Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

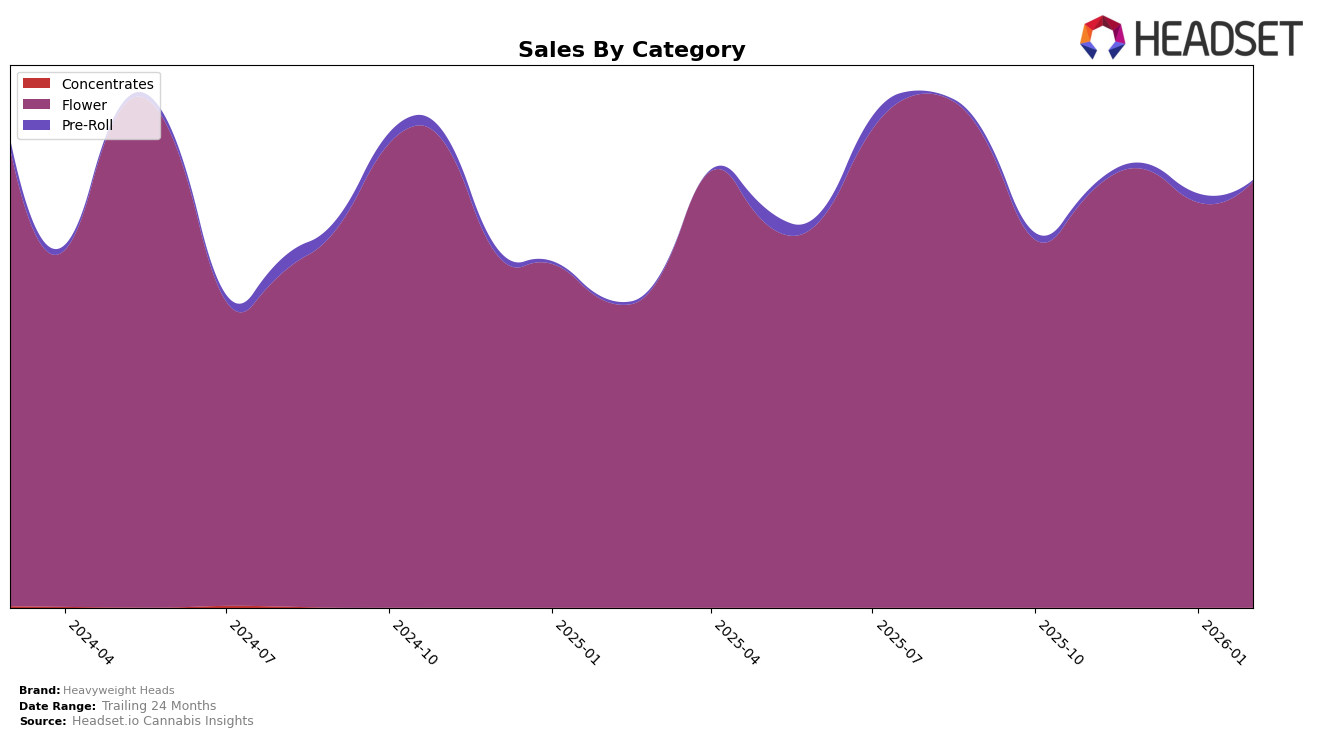

Heavyweight Heads has shown notable performance in the Michigan market, particularly in the Flower category. From November 2025 to February 2026, the brand has climbed from the 23rd position to the 14th, indicating a positive trend in consumer preference or market penetration. This upward movement is significant, especially considering the competitive nature of the Flower category. While sales figures in Michigan saw a dip in January, the brand quickly rebounded in February, suggesting resilience and possibly effective marketing or distribution strategies. This performance highlights Heavyweight Heads' growing influence in Michigan's cannabis market.

In contrast, Heavyweight Heads faces challenges in the New Jersey market, particularly within the Flower category. The brand's ranking fluctuated, peaking at 49th in January 2026 before dropping to 74th in February. This inconsistency suggests possible issues with market engagement or competition. Additionally, the brand's absence in the top 30 for the Pre-Roll category until January 2026, when it ranked 75th, indicates that there is considerable room for growth or improvement in this segment. The New Jersey market presents a different set of challenges and opportunities for Heavyweight Heads compared to Michigan, highlighting the importance of tailored strategies for different state markets.

Competitive Landscape

In the competitive landscape of the Michigan flower market, Heavyweight Heads has experienced notable shifts in rank and sales over recent months. As of February 2026, Heavyweight Heads climbed to the 14th position, marking a significant improvement from its 23rd position in November 2025. This upward trajectory is particularly impressive given the competitive pressure from brands like Skymint, which surged from 33rd to 16th place, and Goldkine, which made a dramatic leap from 35th to 12th place. Despite these competitors' gains, Heavyweight Heads has maintained a consistent sales performance, even surpassing Guerilla Grown, which saw a slight decline in rank from 20th to 15th. Meanwhile, Redemption, a top-tier competitor, experienced a drop from 7th to 13th place, indicating potential market share opportunities for Heavyweight Heads. These dynamics suggest that Heavyweight Heads is well-positioned to capitalize on its current momentum and continue its ascent in the Michigan flower market.

Notable Products

In February 2026, Sunshine (Bulk) emerged as the top-performing product for Heavyweight Heads, climbing from fourth place in January to first place with sales reaching 1964 units. Mikado (Bulk) secured the second spot, maintaining a strong position from its previous third place in November 2025. Orangutan (Bulk) saw a significant comeback, rising to third place after not being ranked in January, reflecting a notable increase in demand. The Reaper (Bulk) consistently held the fourth position from December 2025 through February 2026. Trick Trick OG (1g) rounded out the top five, experiencing a slight drop from its second-place ranking in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.