Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

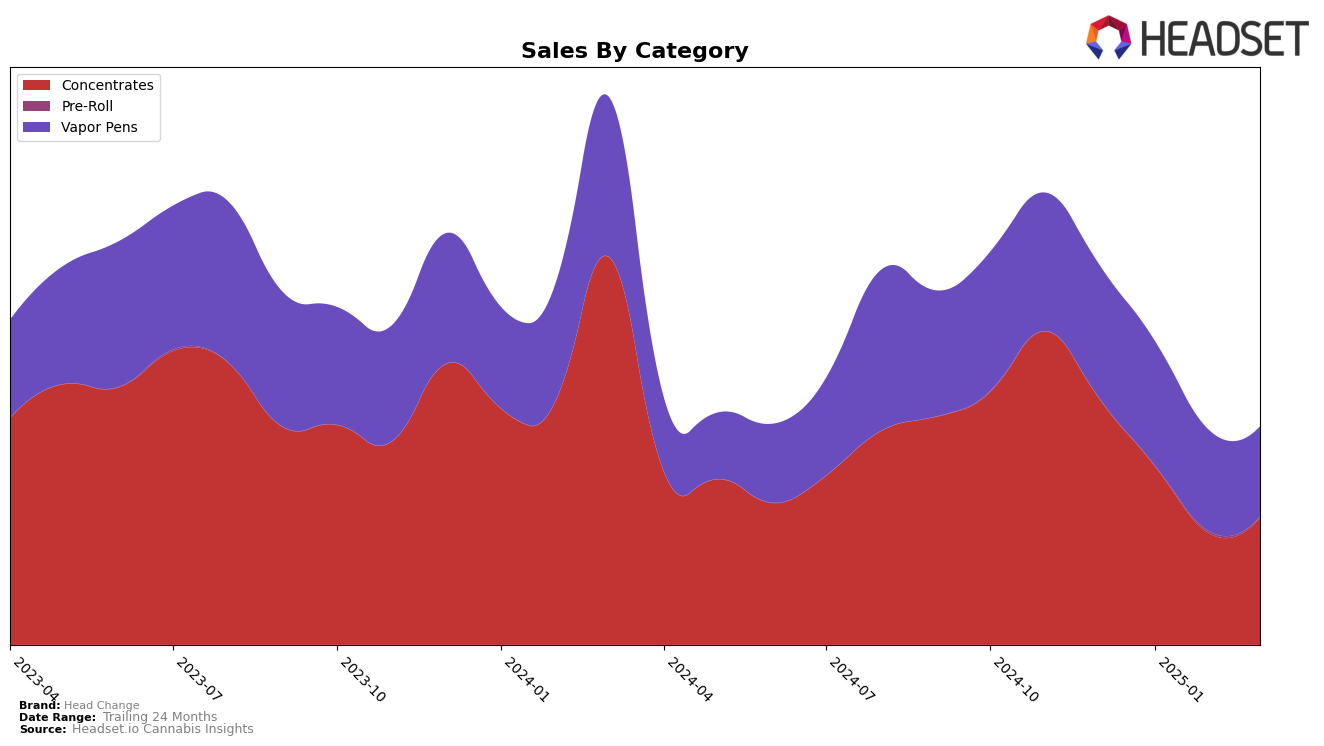

In the Missouri market, Head Change has shown notable performance in the Concentrates category. Starting from a strong position at rank 2 in December 2024, the brand experienced a gradual decline, reaching rank 10 by March 2025. This downward trend suggests a potential loss in market share or increased competition within the state. Despite this, Head Change maintained a presence in the top 10, indicating resilience and a solid consumer base. The sales figures reflect this movement, with a noticeable dip from December to February, followed by a slight recovery in March. This fluctuation could be attributed to seasonal demand changes or strategic shifts in marketing efforts.

Conversely, in the Vapor Pens category, Head Change struggled to maintain its rank, starting at 29 in December 2024 and falling out of the top 30 by February 2025. By March, it had further slipped to rank 40, which may suggest challenges in competing with other brands or a shift in consumer preferences within Missouri. This decline in ranking is mirrored by a consistent decrease in sales during the same period, pointing to potential areas for improvement in product offerings or marketing strategies. The absence from the top 30 in February highlights a significant competitive pressure that Head Change faces in this category, emphasizing the need for strategic adjustments to regain its standing.

Competitive Landscape

In the competitive landscape of the Missouri concentrates market, Head Change has experienced notable fluctuations in its ranking over the past few months. Starting strong in December 2024 with a rank of 2, Head Change saw a decline to rank 10 by March 2025. This shift can be attributed to the dynamic performance of competitors such as Good Day Farm, which also experienced a downward trend, moving from rank 4 in December 2024 to rank 11 in March 2025. Meanwhile, Heartland Labs improved its position from rank 12 in January 2025 to rank 9 by March, indicating a potential threat to Head Change's market share. Additionally, Vibe Cannabis (MO) consistently maintained a top 10 position, slightly improving from rank 7 in January to rank 8 in March. This competitive environment suggests that while Head Change remains a strong player, the brand must strategize effectively to regain its earlier momentum and counter the rising influence of its competitors.

Notable Products

In March 2025, Cherry Limenado Live Badder (1g) emerged as the top-performing product for Head Change, achieving the highest rank in sales within the Concentrates category with 463 units sold. Emmaginary Grapes Live Badder (1g) and Graped Out Live Rosin (1g) both secured the second position, indicating a tie, with notable sales of 379 units each. Trop Galaxy Live Badder (1g) followed closely in third place, showcasing a solid performance within the same category. Angel's Hash Cake Live Resin Sauce Cartridge (0.5g) ranked fourth, leading the Vapor Pens category. Compared to previous months, Cherry Limenado Live Badder (1g) has seen a significant rise, while the other products have maintained consistent rankings, highlighting their strong market presence.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.