Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

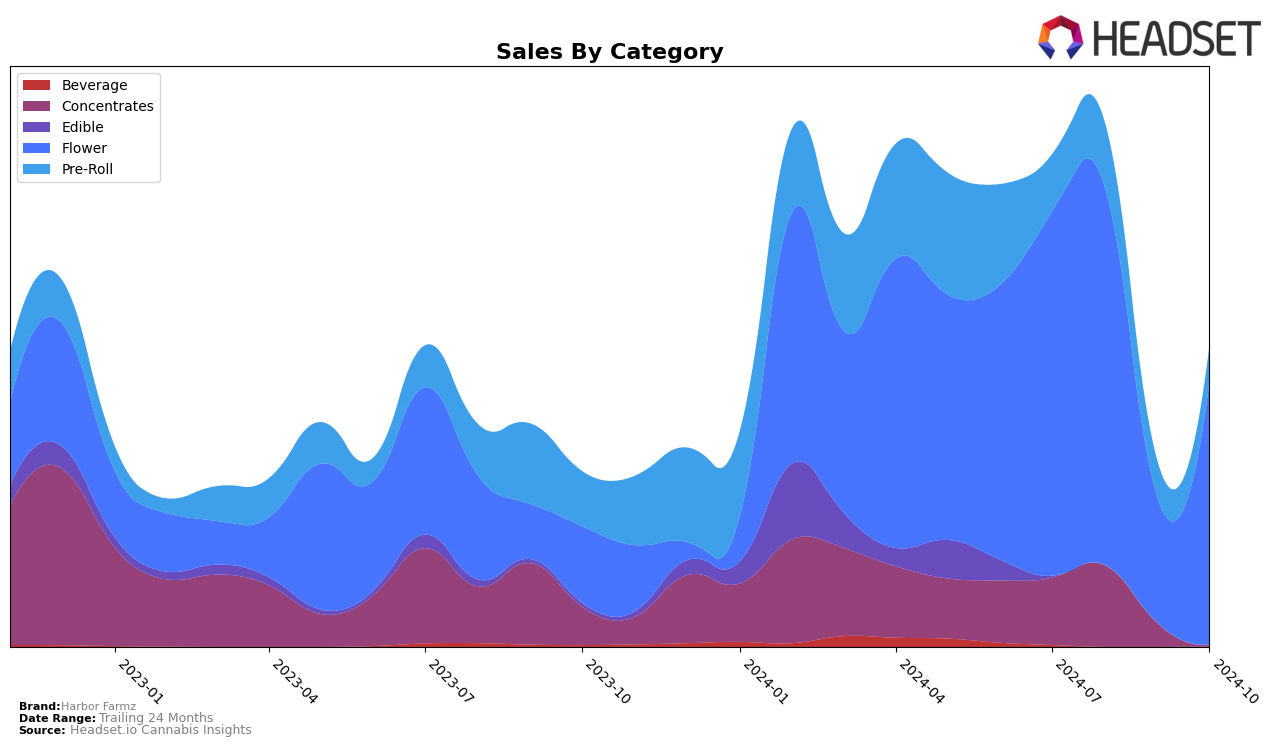

Harbor Farmz has shown varied performance across different product categories in the state of Michigan. In the concentrates category, the brand ranked 32nd in August 2024, but by September, it fell out of the top 30, indicating a significant drop in market presence. This decline is mirrored by a decrease in sales from August to September, suggesting potential challenges in maintaining consumer interest or competitive pricing. On the other hand, the flower category saw a resurgence in October, climbing back to the 55th rank after a steep drop in September. This indicates a potential recovery strategy that might have been implemented to regain traction in this popular category.

The pre-roll category presents a more stable performance for Harbor Farmz, with rankings fluctuating within the top 100 but remaining relatively consistent. The brand ranked 78th in October, a slight improvement from the previous month, which may suggest a steady consumer base or effective marketing strategies in this segment. However, it's noteworthy that despite these rankings, Harbor Farmz did not make it into the top 30 in any category during the months analyzed, which could be a concern for long-term brand visibility and competitiveness in the Michigan market. This consistency in pre-rolls, despite not being in the top tier, could point to a niche market or loyal customer segment that the brand could capitalize on further.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Harbor Farmz has experienced notable fluctuations in its market position over the past few months. In July 2024, Harbor Farmz held a respectable rank of 47, which slightly improved to 45 in August. However, September saw a significant drop to 95, indicating a potential challenge in maintaining consistent sales momentum. By October, Harbor Farmz rebounded to a rank of 55, suggesting a recovery in sales performance. In contrast, Cloud Cover (C3) showed a steady improvement from rank 87 in July to 65 by October, while Traphouse Cannabis Co. experienced a volatile ranking pattern, missing from the top 20 in August but returning to 66 in October. Rare Michigan Genetics demonstrated a consistent upward trend, achieving a rank of 53 in October. Meanwhile, Glorious Cannabis Co., despite a high starting rank of 17 in July, saw a decline to 54 by October. These dynamics highlight the competitive pressures and opportunities for Harbor Farmz to strategize for sustained growth in the Michigan flower market.

Notable Products

In October 2024, the top-performing product for Harbor Farmz was Willie's Kush Cake (Bulk) in the Flower category, which climbed to the number one rank with sales reaching 7959 units. Apple Fritter Pre-Roll (1g) moved up to the second position in the Pre-Roll category, showing a significant increase from its third-place ranking in September. Strawberry Guava (3.5g) made a notable entry into the rankings at third place within the Flower category. Alien Pebbles (3.5g) also debuted at fourth place in the Flower category. Neapolitan Crunch Cake Pre-Roll (1g) maintained its position in the Pre-Roll category, ranking fifth in October.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.