Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

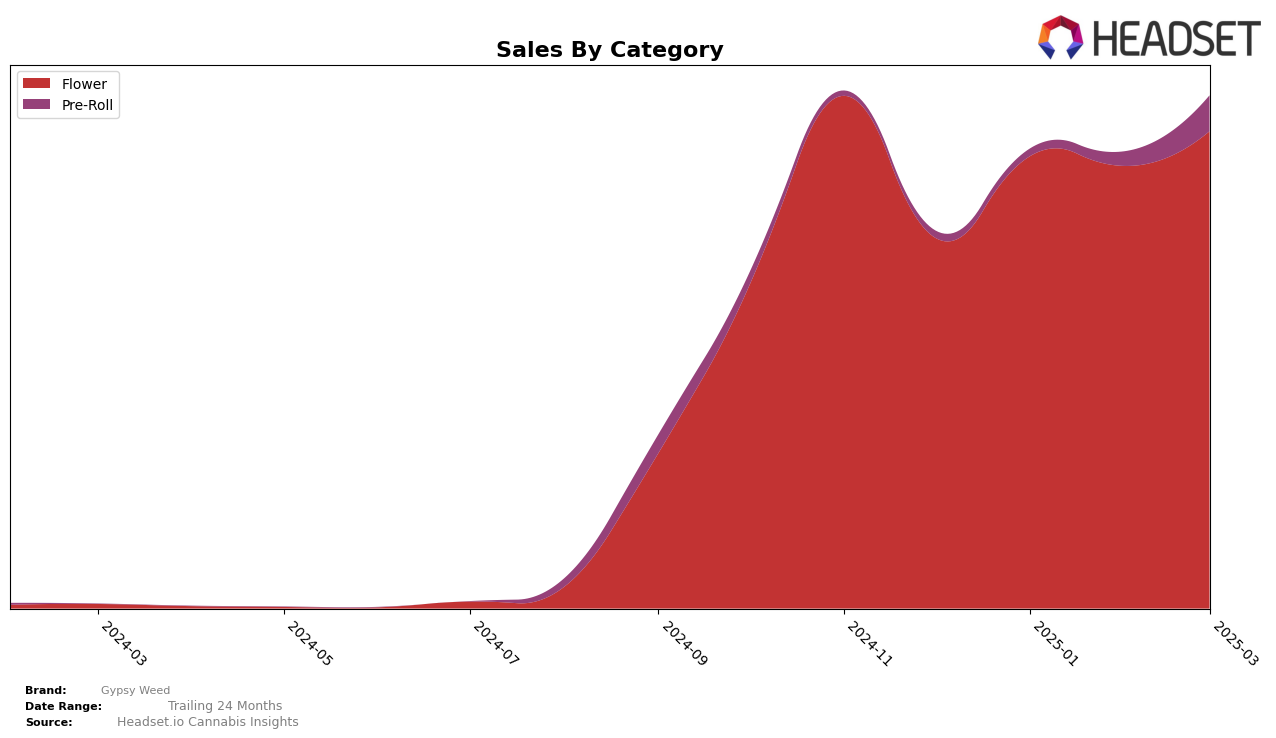

Gypsy Weed has shown a consistent presence in the New York market within the Flower category. Starting from a rank of 29 in December 2024, the brand improved its position to 26 in January 2025, maintaining a stable rank of 27 in both February and March 2025. This upward trend in the early part of the year indicates a positive reception and potentially growing brand loyalty among consumers. However, being on the edge of the top 30 suggests there is still significant competition, and further efforts may be needed to climb higher in the rankings.

Despite not breaking into higher positions, Gypsy Weed's sales figures in New York have been promising, with a noticeable increase from $234,537 in December 2024 to $302,147 by March 2025. This growth trajectory highlights an increasing demand for their products, even if the brand has not yet managed to break into the top 20. The steady rank in February and March suggests a stabilization in their market strategy, which could serve as a foundation for future growth. However, it is important to note that Gypsy Weed did not appear in the top 30 in other states or categories, indicating room for expansion and improvement in broader markets.

Competitive Landscape

In the competitive landscape of the Flower category in New York, Gypsy Weed has shown a steady performance from December 2024 to March 2025, maintaining a rank between 26th and 29th. This period saw Gypsy Weed's sales increase, particularly in March 2025, where it reached a consistent rank of 27th. In comparison, Cookies made a notable leap from being unranked in December 2024 to 28th by March 2025, indicating a significant sales surge. Meanwhile, Alchemy Pure experienced fluctuations, dropping from 26th in December 2024 to 29th in March 2025, suggesting a volatile sales pattern. ghost. showed impressive growth, moving up from 57th to 26th, overtaking Gypsy Weed in March 2025. To The Moon maintained a strong presence, though its rank fell from 17th in December 2024 to 25th by March 2025, reflecting a decline in sales. Gypsy Weed's stable rank amidst these shifts highlights its resilience and potential for growth in a competitive market.

Notable Products

In March 2025, the top-performing product for Gypsy Weed was Jet Fuel Gelato Pre-Roll (1g) in the Pre-Roll category, maintaining its first-place ranking from February with sales reaching 1712 units. Gelato 41 Pre-Roll (1g) climbed to the second position from fourth in February, showing a notable increase in sales to 892 units. RS-11 (28g) held steady in third place in the Flower category, with sales rising to 602 units. Gush Mintz Oreo (28g) appeared in the rankings for the first time, securing fourth place in the Flower category. Amnesia Gelato (3.5g) rounded out the top five in its debut month, also in the Flower category, with sales of 425 units.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.