Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

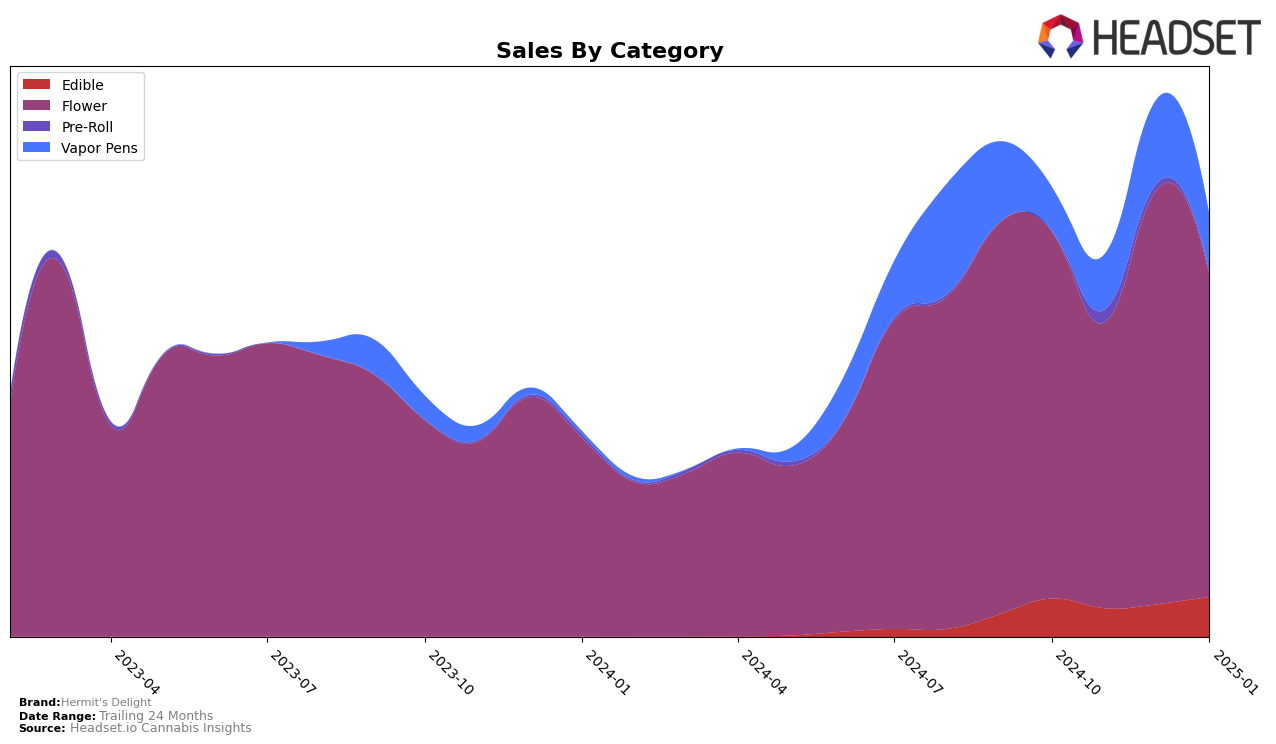

In the state of Missouri, Hermit's Delight has shown varied performance across different cannabis categories. Notably, the brand has maintained a steady presence in the Flower category, consistently ranking within the top 30 from October 2024 to January 2025, peaking at 24th place in both December and January. This indicates a strong foothold in the market for this category. However, the Edible segment tells a different story, where Hermit's Delight has struggled to break into the top 30 rankings, with its closest approach being 32nd place in October 2024. This suggests potential challenges or increased competition in the Edible market within the state, highlighting areas for strategic improvement.

In the Vapor Pens category, the brand has demonstrated an upward trend, improving its rank from 53rd in October 2024 to a consistent 45th place by December 2024 and January 2025. This movement suggests a growing acceptance or popularity of Hermit's Delight's vapor products among consumers in Missouri. Meanwhile, the Pre-Roll category presents a gap, as Hermit's Delight did not make it into the top 30 rankings during the observed months, except for a brief appearance at 48th place in November 2024. This absence in the upper ranks could indicate either a nascent market presence or the need for increased market penetration strategies in this category.

Competitive Landscape

In the competitive landscape of the Flower category in Missouri, Hermit's Delight has shown a fluctuating performance in terms of rank and sales over the past few months. Starting at rank 26 in October 2024, Hermit's Delight dropped to rank 30 in November, only to recover to rank 24 by December and maintain this position in January 2025. This indicates a resilience in the market despite the volatility. In comparison, Nugz consistently outperformed Hermit's Delight, maintaining a higher rank, although it experienced a significant drop from rank 13 in December to rank 22 in January. Meanwhile, Vertical (MO) showed a steady improvement, surpassing Hermit's Delight by January 2025 with a rank of 23. Elevate Cannabis Co also demonstrated a similar trend of fluctuating ranks, but with a notable decline in January, falling to rank 26. These dynamics suggest that while Hermit's Delight faces stiff competition, particularly from brands like Nugz and Vertical (MO), its ability to regain and maintain its rank in December and January highlights potential areas for strategic growth and market positioning.

Notable Products

In January 2025, the top-performing product from Hermit's Delight was Dante's Inferno (Bulk) in the Flower category, securing the first rank with notable sales of 3020 units. Hash Burger (Bulk), also in the Flower category, followed closely in the second position, showing strong sales momentum. Hash Burger (3.5g), which had previously been ranked first in October 2024 and dropped to fourth in November 2024, climbed back to third place in January 2025. Paw Paw Distillate Cartridge (1g) in the Vapor Pens category achieved the fourth rank, maintaining its presence in the top five since November 2024. Gush Mintz (Bulk) rounded out the top five, indicating a consistent demand for bulk flower products.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.