Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

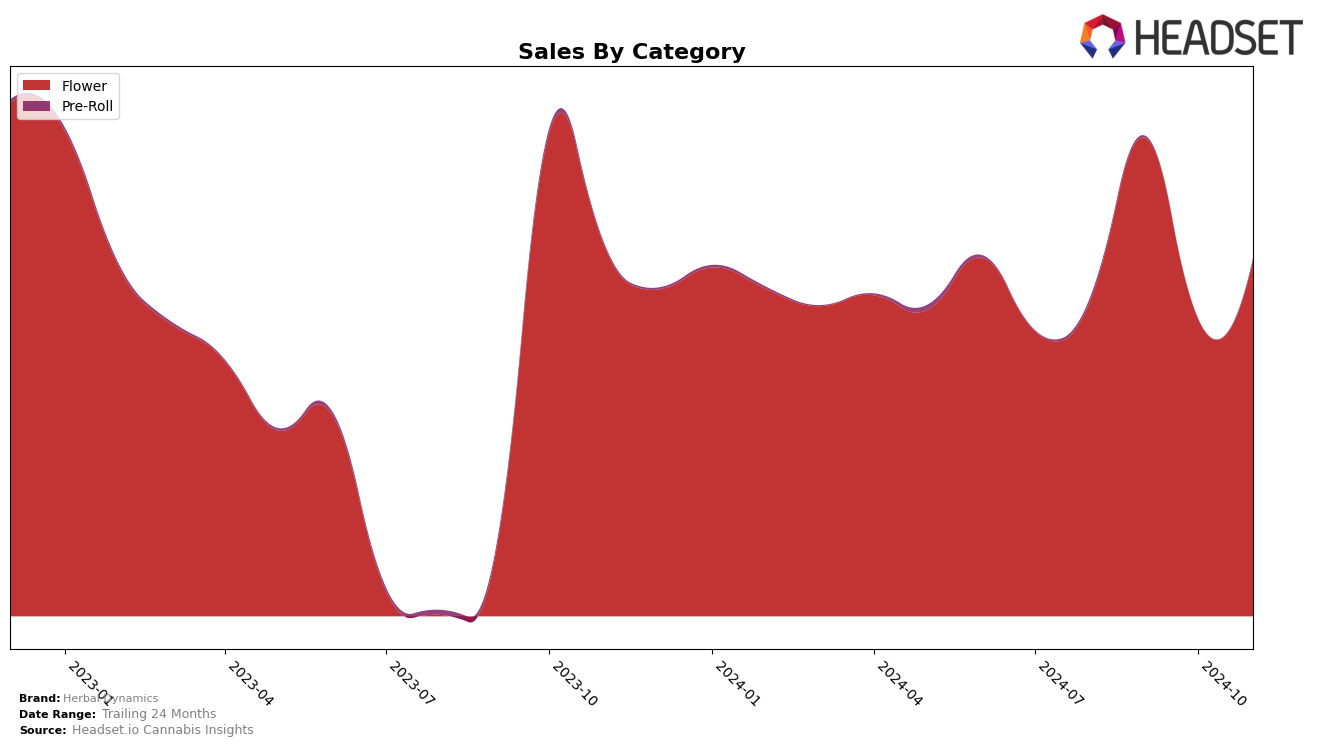

Herbal Dynamics has shown a fluctuating performance across different categories and states, particularly in Oregon. In the Flower category, the brand experienced significant movement, entering the top 30 in September 2024 with an 18th place ranking, which marked a notable improvement from its 33rd position in August. However, the brand's momentum was not sustained as it slipped out of the top 30 in October, before making a comeback in November with a 29th place ranking. This oscillation suggests that while Herbal Dynamics has the potential to capture market share, maintaining a consistent presence remains a challenge. The sales figures reflect this volatility, with a peak in September followed by a drop in October, and a modest recovery in November.

While Herbal Dynamics has made some headway in Oregon's Flower category, its absence from the top 30 in other categories and states indicates areas for potential growth and improvement. The brand's ability to re-enter the top 30 in November suggests resilience and a capacity to adapt, yet the lack of consistent rankings across multiple states or provinces underscores the competitive nature of the cannabis market. Understanding the dynamics in other regions where Herbal Dynamics is not currently making a significant impact could provide insights into strategic opportunities for expansion or repositioning. Nevertheless, the brand's fluctuating performance in Oregon highlights both its potential and the challenges it faces in a competitive landscape.

Competitive Landscape

In the competitive landscape of the Oregon flower category, Herbal Dynamics has experienced notable fluctuations in its market position over recent months. After a strong performance in September 2024, where it climbed to 18th place, Herbal Dynamics saw a decline in October, dropping to 34th, before slightly recovering to 29th in November. This volatility contrasts with competitors like Garden First and Earl Baker, which maintained more stable rankings, albeit outside the top 20. Interestingly, Roots Grass Cannabis made a significant leap from being unranked in October to 30th in November, indicating a potential rising competitor. These shifts suggest that while Herbal Dynamics has the potential for strong sales surges, maintaining consistent market presence remains a challenge amidst dynamic competition.

Notable Products

In November 2024, Ice Cream Cake (Bulk) reclaimed its position as the top-performing product for Herbal Dynamics, having previously slipped to third place in October. Velvet Glove (Bulk) followed closely in second place, showing a notable drop from its first-place ranking in October. Golden Sunset (Bulk) made its debut in the rankings, securing the third position for the month. Black Garlic (1g) saw an improvement, moving up to fourth place from fifth in October, with sales reaching 602 units. Frosted Flakez (Bulk) experienced a decline, dropping to fifth place from second in the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.