Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

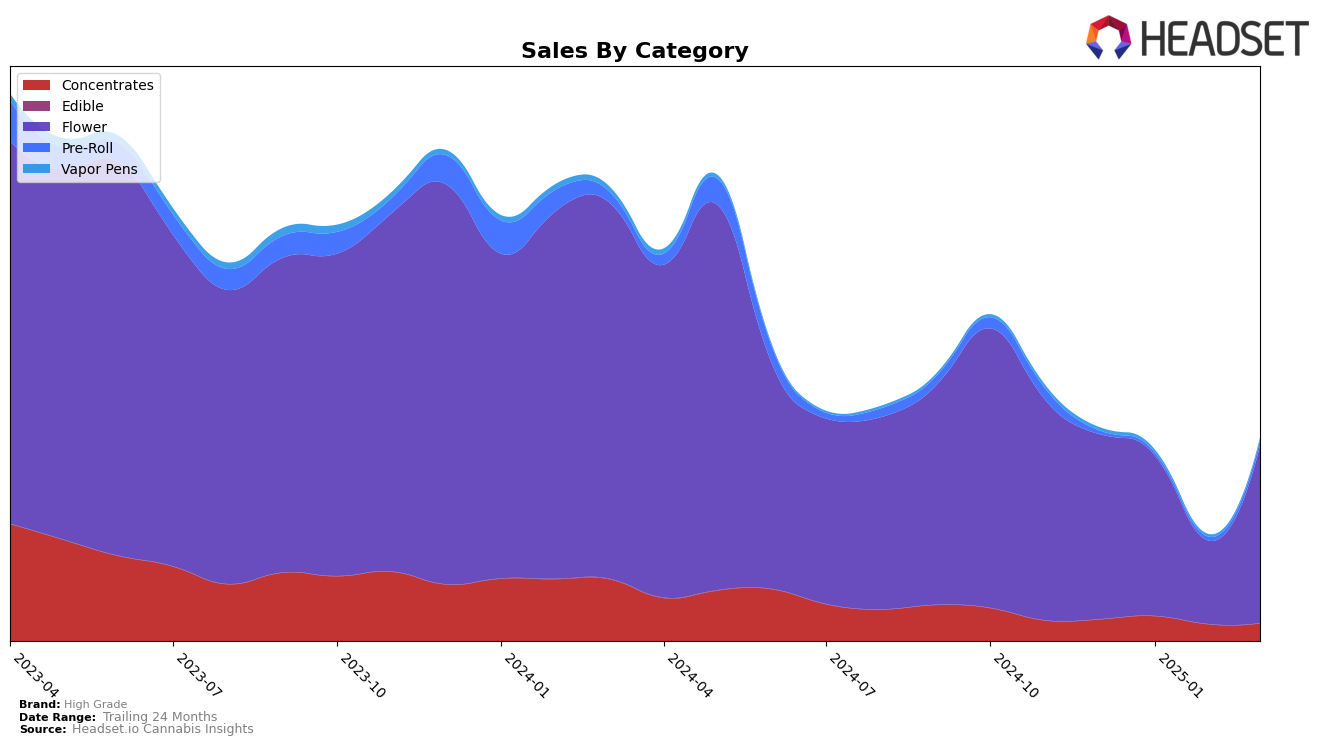

High Grade's performance in Arizona showcases notable fluctuations across different product categories. In the Concentrates category, the brand experienced a slight decline in rankings, moving from 9th place in December 2024 to 11th place by March 2025. Despite this, their sales figures remained relatively stable, indicating a consistent demand. In contrast, their Flower category saw a significant drop in February 2025, falling to 17th place, before recovering to 4th place in March. This rebound suggests a strong market presence and adaptability in the Flower category, which is crucial for maintaining their competitive edge.

In the Pre-Roll category, High Grade did not make it into the top 30 brands until March 2025, where they ranked 40th. This indicates a potential area for growth or a need for strategic adjustments to improve their standing. The absence of rankings in previous months could be seen as a challenge, but also as an opportunity to capture market share. Overall, High Grade's performance in Arizona highlights both their strengths and areas for improvement, providing insights into their strategic positioning within the state's cannabis market.

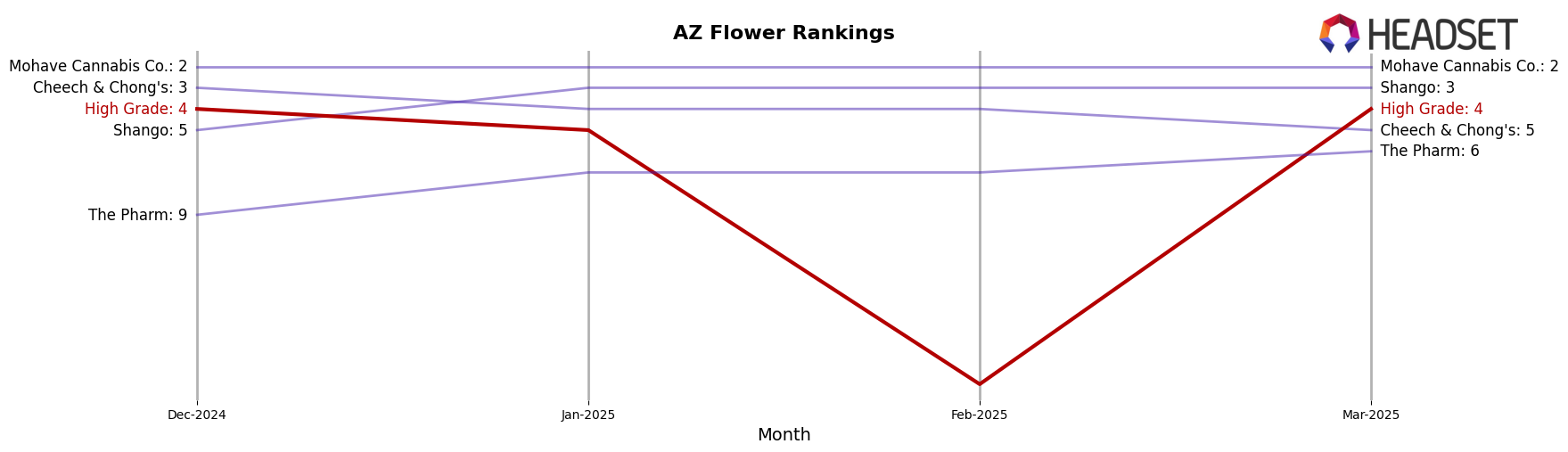

Competitive Landscape

In the competitive landscape of the Flower category in Arizona, High Grade experienced notable fluctuations in its ranking and sales over the past few months. While it started strong in December 2024 with a rank of 4th, it saw a significant drop to 17th in February 2025, indicating a temporary dip in market presence. However, by March 2025, High Grade rebounded to 4th place, showcasing resilience and a potential strategic adjustment. In contrast, Mohave Cannabis Co. maintained a consistent 2nd place ranking throughout this period, suggesting a stable and strong market position. Meanwhile, Shango improved its rank from 5th to 3rd, and Cheech & Chong's experienced a decline from 3rd to 5th. These dynamics highlight the competitive pressures High Grade faces and underscore the importance of strategic initiatives to maintain and improve its market standing in Arizona's Flower category.

Notable Products

In March 2025, the top-performing product from High Grade was Vice City (3.5g) in the Flower category, securing the number one rank with sales reaching 9,386 units. Fam 95 (3.5g) followed in second place, showing a significant jump from its first-place position in February 2025, with a notable sales figure of 7,868 units. High Grade x Exotic Genetix - Neon Sunshine (3.5g) secured the third rank, maintaining a strong presence since its debut in March. Astro Kush (3.5g) and Plasma Gas (3.5g) rounded out the top five, both new entries in the rankings for March. The rankings indicate a dynamic shift in consumer preferences from February, with Vice City (3.5g) emerging as a new leader in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.