Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

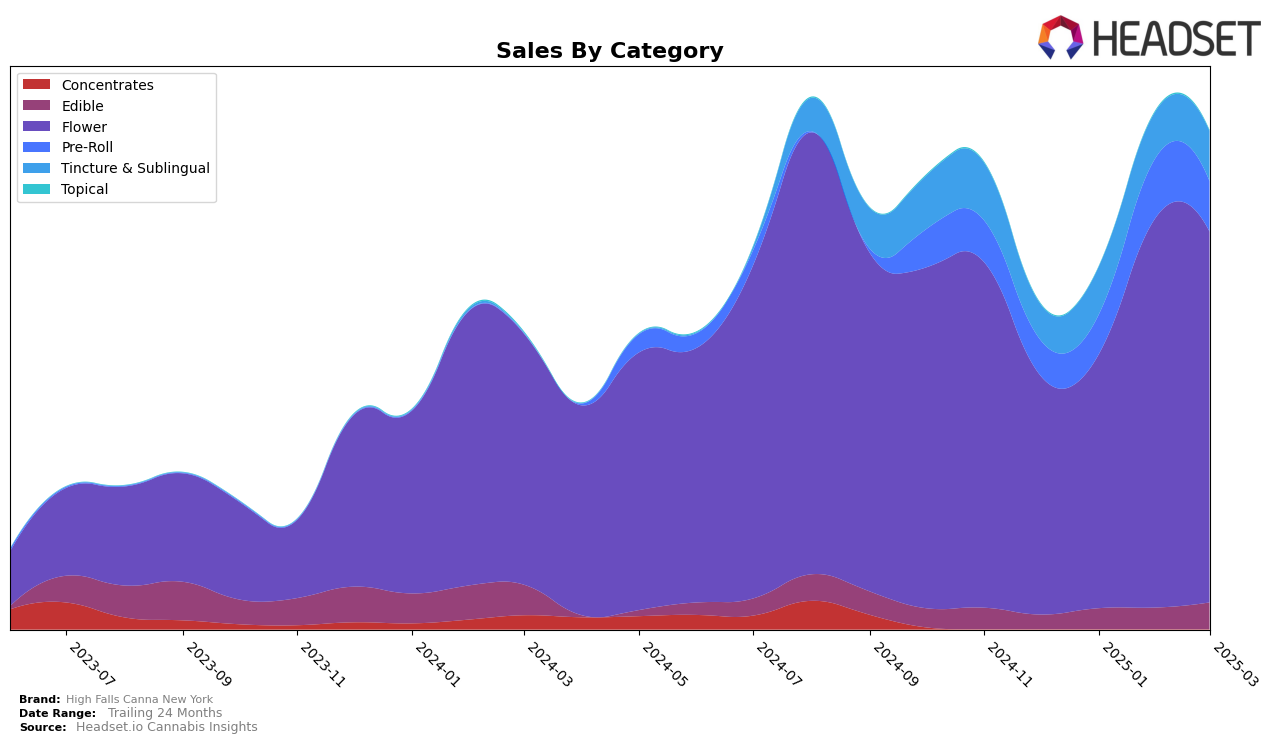

High Falls Canna New York has shown a varied performance across different product categories in the state of New York. In the Edible category, the brand has not made it into the top 30 rankings from December 2024 through March 2025, indicating a potential area for growth. However, the Flower category tells a different story, with the brand climbing from 44th place in December 2024 to 30th in February 2025, although it slightly dipped to 33rd in March 2025. This shows a strong upward trend, suggesting that their Flower products are gaining traction among consumers.

In the Pre-Roll category, High Falls Canna New York has experienced some fluctuations. Starting at 92nd place in December 2024, they improved to 73rd in February 2025 but fell back to 88th in March 2025. This indicates a volatile performance that might benefit from strategic adjustments. On a more positive note, the brand has consistently ranked within the top 10 for Tincture & Sublingual products, maintaining a strong presence with an 8th or 9th place ranking throughout the observed months. This consistent performance highlights the brand's strength in this category, potentially serving as a foundation for further market penetration.

Competitive Landscape

In the competitive landscape of the New York flower category, High Falls Canna New York has shown a promising upward trajectory in recent months. Notably, from December 2024 to March 2025, High Falls Canna New York improved its rank from 44th to 33rd, indicating a significant rise in market presence. This positive trend contrasts with competitors such as Hudson Cannabis, which experienced a gradual decline in rank from 25th to 31st over the same period. Meanwhile, Hashtag Honey maintained a relatively stable position, though it saw a slight drop from 21st to 30th. The sales growth for High Falls Canna New York, especially the jump from January to February 2025, suggests a strong consumer response to their offerings, positioning them as a rising contender in the market. This upward momentum could potentially challenge established brands like Zizzle, which saw a decline from 30th to 38th, indicating a shift in consumer preferences that favors High Falls Canna New York's products.

Notable Products

In March 2025, the top-performing product for High Falls Canna New York was Cherry Kandy Pre-Roll 1g, maintaining its consistent first-place ranking from previous months with sales reaching 1478 units. Killer Queen HV 3.5g rose impressively to the second position from fourth in February, with a notable sales figure of 1065 units. Orangeade 3.5g dropped to third place from its previous second-place ranking in February, while G13 Genius 3.5g entered the rankings for the first time at fourth place. OG Kush 3.5g remained steady in fifth position, showing a gradual increase in sales over the months. Overall, March saw dynamic shifts in product rankings, particularly within the Flower category, highlighting a competitive sales environment.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.