Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

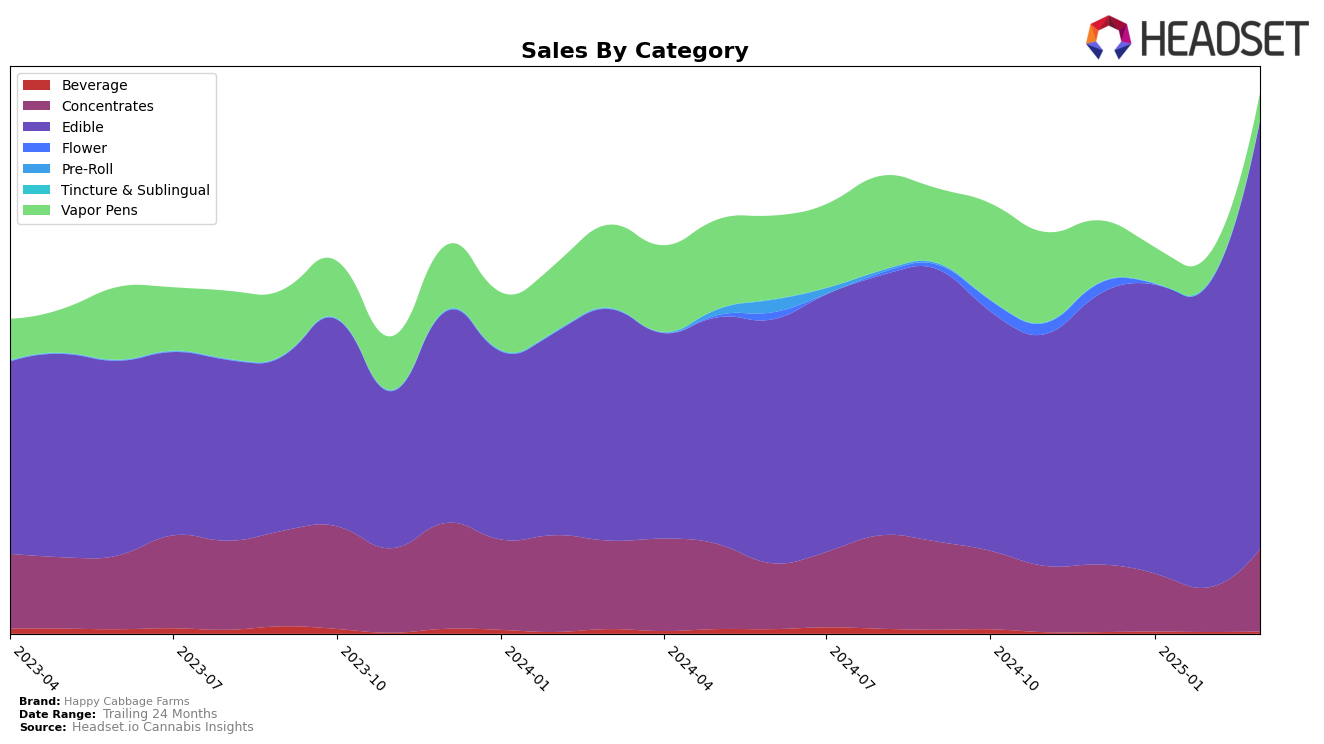

Happy Cabbage Farms has shown notable performance variations across different states and product categories. In New York, the brand made an impressive entry into the Concentrates category, securing the 15th position by March 2025, despite not being in the top 30 in the preceding months. This indicates a significant upward trajectory in this category. Meanwhile, their Edibles category in New York also experienced substantial growth, climbing from the 51st position in December 2024 to the 21st by March 2025. This consistent improvement in rankings suggests a strengthening market presence and increasing consumer demand for their edible products in the state.

In Oregon, Happy Cabbage Farms maintained a steady presence in the Edible category, consistently ranking 7th from January to March 2025, demonstrating stability and consumer loyalty. However, their performance in the Concentrates category saw a decline, dropping from the 27th position in December 2024 to 37th in March 2025, which may indicate challenges in maintaining market share. The Vapor Pens category also presented a downward trend, with rankings falling outside the top 30, highlighting potential areas for improvement. In Washington, the brand showed consistency in the Edibles category, holding the 21st position through March 2025, reflecting a stable market presence there as well.

Competitive Landscape

In the competitive landscape of the Oregon edible market, Happy Cabbage Farms has shown a consistent performance, maintaining its rank at 7th place from January to March 2025, after a slight improvement from 8th place in December 2024. This steady ranking indicates a stable market presence, although it remains behind top competitors like Smokiez Edibles and Good Tide, which have consistently held the 5th and 6th ranks respectively. Despite a dip in sales in February 2025, Happy Cabbage Farms rebounded in March, suggesting resilience and potential for growth. Meanwhile, Hapy Kitchen and Private Stash have fluctuated in ranks, with Hapy Kitchen dropping to 9th place and Private Stash climbing to 8th, highlighting a competitive environment where Happy Cabbage Farms must continue to innovate and capture market share to improve its standing.

Notable Products

In March 2025, Happy Cabbage Farms' top-performing product was Blox - Green Apple Solventless Hash Gummy (100mg), maintaining its number one rank for the fourth consecutive month with impressive sales of 5,291 units. Blox - Midnight Melons Rosin Gummies 10-Pack (100mg) climbed to the second position from third in February, showcasing a significant increase in sales. Blox - Cherry Limeade Solventless Rosin Gummy (100mg) moved up one rank to third place, reversing its previous decline. The Blox - Mango Solventless Hash Gummy (100mg) re-entered the rankings in fourth place after being absent in January and February. Finally, Blox - Tropical Smoothie Solventless Rosin Gummies 10-Pack (100mg) remained steady at the fifth position, despite a slight dip in sales from January to February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.