Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

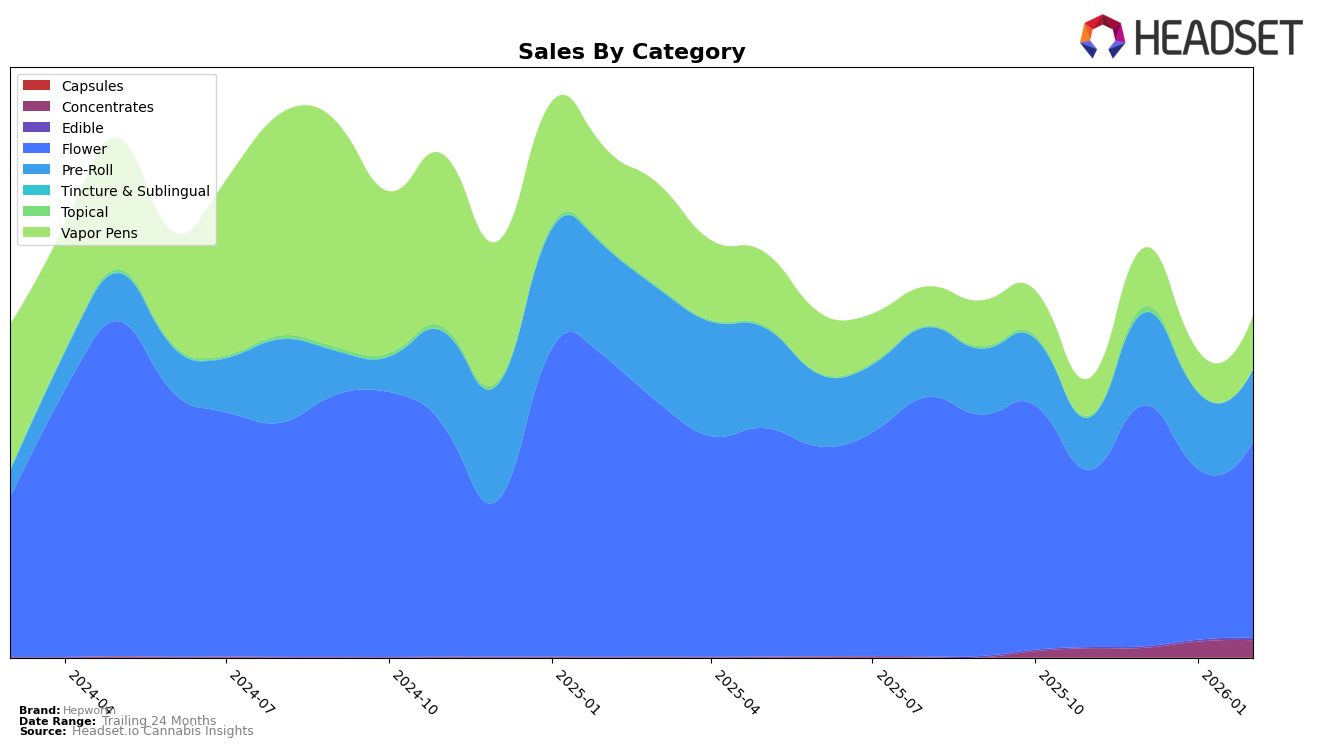

Hepworth's performance in the New York cannabis market has shown noteworthy fluctuations across various product categories. In the Concentrates category, Hepworth made a significant leap from being unranked in the top 30 to securing the 24th position by February 2026. This indicates a positive trend and suggests a growing consumer preference or effective marketing strategies for their concentrates. Conversely, in the Flower category, Hepworth experienced some volatility, dropping out of the top 30 in January 2026 before rebounding to the 29th position in February. This movement might reflect competitive pressures or shifts in consumer tastes within the state.

In the Pre-Roll category, Hepworth's ranking saw a decline from 37th in December 2025 to 43rd by February 2026, indicating potential challenges in maintaining market share. Meanwhile, their Vapor Pens category has shown a slight improvement, moving from 56th to 50th over the same period, suggesting a modest but positive trajectory. Despite not being in the top 30 for some categories, Hepworth's overall sales figures, particularly in Concentrates, have shown a consistent upward trend, reflecting a potential area of strength for the brand in New York. These movements highlight the dynamic nature of the cannabis market and the importance of strategic positioning across different product lines.

Competitive Landscape

In the competitive landscape of the Flower category in New York, Hepworth has shown a dynamic performance in recent months. Notably, Hepworth's rank fluctuated from 27th in November 2025 to 22nd in December 2025, before dropping to 33rd in January 2026 and then climbing back to 29th in February 2026. This indicates a volatile market position, possibly impacted by seasonal trends or competitive pressures. During this period, Jetpacks maintained a relatively stable rank, hovering around the 30th position, while Runtz and To The Moon demonstrated upward momentum, with To The Moon making a significant leap to 28th in February 2026. Meanwhile, Left Coast showed a consistent improvement, securing the 27th rank by February 2026. These shifts suggest that while Hepworth has potential for growth, it faces stiff competition from brands like Left Coast and To The Moon, which are gaining traction in the market.

Notable Products

In February 2026, Hepworth's top-performing product was Mango Dog x White Runtz (3.5g) in the Flower category, maintaining its leading position from December 2025, with sales reaching 4,239 units. Following closely, Terp Poison (3.5g) ranked second, having dropped from the top spot in January 2026. High Octane Grape Pre-Roll 5-Pack (2.5g) made a notable appearance in third place, marking its first ranking entry. Super Sour Diesel Sauce Cartridge (1g) climbed to fourth place from a previous fifth in January. Kush Mintz x Gelato 41 Pre-Roll 5-Pack (2.5g) slipped to fifth place, showing a slight decrease in sales from the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.