Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

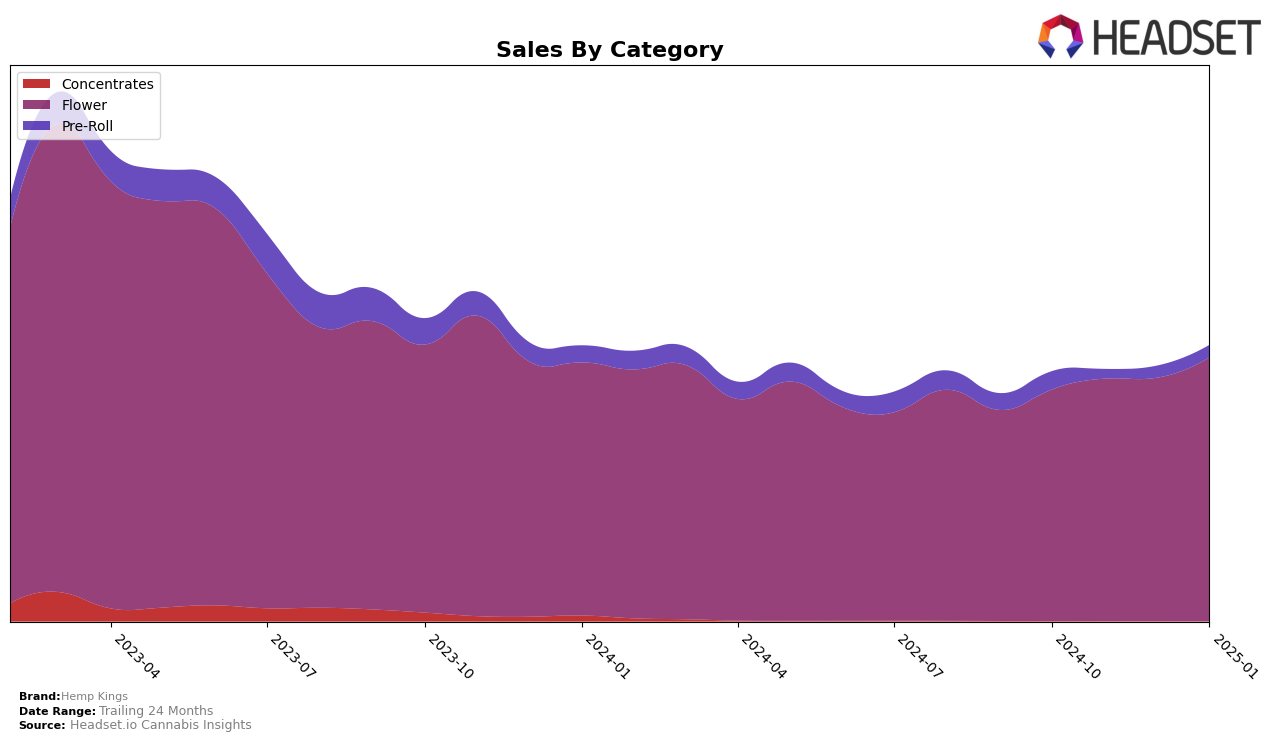

In the state of Washington, Hemp Kings has shown a notable upward trajectory in the Flower category. From October 2024 to January 2025, the brand climbed from a rank of 35 to 21, indicating a strong performance and increased consumer demand. This movement into the top 30 is significant, as it reflects the brand's growing market presence and competitiveness. The sales figures support this trend, with a steady increase over the months, culminating in $271,800 in January 2025. Such progress highlights the brand's effective strategies in capturing market share and enhancing its visibility among consumers.

Despite these gains in Washington, it is important to note that Hemp Kings did not appear in the top 30 brands in other states or provinces for this period across various categories. This absence suggests that while the brand is gaining traction in Washington, it may need to bolster its efforts in other regions to achieve similar success. The focus on Flower in Washington could serve as a model for expansion strategies elsewhere, but the brand must address the challenges of penetrating new markets and diversifying its category presence. Observing the brand's tactics in Washington could provide insights into potential growth opportunities in other states or provinces.

Competitive Landscape

In the competitive landscape of the flower category in Washington, Hemp Kings has shown a notable upward trajectory in its rankings and sales over the past few months. Starting from a rank of 35 in October 2024, Hemp Kings improved to 21 by January 2025, indicating a positive trend in market presence. This improvement is reflected in its sales growth, which aligns closely with its rise in rank. Notably, Mini Budz and Bondi Farms also demonstrated significant rank improvements, with Mini Budz climbing from 42 to 20 and Bondi Farms from 33 to 19 over the same period. Despite these competitors' advancements, Hemp Kings' consistent sales increase suggests a strong brand loyalty and effective market strategies. Meanwhile, Withit Weed maintained a steady performance, closely trailing Hemp Kings by January 2025. The competitive dynamics in Washington's flower market highlight Hemp Kings' resilience and potential for continued growth amidst a rapidly evolving landscape.

Notable Products

In January 2025, Hemp Kings' top-performing product was Gorilla Glue #4 (3.5g) in the Flower category, maintaining its first-place rank from the previous two months with sales of 2067 units. Wedding Cake (3.5g), also in the Flower category, held steady at the second rank, showing consistent performance from November and December 2024. Wedding Cake (1g) remained third, mirroring its position from the last two months as well. Gorilla Glue #4 Pre-Roll 2-Pack (1g) stayed in the fourth spot, unchanged from December 2024. Notably, Wedding Cake Pre-Roll 2-Pack (1g) maintained its fifth-place ranking, highlighting a stable sales trend for Hemp Kings' pre-roll offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.