Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

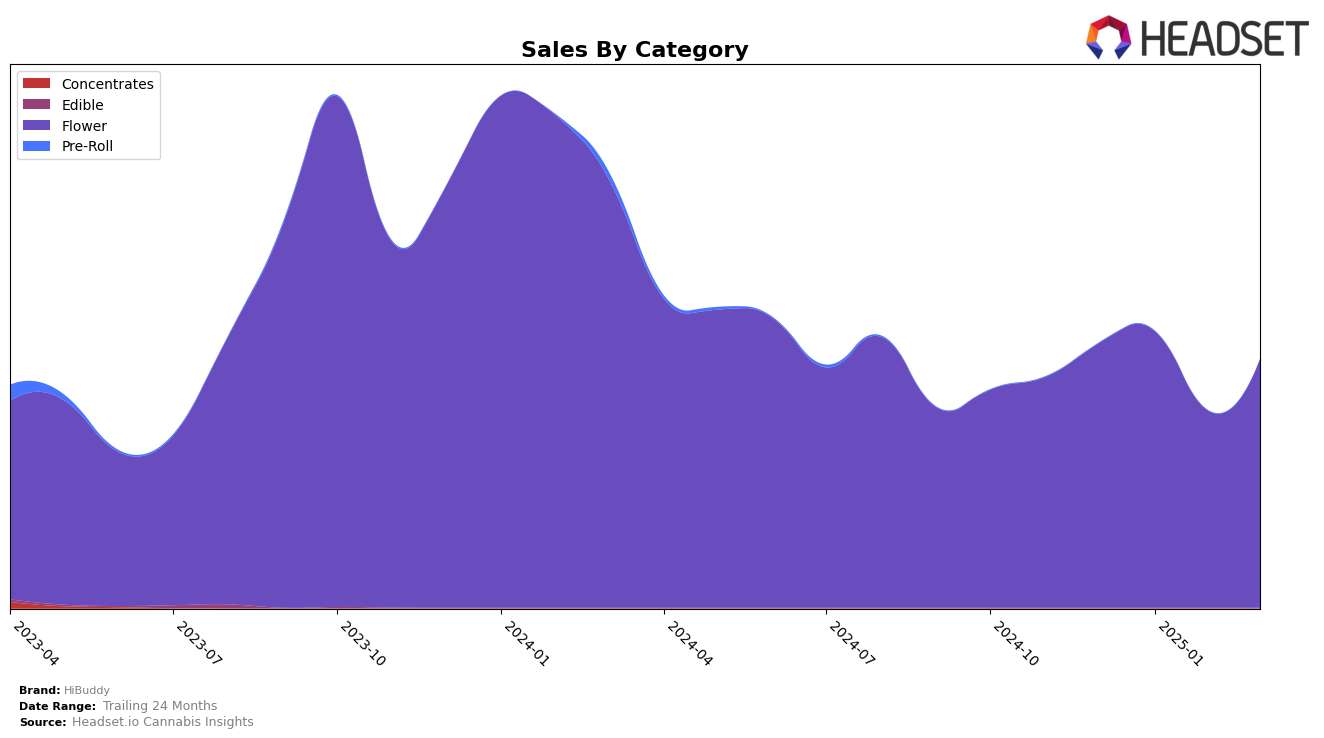

In the state of Arizona, HiBuddy has shown fluctuating performance in the Flower category over the past few months. Notably, the brand was not ranked in the top 30 in February 2025, indicating a dip in their market presence during that period. However, HiBuddy made a comeback in March 2025, securing the 30th position. This rebound suggests a potential recovery or strategic shift that helped regain some market traction. Despite these ups and downs, it's clear that maintaining a consistent top 30 presence remains a challenge for HiBuddy in Arizona's competitive Flower market.

Looking at sales trends, HiBuddy experienced a peak in January 2025, followed by a significant drop in February, which correlates with their absence from the top 30 rankings that month. This decline could point to seasonal factors, competitive pressures, or internal challenges. The subsequent increase in March sales aligns with their return to the rankings, indicating that the brand may have implemented effective measures to address previous setbacks. While the specific strategies behind these movements are not detailed here, the data highlights the dynamic nature of HiBuddy's market performance in Arizona.

```Competitive Landscape

In the competitive landscape of the Flower category in Arizona, HiBuddy has shown a dynamic shift in its market positioning from December 2024 to March 2025. HiBuddy's rank improved from 31st in December 2024 to 30th by March 2025, indicating a positive trend despite fluctuations in sales. This improvement is notable considering the performance of competitors like Old Pal and Vortex Cannabis Inc., who maintained relatively stable or declining ranks. GRAS Cannabis made a significant leap from 42nd to 28th, surpassing HiBuddy in March. Meanwhile, Grow Sciences saw a decline in rank, dropping to 36th by March. HiBuddy's ability to climb the ranks amidst such competition suggests a resilient market strategy, although the brand must continue to innovate to maintain and further improve its position against rising competitors like GRAS Cannabis.

Notable Products

In March 2025, GMO (7g) maintained its top position in HiBuddy's product lineup with sales reaching 1249 units, showing consistent performance as the number one product since January 2025. Citrus Octane (7g) climbed to the second spot, surpassing Wedding Cake (7g), which dropped to third place after holding second for two consecutive months. Couchlock Kush (7g) entered the rankings for the first time, securing the fourth position, while Lemon Cherry Gelato (7g) followed closely at fifth. Notably, Wedding Cake (7g) experienced a decline in rank from its previous leading position in December 2024. These shifts highlight the dynamic changes in consumer preferences within HiBuddy's product offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.