Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

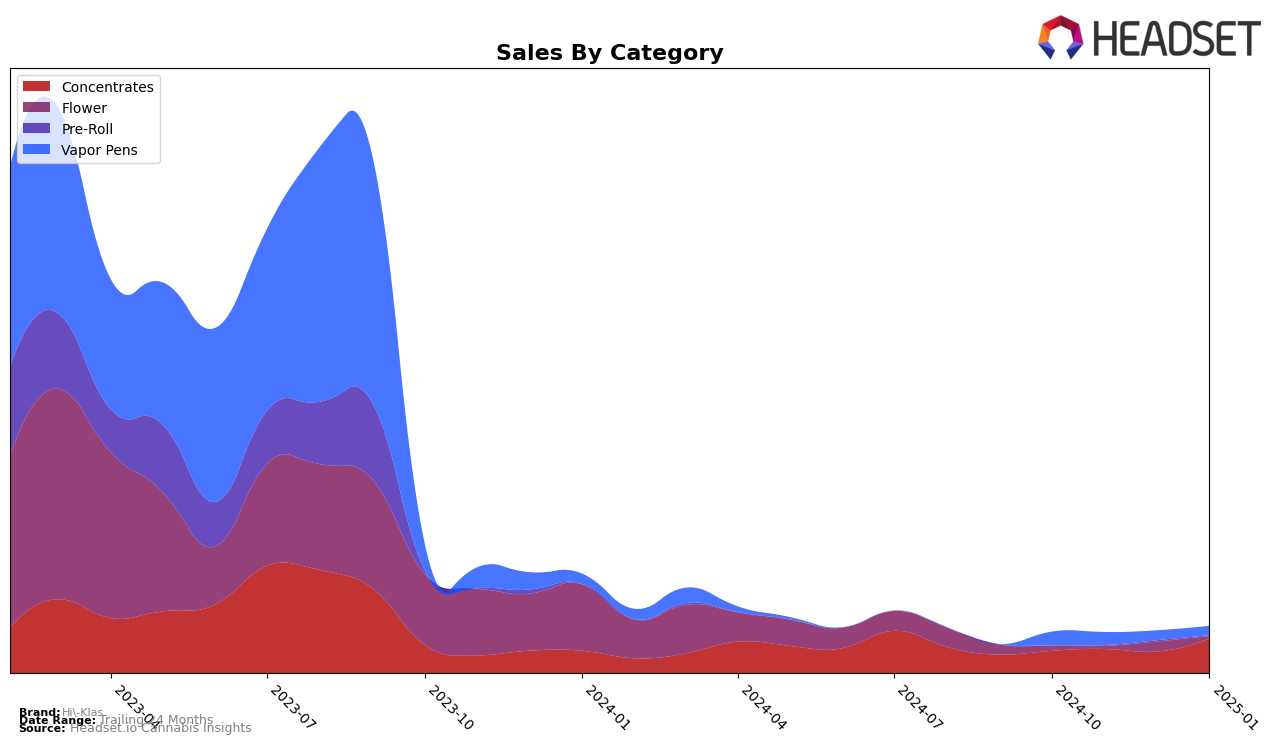

Hi-Klas has shown notable performance shifts across different categories and states, particularly in Arizona. In the Concentrates category, Hi-Klas has made significant strides, moving from outside the top 30 in October 2024 to securing the 25th position by January 2025. This upward trajectory is underscored by a substantial increase in sales, particularly notable in January 2025, where sales reached 42,413. In contrast, the Flower category presents a different story, with Hi-Klas not making it into the top 30 rankings during the observed months, indicating a potential area for growth or reevaluation in their product strategy.

In the Vapor Pens category, Hi-Klas has experienced some fluctuations in Arizona. Despite a brief dip in rankings in December 2024, where they fell to 69th place, they maintained this position into January 2025. This stability at the lower end of the rankings may suggest challenges in this segment, especially considering the sales decline from October 2024 to January 2025. However, the brand's ability to maintain a presence in the rankings highlights their ongoing relevance in the market, albeit with room for improvement. These movements across categories and states offer a glimpse into Hi-Klas's market strategies and potential areas for future focus.

Competitive Landscape

In the competitive landscape of the concentrates category in Arizona, Hi-Klas has shown a notable upward trajectory in its market position over the recent months. Starting from a rank of 35 in October 2024, Hi-Klas improved its standing to 25 by January 2025, indicating a significant climb in the ranks. This positive trend is particularly impressive when compared to competitors like Abundant Organics, which remained outside the top 20 throughout the same period. Meanwhile, Mozey Extracts and WZRD experienced fluctuations, with Mozey Extracts dropping from 16 to 24 and WZRD declining from 17 to 26, suggesting potential volatility in their market positions. Space Rocks, however, maintained a relatively stable presence, hovering around the 22 to 23 rank. Hi-Klas's rise in rank, coupled with an increase in sales from October to January, highlights its growing influence and potential to capture more market share in Arizona's concentrates sector.

Notable Products

In January 2025, Slurricane Crumble (1g) emerged as the top-performing product for Hi-Klas, leading the Concentrates category with a notable increase to first place from its previous third-place ranking in December 2024, achieving sales of 468 units. Birthday Sass Budder Wax (1g) secured the second position, showing significant traction as it was unranked in prior months. Birthday Sass Budder (1g) followed closely, ranking third, also making a strong entry from being previously unlisted. Trop Kush Crumble (1g) maintained its fourth position from December 2024 to January 2025 with steady sales growth. Papaya Moose Sugar (1g) rounded out the top five, marking its debut in the rankings for January 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.