Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

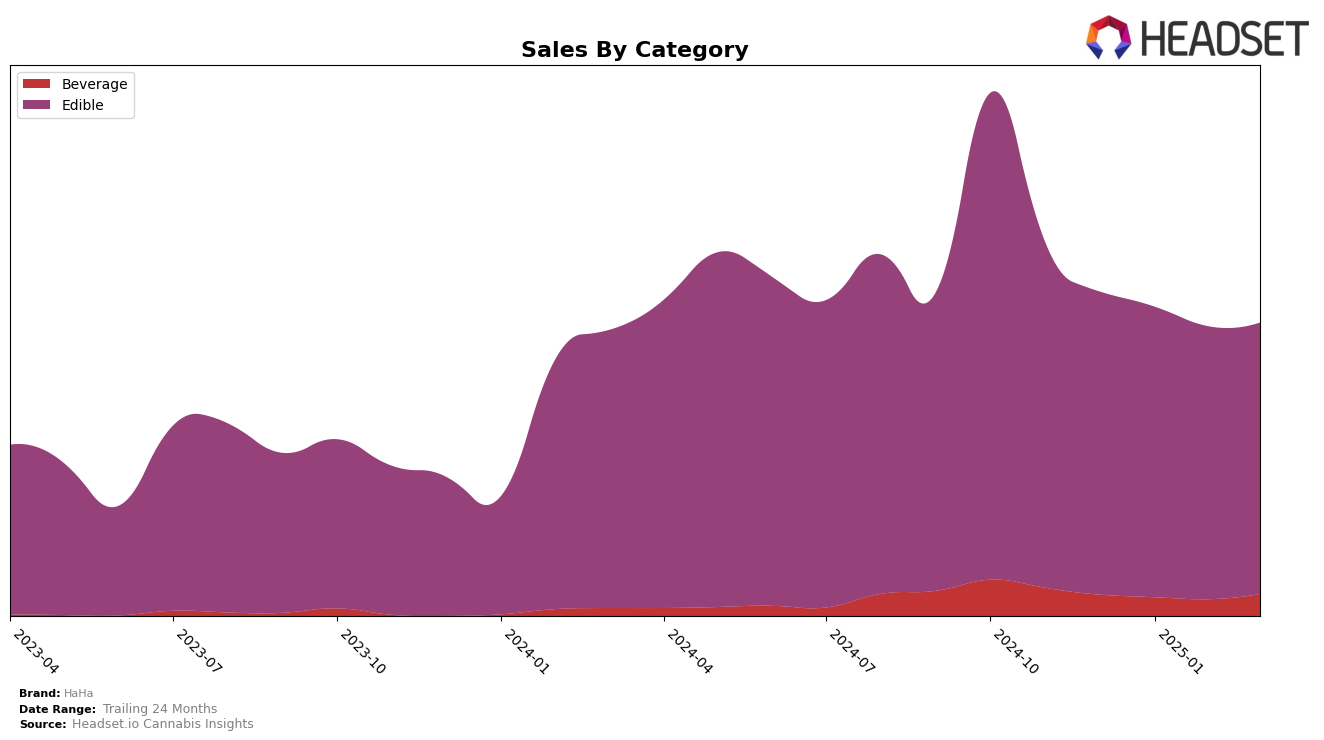

In the Nevada market, HaHa has demonstrated a consistent presence in the Beverage category, maintaining a strong position throughout the months. Starting from a solid second place in December 2024, they held onto this rank in January 2025 before slipping to third in February and March 2025. Despite this slight decline in ranking, the brand's sales figures reveal a noteworthy rebound in March, showing a recovery from the dip experienced in the previous months. This resilience in sales performance suggests that HaHa has a robust customer base in Nevada's beverage sector, though there is room for improvement to regain their earlier standing.

HaHa's performance in the Edible category in Nevada also reflects a similar trend of consistency with a bit of fluctuation. The brand started strong in December 2024, ranking second, but dropped to third in January 2025 and maintained this position through March. While the ranking indicates a slight decline, the sales trajectory shows a gradual decrease over the months, which could signal increasing competition or shifting consumer preferences. The absence of a top 30 ranking in any other state or category suggests that HaHa's influence is currently concentrated in Nevada, providing a focused area for potential expansion or strategic adjustments.

Competitive Landscape

In the competitive landscape of the Nevada edible cannabis market, HaHa has maintained a consistent rank of 3rd place from January to March 2025, despite a slight dip from its 2nd place position in December 2024. This shift is primarily due to the steady performance of Incredibles, which climbed to 2nd place in January 2025 and held that position through March. Meanwhile, Wyld has dominated the market, consistently ranking 1st with a significant lead in sales. HaHa's sales have experienced a downward trend over these months, which could be attributed to the increasing competition from brands like Gron / Grön and Camino, both of which have shown resilience and slight improvements in their rankings. This competitive environment suggests that while HaHa remains a strong contender, it faces challenges in gaining ground against the top-ranking brands, necessitating strategic marketing efforts to bolster its market position.

Notable Products

In March 2025, HaHa's top-performing product was the CBG/THC 3:1 Mighty Mango Gummies 10-Pack, maintaining its first-place ranking from previous months with a notable sales figure of 5918 units. The CBN/THC 2:1 Blue Raz Gummies 10-Pack held steady in second place, showing a slight increase in sales compared to February. Watermelon Gummies 10-Pack remained consistently in third place, while the newly ranked Strawberry Lover Lemonade Gummies 10-Pack entered the scene at fourth place. Blue Raspberry Gummy 10-Pack regained its fifth position, showing resilience after not being ranked in February. Overall, the rankings have shown stability with minor shifts, indicating a strong brand loyalty among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.