Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

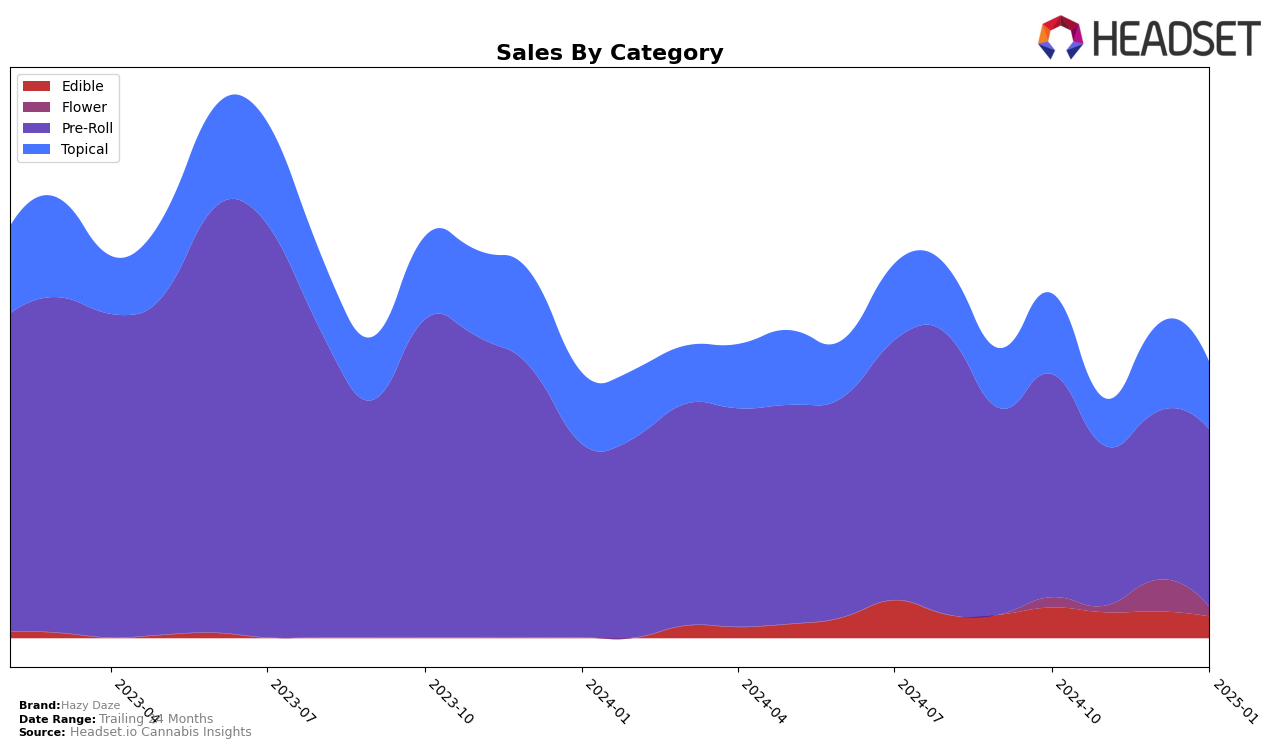

Hazy Daze has shown notable performance in the Topical category within the state of Washington. In October 2024, they achieved a commendable 6th position, a ranking they maintained in December 2024. However, they were absent from the top 30 in November 2024 and January 2025, indicating some fluctuations in their market standing. Despite this inconsistency, the brand experienced a positive sales trend, with an increase from October to December. This suggests that while their market presence may be volatile, there is a steady demand for their products when they are available.

The absence of Hazy Daze from the top 30 in November 2024 and January 2025 could be seen as a challenge for the brand, as it indicates potential missed opportunities in maintaining a consistent market presence. This fluctuation might reflect strategic shifts or external market factors affecting their performance. The ability to rebound quickly, as seen in December, shows resilience and potential for growth. The data highlights the importance of stability in ranking to ensure sustained visibility and success within the competitive cannabis market.

Competitive Landscape

In the Washington Topical category, Hazy Daze has experienced fluctuating rankings, indicating a dynamic competitive landscape. In October 2024, Hazy Daze was ranked 6th, but it dropped out of the top 20 in November 2024, only to regain its 6th position in December 2024. This inconsistency suggests potential volatility in sales or market presence, which could be influenced by competitive pressures. Notably, Lucid maintained a steady 5th position throughout the same period, suggesting a more stable market performance. Meanwhile, Honu appeared in the rankings in December 2024 at 7th place, which could indicate a rising competitor. These insights highlight the need for Hazy Daze to strategize effectively to maintain and improve its market position amidst strong competition.

Notable Products

In January 2025, the top-performing product from Hazy Daze was the Hashtag - Indica Infused Blunt (1g) in the Pre-Roll category, which climbed to the number one rank with sales of 402 units. Following closely was the Indica #Live Resin Infused Pre-Roll (1g), which maintained a strong second position, showing a slight decline from its previous first-place rankings in October and November 2024. The Hashtag - Sativa Infused Pre-Roll 2-Pack (1g) entered the rankings for the first time, securing the third position. Meanwhile, the CBD/THC 9:1 Bud-ease Biscuits Dog Treat Biscuits 10-Pack remained steady in fourth place, consistent with its ranking in December 2024. Notably, the Sativa #Live Infused Blunt (1g) also made its debut on the list, sharing the third spot in the Pre-Roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.