Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

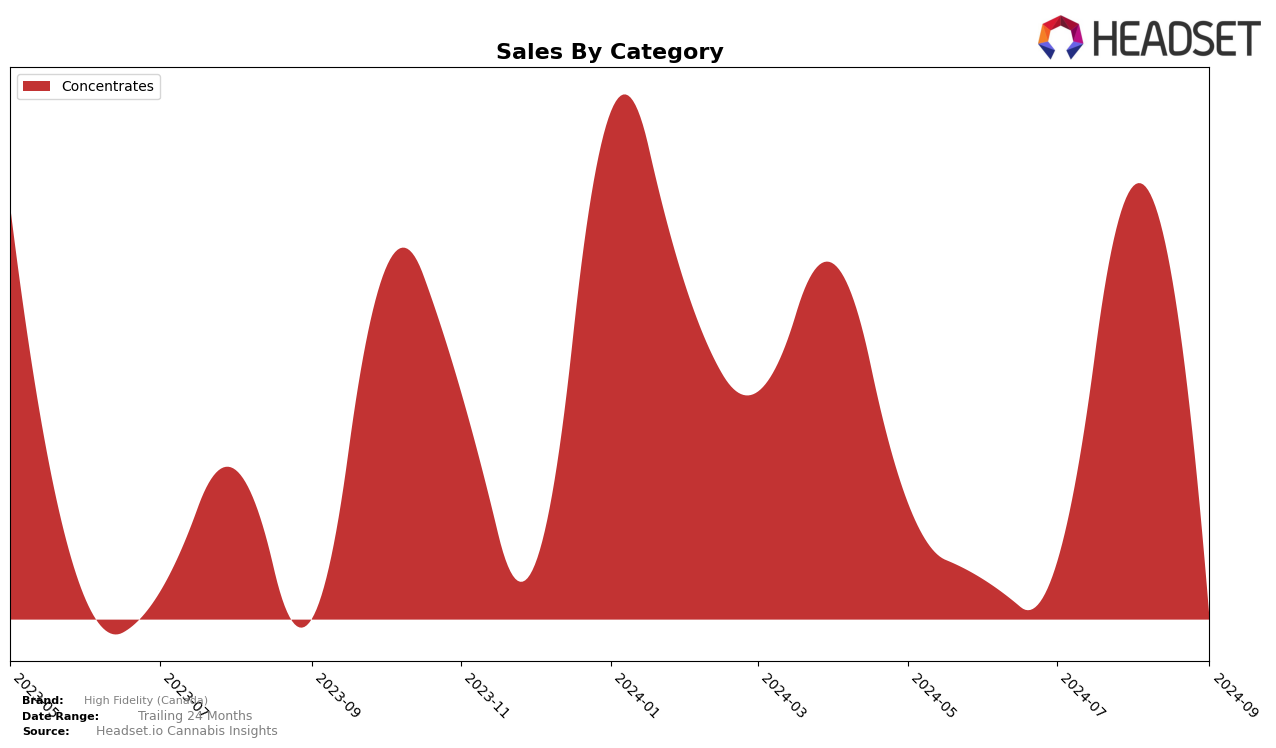

High Fidelity (Canada) has shown notable fluctuations in its performance across different categories and provinces, particularly in the Concentrates category in British Columbia. Starting in June 2024, the brand was ranked 26th, but it climbed to the 9th position by August before falling back to 24th in September. This rise and subsequent drop in rankings indicate a volatile market presence, which could be influenced by various factors such as seasonal demand or competitive activities. The peak in August, where they reached the 9th spot, suggests a significant uptick in consumer interest or effective promotional strategies during that period.

Despite the fluctuations in rankings, High Fidelity (Canada) experienced a substantial increase in sales from June to August, with sales peaking at over 75,000 in August, before seeing a decline in September. This trend highlights the brand's potential to capitalize on market opportunities, even if it struggles to maintain a consistent top-tier position. The absence of High Fidelity (Canada) from the top 30 in September could be seen as a setback, reflecting either a decrease in consumer demand or increased competition. Understanding these dynamics could provide insights into the brand's strategic adjustments and market positioning efforts in the coming months.

Competitive Landscape

In the British Columbia concentrates market, High Fidelity (Canada) experienced notable fluctuations in its rank over the past few months, highlighting a dynamic competitive landscape. In June 2024, High Fidelity (Canada) held the 26th position, but it impressively climbed to 9th place by August, demonstrating a significant surge in market presence. However, by September, it slipped back to 24th, indicating potential challenges in sustaining its momentum. This volatility is contrasted by competitors like Dymond Concentrates 2.0, which consistently hovered around the 16th to 22nd positions, and Spinello Cannabis Co., which showed a steady rise from 31st to 23rd. The sharp increase in High Fidelity (Canada)'s rank in August suggests a successful marketing or product strategy during that period, but the subsequent decline points to the need for sustained efforts to maintain competitive advantage in a market where brands like Happy Hour are also making gains, moving from 31st to 25th by September.

Notable Products

In September 2024, Gold Line - Diamonds and Sauce (1g) emerged as the top-performing product for High Fidelity (Canada) within the Concentrates category, climbing from a consistent third position in previous months to first place with sales of 131 units. Platinum Line - Rainbow Driver Live Rosin (1g) slipped to second place despite being the top product from June through August. Dosido Live Rosin (1g) maintained its presence among the top three, though it fell to third place after previously holding second. Gold Line Live Rosin (1g) improved its ranking to fourth, showing a notable increase in sales compared to previous months. Meanwhile, Platinum Line - Rainbow Driver Diamonds & Sauce (1g) dropped to fifth, indicating a shift in consumer preference towards other products within the same category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.