Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

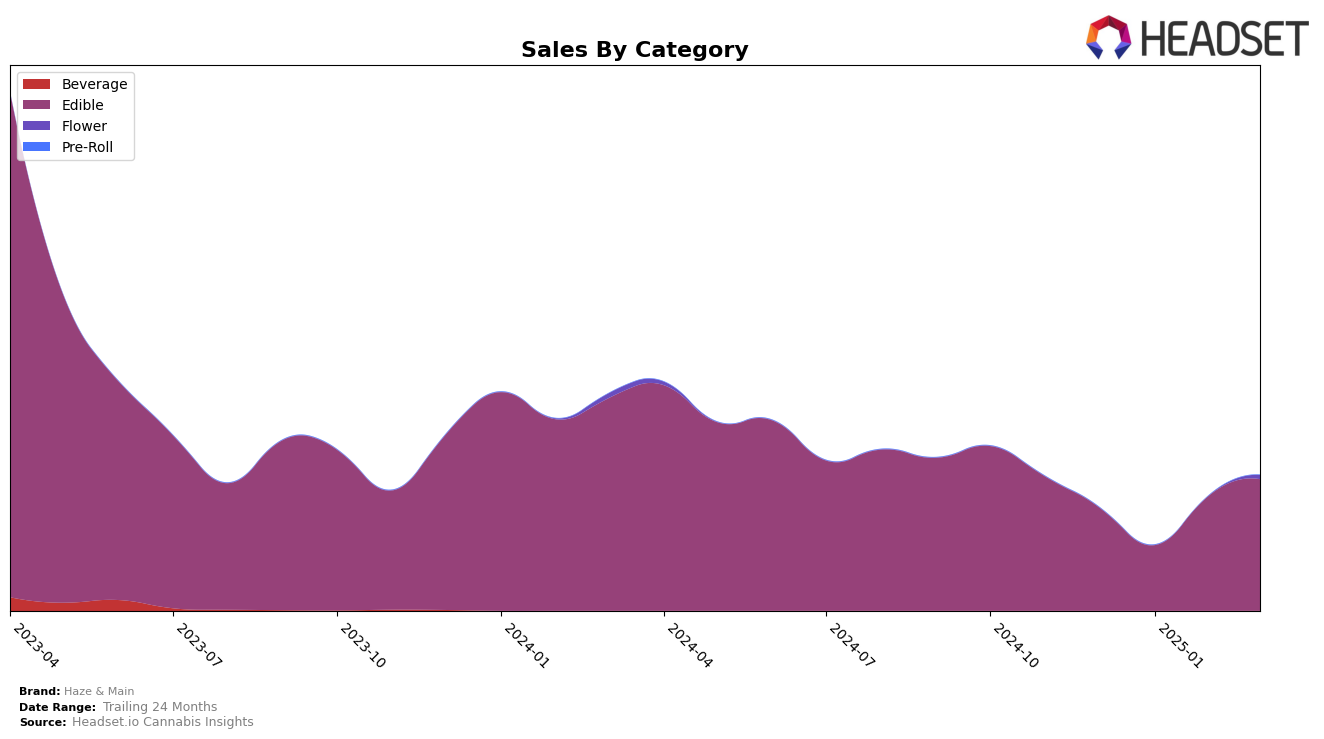

Haze & Main has shown a dynamic performance across various categories and states, particularly in the Edible category in Arizona. The brand has fluctuated within the top 30 rankings, slipping to 30th position in January 2025 before recovering to 21st in February and advancing further to 20th by March. This upward trajectory is noteworthy as it reflects a significant rebound in sales performance, particularly after a dip in January. Such movements suggest an effective strategy in regaining market presence, possibly through new product launches or marketing efforts that resonated well with the local consumers.

While Haze & Main's performance in Arizona's Edible category is commendable, the absence of rankings in other states and categories indicates areas for potential growth or existing challenges. Not appearing in the top 30 could suggest either a lack of market penetration or stiff competition in those regions. This presents an opportunity for the brand to analyze competitive landscapes and consumer preferences in those markets to enhance their strategy. Additionally, the brand's ongoing performance in Arizona could serve as a model for expansion efforts, leveraging successful tactics to improve visibility and sales in other states or categories.

Competitive Landscape

In the competitive landscape of the Arizona edible market, Haze & Main has shown a notable improvement in its ranking, climbing from 30th in January 2025 to 20th by March 2025. This upward trajectory is particularly significant given the competitive pressure from brands like Sublime, which maintained a higher rank but saw a decline from 15th in December 2024 to 18th in March 2025. Meanwhile, Tru Infusion and BITS have shown fluctuating ranks, with Tru Infusion slightly dropping from 20th to 21st and BITS falling from 18th to 22nd over the same period. Notably, Mom & Pop also demonstrated a strong performance, rising to 19th in March 2025. Haze & Main's sales have increased significantly from January to March, suggesting effective strategies in gaining market share and consumer preference amidst a competitive field.

Notable Products

In March 2025, the top-performing product from Haze & Main was the Milk Chocolate Bar 10-Pack (100mg) in the Edible category, maintaining its number one rank for four consecutive months with an impressive sales figure of 2,673 units. The Dark Chocolate Fubar Bar 10-Pack (1000mg) also held steady in second place throughout the same period. Notably, the Dark Chocolate 10-Pack (100mg) climbed from fifth place in December 2024 to third place by March 2025, showing a significant increase in sales. Meanwhile, the Dark Plain Chocolate Bar (100mg) experienced a slight decline, dropping from third in February to fourth in March. The Dark Chocolate Bar 10-Pack (500mg) remained consistently in the fifth position, reflecting stable but lower sales compared to its peers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.