Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

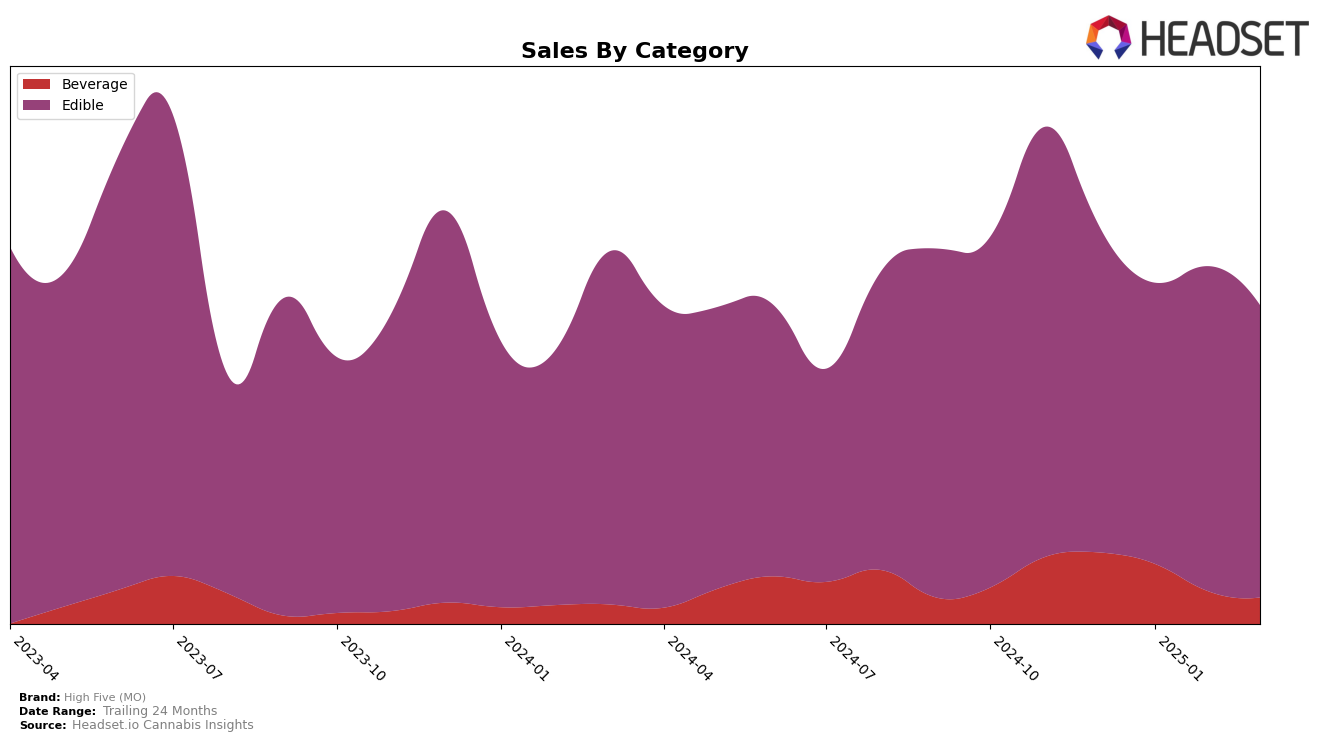

High Five (MO) has shown a notable presence in the Missouri cannabis market, particularly within the Beverage category. Over the period from December 2024 to March 2025, the brand maintained a consistent ranking of 5th place for three consecutive months before experiencing a slight dip to 6th in March 2025. This movement suggests a stable yet slightly declining performance in the Beverage category, reflecting a need for strategic adjustments to regain or enhance their position. While the raw sales figures reveal a downward trend, the brand's ability to stay within the top 10 indicates a strong foothold in this category compared to competitors.

In contrast, the Edible category presents a more fluctuating scenario for High Five (MO) in Missouri. The brand's ranking oscillated between 23rd and 27th place, with a peak at 23rd in February 2025. This variation suggests a competitive environment where High Five (MO) struggles to maintain a consistent top-tier position. Despite this, maintaining a rank within the top 30 signifies a persistent presence in the market, though the brand did not consistently secure a higher ranking. Such dynamics highlight the challenges faced in the Edible category, possibly due to changing consumer preferences or increased competition, warranting a closer examination of market strategies to enhance their standing.

Competitive Landscape

In the Missouri edible cannabis market, High Five (MO) has experienced fluctuations in its rank over the past few months, indicating a competitive landscape. In December 2024, High Five (MO) held the 24th position, but its rank dropped to 26th in January 2025, before climbing back to 23rd in February, only to fall again to 27th by March. This volatility suggests a dynamic market where consumer preferences or competitive actions are influencing brand performance. Notably, Smackers consistently outperformed High Five (MO), maintaining a rank between 22nd and 25th, while Flav showed a steady improvement, moving from 32nd to 26th over the same period. Meanwhile, Vivid (MO) remained relatively stable, hovering around the 27th to 28th positions. These shifts highlight the need for High Five (MO) to strategize effectively to regain and maintain a stronger market position amidst rising competition.

Notable Products

In March 2025, the top-performing product from High Five (MO) was the Sour Blue Raspberry High Dose Gummies 20-Pack (500mg) in the Edible category, maintaining its number one rank for three consecutive months. This product achieved sales of $906, following a peak in February. The THC/CBN 1:1 Sweet Dark Cherry Gummies 20-Pack (100mg THC, 100mg CBN) held a steady second place, demonstrating consistent demand. The CBD/THC 1:1 Sour Lemon Lime Gummies 20-Pack (100mg CBD, 100mg THC) entered the rankings in February and climbed to third place in March, showing a positive trend. Notably, the Stiribles- Unflavorable Pure Dissolvable Powder 20-Pack (100mg) improved its position from fifth to fourth place, indicating growing interest in the Beverage category.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.