Feb-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

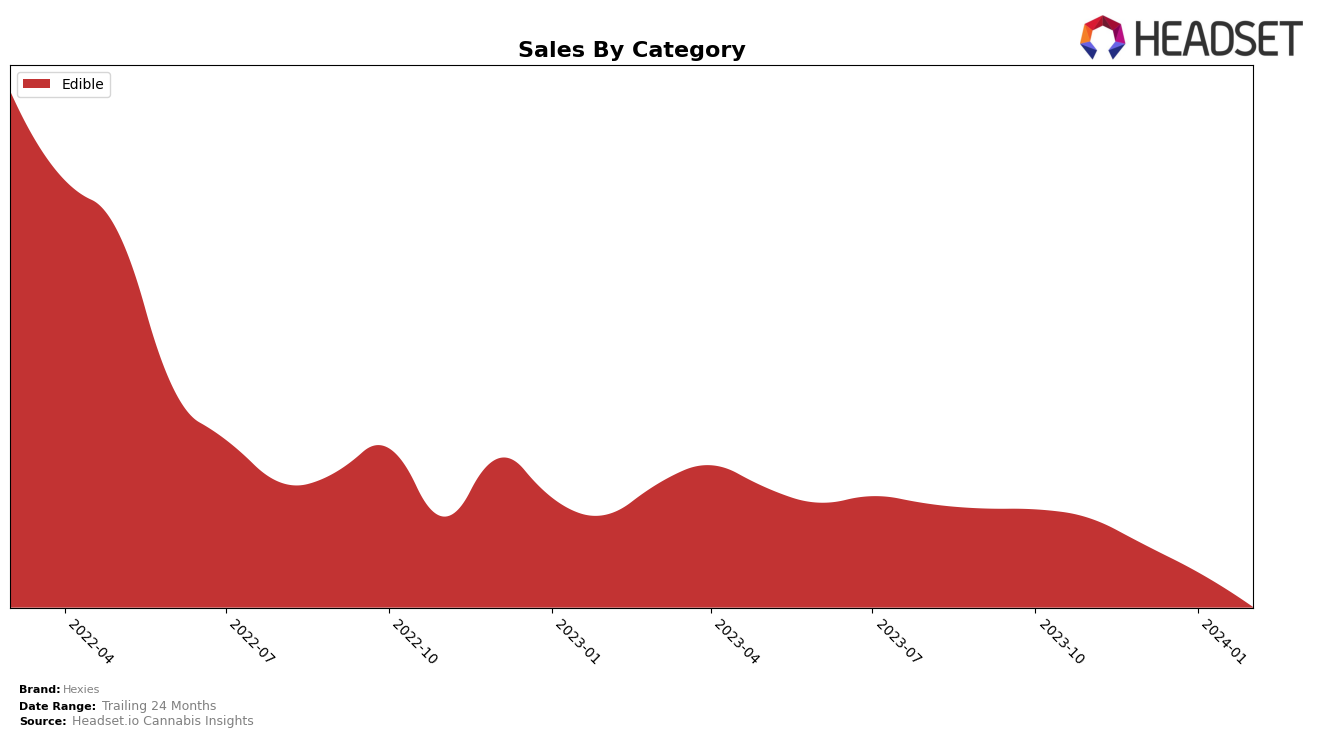

In Massachusetts, Hexies has shown a fluctuating performance in the edibles category over the recent months. Starting from a strong position at 14th in November 2023, with sales reaching $199,658, the brand experienced a gradual decline in its ranking, slipping to 16th in December, 18th in January 2024, and finally landing at 27th in February. This downward trend is not only indicative of a decrease in Hexies' market share within the edibles category but also highlights the brand's struggle to maintain its competitive edge against other brands in a highly competitive market. The significant drop in sales from November 2023 to February 2024 further emphasizes the challenges Hexies faces in sustaining its performance and appeal among consumers in Massachusetts.

The consistent decline in rankings from November 2023 to February 2024 raises questions about the factors contributing to Hexies' decreasing popularity in the Massachusetts edibles market. While specific reasons for this trend are not detailed, potential factors could include increased competition, changes in consumer preferences, or possible shifts in the brand's marketing strategies. The fall to 27th place in February, where Hexies was not even within the top 30 brands in previous months, suggests a critical need for the brand to reevaluate its position and strategy in the market. To regain its footing, Hexies may need to explore innovative approaches to product development, marketing, and consumer engagement to enhance its visibility and appeal in the highly competitive and dynamic edibles category.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Massachusetts, Hexies has experienced a notable shift in its position. Initially ranked 14th in November 2023, Hexies saw a gradual decline in rank, moving down to 27th by February 2024. This change in rank is reflective of a decrease in sales over the same period, indicating a challenging market environment for Hexies. Competitors such as Green Hornet and Glorious Cannabis Co. have shown significant improvements in their rankings, with Glorious Cannabis Co. making a notable jump from 49th to 25th place. Meanwhile, Encore Edibles and Harbor House Collective have maintained relatively stable positions, indicating a consistent performance amidst the competitive dynamics. This scenario underscores the importance for Hexies to reassess its market strategies and possibly innovate its product offerings to regain its footing in the Massachusetts edible cannabis market.

Notable Products

In Feb-2024, Hexies saw its Blue Razz Gummies 10-Pack (50mg) as the top-selling product with a sales figure of 1519 units, marking its rise to the top from the second position in the previous month. Following closely, Strawberry Kiwi Gummies 20-Pack (100mg) moved down to the second rank, despite having been the leader in Jan-2024. The Watermelon Gummies 10-Pack (50mg) secured the third spot, showing a consistent performance by maintaining its position from the previous month. The Strawberry Kiwi Fruit Chews 10-Pack (50mg) experienced a slight decline, dropping to the fourth rank from its previous third position in Jan-2024. Lastly, the Mango Fruit Chews 10-Pack (50mg) rounded out the top five, slipping from the fourth position in Jan-2024 to fifth, indicating a competitive and dynamic market within Hexies' product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.