Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

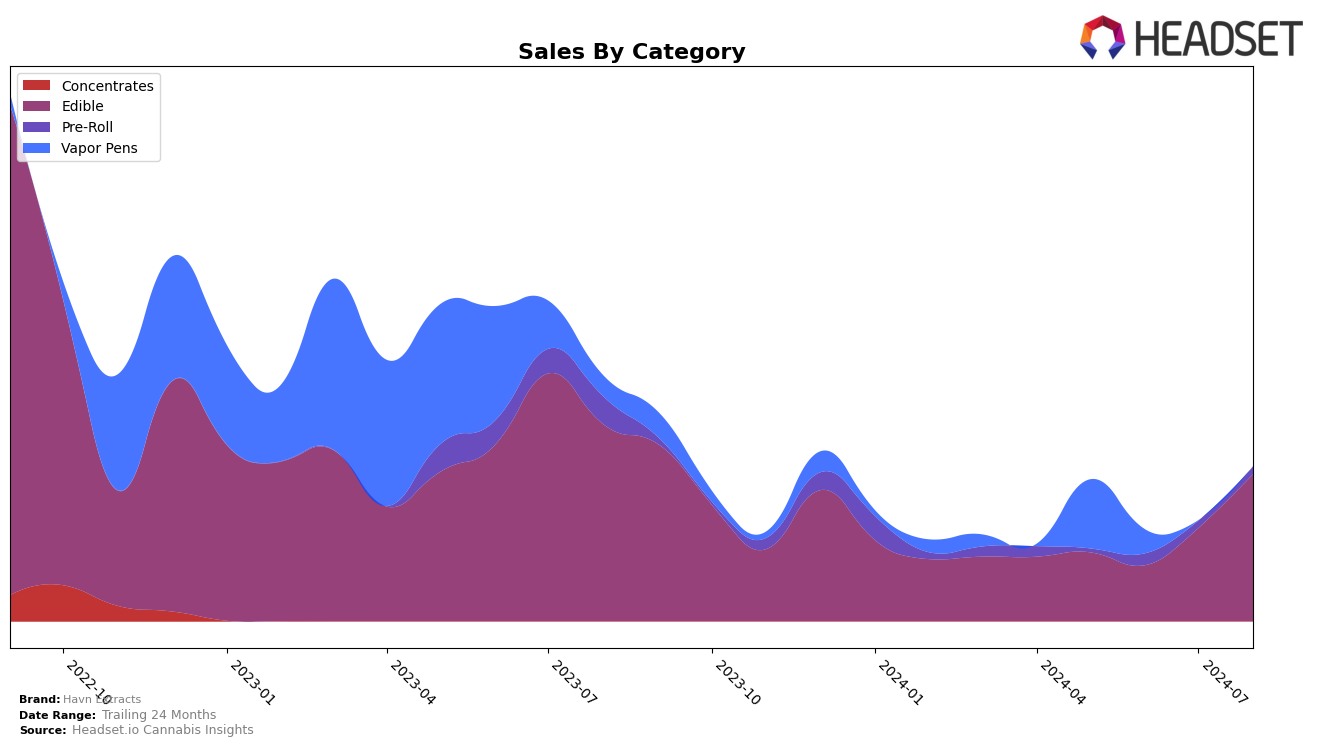

Havn Extracts has shown notable performance improvements in the Edible category within Massachusetts. Starting from a rank of 45 in May 2024, the brand climbed steadily to reach rank 26 by August 2024. This upward trajectory is accompanied by a significant increase in sales, jumping from $51,862 in May to $111,464 in August. This consistent improvement suggests a growing consumer preference for Havn Extracts' edible products in the Massachusetts market. However, the brand's performance in the Vapor Pens category has been less impressive, failing to secure a spot in the top 30 rankings for July and August, which could indicate a need for strategic adjustments in this segment.

In the Vapor Pens category, Havn Extracts' ranking in Massachusetts dropped from 64 in May to 90 in June, and the brand did not appear in the top 30 for July and August. This decline in rankings, coupled with a drop in sales from $52,046 in May to $17,838 in June, highlights potential challenges in maintaining market share in this competitive category. The absence from the top 30 rankings in subsequent months could be seen as a negative indicator of the brand's current positioning. These mixed results across categories suggest that while Havn Extracts is gaining traction in edibles, there is room for improvement in their vapor pen offerings.

Competitive Landscape

In the Massachusetts edible cannabis market, Havn Extracts has shown a notable upward trend in its rankings over the past few months, moving from 45th place in May 2024 to an impressive 26th place by August 2024. This significant climb suggests a positive reception and growing consumer interest in Havn Extracts' products. In comparison, competitors like Kiva Chocolate and Joygum have maintained relatively stable positions within the top 25, though their sales figures have seen minor fluctuations. Meanwhile, Southie Adams and Sparq Cannabis Company have experienced more volatility, with Sparq Cannabis Company dropping from 21st to 28th place over the same period. This dynamic market landscape indicates that while Havn Extracts is gaining traction, it still faces stiff competition from established brands, necessitating continuous innovation and marketing efforts to sustain its upward momentum.

Notable Products

In August 2024, the top-performing product for Havn Extracts was THC/CBG 1:1 Lemon With Blue Dream Gummies 20-Pack (100mg THC, 100mg CBG), maintaining its rank from the previous month with notable sales of $1712. Raspberry Lemonade Hash Rosin Gummies 20-Pack (100mg) rose to the second position from fifth in July, showing a significant increase in sales. THC/CBN 2:1 Blackberry Gummies 20-Pack (100mg THC, 50mg CBN) held steady in the third position, while CBD/THC 1:1 Strawberry With Orange Wifi Gummies 20-Pack (100mg CBD, 100mg THC) dropped one spot to fourth. Black Cherry Hash Rosin Gummies 20-Pack (100mg) remained consistent in fifth place, indicating stable performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.