics, with True Care Farms making a significant leap from 58th in October to 23rd in January, surpassing Gud Gardens. These shifts highlight the competitive intensity in the Oregon Flower market, where brands like Gud Gardens must navigate both upward and downward trends to sustain and enhance their market share.

Notable Products

In January 2026, Gud Gardens' top-performing product was Ginger Tea (Bulk) in the Flower category, securing the first rank with sales of 6,221 units. Following closely in the Flower category was Hot Tropic (Bulk), which held the second rank. Green Crack (1g) also performed well, achieving the third rank in the same category. Notably, Tropical Z (1g) maintained its fourth position from December 2025 to January 2026, indicating stable demand. The Gud Day Pre-Roll 6-Pack (4.8g), previously ranked first in November and December 2025, dropped to the fifth position, suggesting a shift in consumer preference towards bulk flower products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.