Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

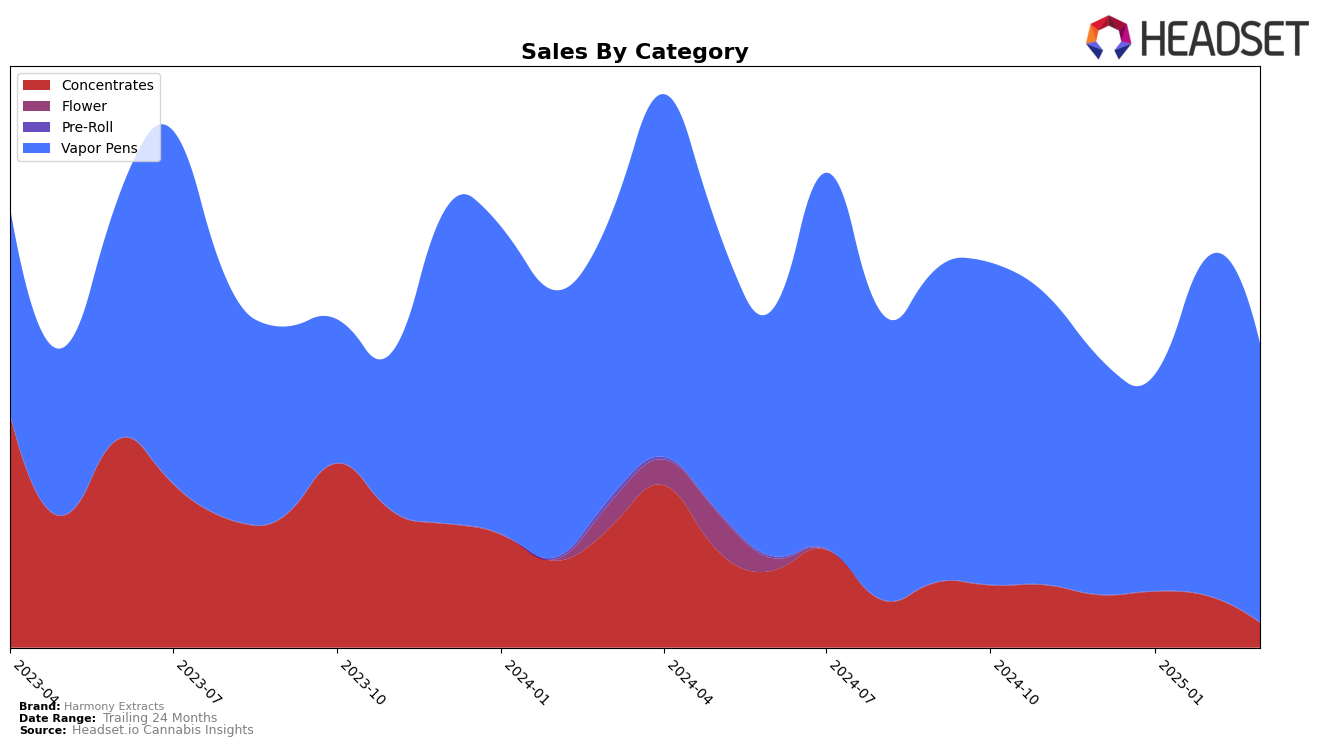

In the state of Colorado, Harmony Extracts has shown varying performance across different product categories. In the Concentrates category, the brand experienced a decline in ranking, starting at 28th position in both December 2024 and January 2025, slipping to 29th in February, and then dropping out of the top 30 by March 2025. This downward trend could be indicative of increased competition or shifting consumer preferences. Notably, the sales for this category also saw a significant decrease by March, suggesting possible challenges in maintaining market share.

Conversely, in the Vapor Pens category, Harmony Extracts demonstrated a more positive trajectory. Beginning at 24th place in December 2024, the brand's rank improved to 13th by February 2025, before slightly dropping to 18th in March. This improvement suggests a strengthening presence in the Vapor Pens market, potentially due to successful product offerings or strategic marketing efforts. Despite the fluctuation in rankings, the sales figures indicate a robust performance, with a notable peak in February 2025. These trends highlight the brand's ability to adapt and thrive in certain segments, even as it faces challenges in others.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Harmony Extracts has shown a remarkable shift in rankings over the early months of 2025. While starting outside the top 20 in December 2024, Harmony Extracts surged to rank 13 in February 2025, indicating a significant upward trajectory in sales performance. This rise can be contrasted with competitors such as The Colorado Cannabis Co., which remained relatively stable, maintaining a rank between 15 and 19, and AiroPro, which experienced a slight decline in rank. Notably, Natty Rems also showed volatility, dropping to 29 in February before rebounding to 16 in March. This dynamic environment suggests that Harmony Extracts' strategies may be effectively capturing market share and driving sales growth, positioning them as a formidable player in the Colorado vapor pen market.

Notable Products

In March 2025, Harmony Extracts' top-performing product was Flash - Fairy Floss Distillate Disposable (1g) in the Vapor Pens category, maintaining its number one rank from previous months with a sales figure of 3360. Flash - Strawberry Distillate Disposable (1g) moved up to the second rank, showing a consistent improvement from its third rank in prior months. Flash - Watermelon Distillate Disposable (1g) experienced a slight decline, dropping to third place from its second rank in February. Flash - Mountain Dank Distillate Disposable (1g) remained stable at fourth rank, following a previous rank of fourth in February. Notably, Flash - Blueberry Muffin Distillate Disposable (1g) entered the rankings for the first time in March, securing the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.