Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

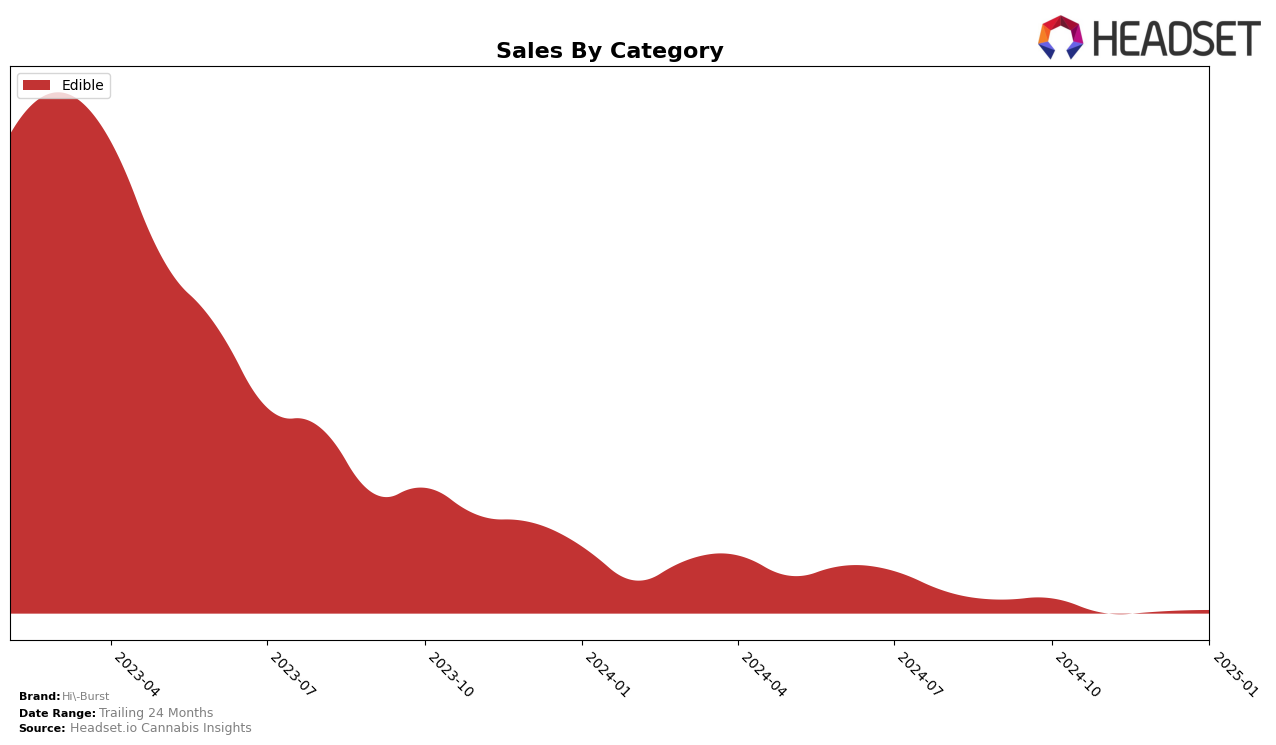

Hi-Burst's performance in the Washington market within the Edible category shows a consistent presence in the top 30 rankings, although with a slight downward trend. Starting at the 24th position in October 2024, the brand slipped to 26th in November and continued to hold the 27th position in both December and January 2025. This indicates a relatively stable, albeit slightly declining, market position over the observed months. Despite this modest drop in rankings, the sales figures show a slight rebound from November to January, suggesting a potential resilience in consumer demand or effective sales strategies that could be further explored for insights.

Interestingly, Hi-Burst's absence from the top 30 rankings in any other state or province highlights a significant opportunity for growth and expansion. The lack of presence in other markets could be seen as a limitation, but also as a potential area for strategic development. By focusing on strengthening its market position in Washington while exploring entry into new regions, Hi-Burst could potentially enhance its overall brand recognition and market share. The data suggests that while Hi-Burst maintains a foothold in Washington, there is room for growth and improvement both within and beyond the state.

Competitive Landscape

In the Washington edibles market, Hi-Burst has experienced a slight decline in its competitive positioning from October 2024 to January 2025, dropping from 24th to 27th rank. This shift is notable as it coincides with a decrease in sales from October to November, followed by a modest recovery through January. In contrast, Agro Couture maintained a relatively stable presence, fluctuating slightly but consistently ranking higher than Hi-Burst in December and January. Meanwhile, June's Sweets & Savories has shown a positive trend, climbing to 24th place by January, surpassing Hi-Burst. This competitive landscape suggests that while Hi-Burst is facing challenges in maintaining its rank, competitors like June's Sweets & Savories are capitalizing on market opportunities, potentially impacting Hi-Burst's sales trajectory and market share.

Notable Products

In January 2025, the top-performing product from Hi-Burst was the Sativa Sour Raspberry Lemonade Fruit Chew 10-Pack (100mg), maintaining its first-place ranking for the fourth consecutive month with sales of 697 units. The Sativa Sour Blue Raspberry Fruit Chews 10-Pack (100mg THC, 1.88oz) held steady in the second position, showing a notable sales increase to 512 units from December. The Indica Sour Blue Raspberry Fruit Chew 10-Pack (100mg) remained in third place, continuing its consistent performance over the months. New to the rankings, the CBD/THC 1:1 Sativa Raspberry Lemonade Fruit Chew 10-Pack (100mg CBD, 100mg THC) debuted at fourth place. The Indica Lemonade Fruit

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.