Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

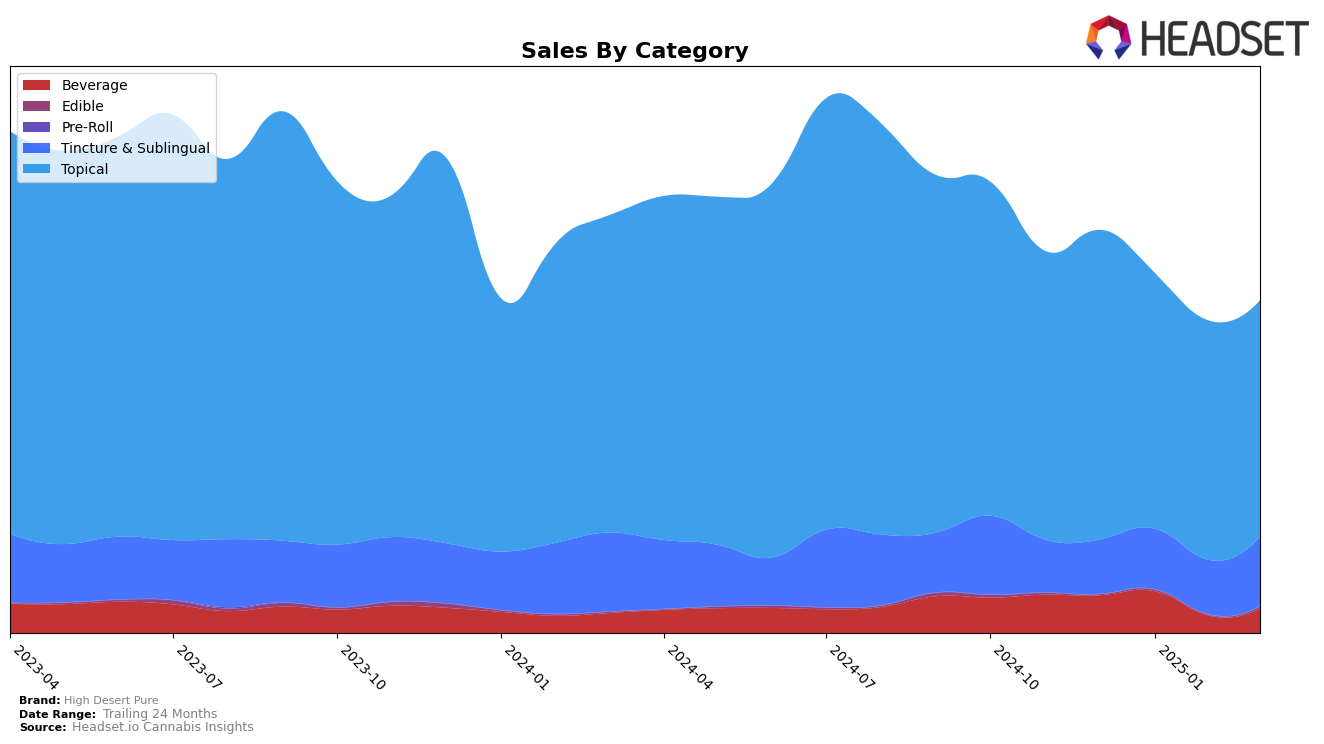

High Desert Pure has shown varied performance across different states and categories. In California, the brand's presence in the Topical category has seen a decline, moving from 9th place in December 2024 to 12th by March 2025. This downward trend is coupled with a decrease in sales, indicating potential challenges in maintaining its position in this competitive market. On the other hand, in Oregon, the brand has maintained a strong foothold in the Topical category, consistently holding the number one spot from December 2024 through March 2025. This stability suggests a strong consumer base and effective market strategies in Oregon.

In the Beverage category in Oregon, High Desert Pure has experienced some fluctuations. The brand improved its rank from 8th in December 2024 to 6th in January 2025, before dropping back to 8th in February and slightly recovering to 7th in March 2025. Despite these shifts, the brand remains within the top 10, indicating resilience in this category. Meanwhile, in the Tincture & Sublingual category in Oregon, High Desert Pure has consistently ranked within the top five, showing a solid performance with a stable consumer interest. The brand's ability to maintain its ranking in this category highlights its strong product offerings and brand loyalty among consumers.

Competitive Landscape

In the Oregon topical cannabis market, High Desert Pure has consistently maintained its dominance, securing the top rank from December 2024 through March 2025. This unwavering position highlights its strong brand presence and customer loyalty. Despite a noticeable decline in sales over these months, High Desert Pure remains significantly ahead of its closest competitor, Medicine Farm, which consistently ranks second. Meanwhile, Angel (OR) has shown a promising upward trend, moving from sixth to fourth place, indicating potential future competition. This competitive landscape suggests that while High Desert Pure is currently the leader, it must address the sales decline to maintain its top position amidst rising competitors.

Notable Products

In March 2025, the CBD/THC 1:1 Ginger Lime Lotion (750mg CBD, 750mg THC, 3.5fl oz) maintained its top position in the Topical category, with sales reaching 863 units. The CBD/THC 1:1 Clinical Strength Menthol Lotion followed as the second best-seller, consistently holding the second rank from February. The CBD/THC 1:1 Eucalyptus Balm showed an improvement, climbing to third place from fourth in February, with sales increasing to 578 units. The CBD/THC 1:1 Big Balm, despite a drop to fourth place, remains a strong performer in the Topical category. The CBD/THC/CBN 15:5:2 Hibernate Honey Almond Tincture experienced a decline in rank, dropping to fifth from its previous third position, indicating a potential shift in consumer preference within the Tincture & Sublingual category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.