Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

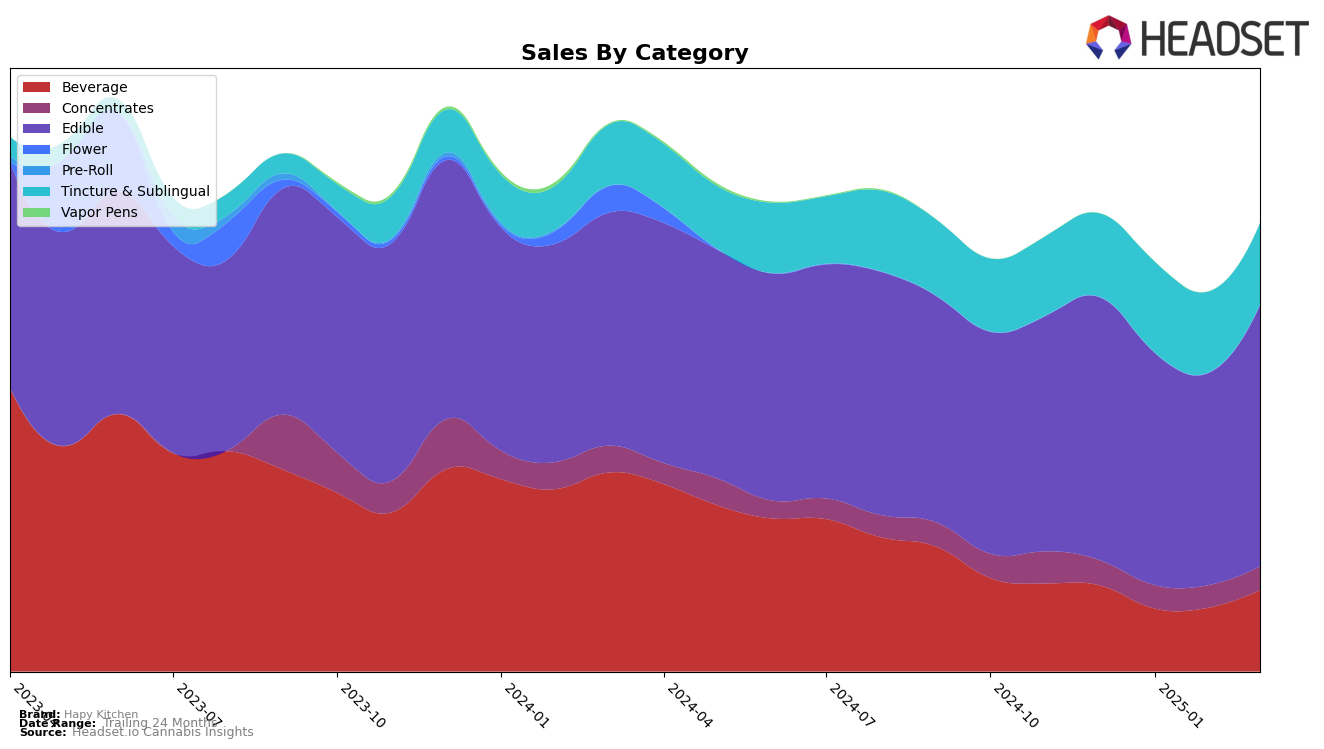

Hapy Kitchen has shown consistent performance in the Oregon market, particularly in the Beverage category, where it maintained a steady rank of 5th from December 2024 through March 2025. This stability indicates a strong foothold in the beverage segment, despite some fluctuations in sales figures. In contrast, the brand's performance in the Concentrates category has been less impressive, with rankings hovering around the 52nd and 53rd positions, suggesting room for growth or strategic reevaluation in this segment. It's notable that Hapy Kitchen did not crack the top 30 in the Concentrates category, which could be a point of concern or an opportunity for expansion.

In the Edible category, Hapy Kitchen experienced a slight dip in rankings, moving from 7th in December 2024 to 9th in the following months, though sales rebounded in March 2025. This fluctuation may reflect competitive pressures or changing consumer preferences, but the brand remains a top contender in this category. Meanwhile, Hapy Kitchen's performance in Tincture & Sublinguals has been commendable, consistently holding the 3rd position, indicating a strong brand presence and consumer loyalty. This category's stability might reflect effective product offerings or marketing strategies that resonate well with consumers in Oregon.

Competitive Landscape

In the competitive landscape of the Oregon edible cannabis market, Hapy Kitchen has experienced some fluctuations in its ranking and sales over the past few months. Starting in December 2024, Hapy Kitchen was ranked 7th, but it slipped to 9th place from January to March 2025. This decline in rank coincides with a decrease in sales from December's figures, although there was a recovery in March 2025. In contrast, Happy Cabbage Farms maintained a steady 7th rank from January to March, suggesting a stable market presence. Meanwhile, Private Stash improved its position from 10th in December to 8th in January and maintained that rank through March, indicating a positive trend in sales performance. Quality Drugs saw a decline from 9th to 11th place by March, while Botz improved slightly from 11th to 10th place in March. These dynamics suggest that while Hapy Kitchen faces challenges in maintaining its rank, there is potential for recovery, especially if it can capitalize on the market trends that are benefiting its competitors.

Notable Products

In March 2025, Hapy Kitchen's top-performing product was the Chocolate Brownie 2-Pack (100mg), maintaining its first-place rank from previous months and achieving a notable sales figure of 7595 units. The Chocolate Brownie (100mg) also held steady in second place, demonstrating consistent popularity. The Muddy Buddy Wedding Cake Hash Rosin Cookie (100mg) remained in third place, showing stable demand. A new entry in the rankings, the THC/CBN 1:1 Brown Butter Bliss Sugar Magnolia Hash Rosin Infused Cookie (100mg CBN, 100mg THC), climbed to fourth place after its introduction in February. Additionally, the Supreme Cookie X Blue Dream Hash Rosin Cookie (100mg) debuted in fifth place, indicating a successful market entry.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.