Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

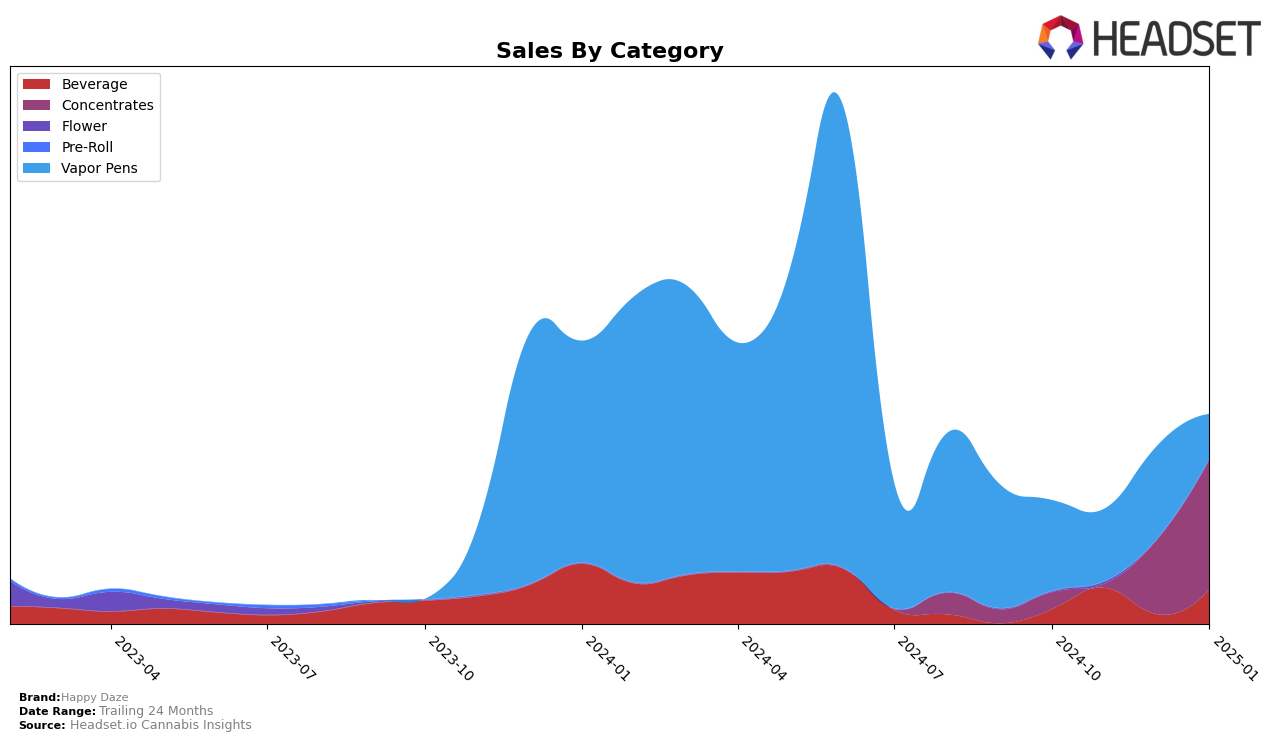

In the California market, Happy Daze has shown a consistent presence in the Beverage category. While the brand was not in the top 30 in October and December 2024, it achieved a rank of 23 in both November 2024 and January 2025. This suggests that Happy Daze has a fluctuating yet recurring presence in the competitive landscape of California's beverage market. The dip in December could indicate seasonal variations or increased competition, but their rebound in January points towards a resilient brand strategy or possibly effective marketing efforts during the holiday season.

In Michigan, Happy Daze has been making notable strides in the Concentrates category. Despite not appearing in the top 30 for October, November, and December 2024, the brand made a significant leap to rank 52 in January 2025. This upward movement highlights a potentially growing demand or improved distribution strategy for Happy Daze concentrates in Michigan. The sales figures, notably increasing from November to January, support this positive trend, suggesting that Happy Daze is gaining traction and could continue to climb the ranks if these efforts are sustained.

Competitive Landscape

In the Michigan concentrates market, Happy Daze has experienced a notable shift in its competitive standing over recent months. While Happy Daze was not ranked in the top 20 brands for October and November 2024, it made a significant entry at rank 86 in December 2024 and improved to rank 52 by January 2025. This upward trajectory suggests a positive momentum in sales and brand presence. In contrast, Redbud Roots, a key competitor, saw a decline from rank 26 in October 2024 to rank 53 in January 2025, indicating a potential opportunity for Happy Daze to capture more market share. Meanwhile, Mozey Extracts maintained a relatively stable position, entering the ranks at 45 in December 2024 and slightly dropping to 57 in January 2025. The fluctuating ranks of competitors like Shatter House Extracts and White Label Extracts (OR) further highlight the dynamic nature of this market, presenting both challenges and opportunities for Happy Daze to enhance its market position.

Notable Products

In January 2025, Happy Daze's top-performing product was Strawberry Lemonade (100mg) in the Beverage category, maintaining its first-place rank from November 2024 with sales of 5982 units. Following closely is Fruit Punch Lemonade (100mg THC, 12oz) which remained steady in second place, showing consistent sales performance from the previous months. The Concentrates category saw new entries with Candy Runtz Live Resin (1g) debuting at third place, while Purple Pebbles Live Resin (1g) and Happy Dab Live Resin (1g) secured the fourth and fifth ranks respectively. Notably, the Concentrates products were not ranked in the previous months, indicating a fresh interest in this category. Overall, the Beverage category continues to dominate, but the emergence of Concentrates suggests a potential shift in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.