Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

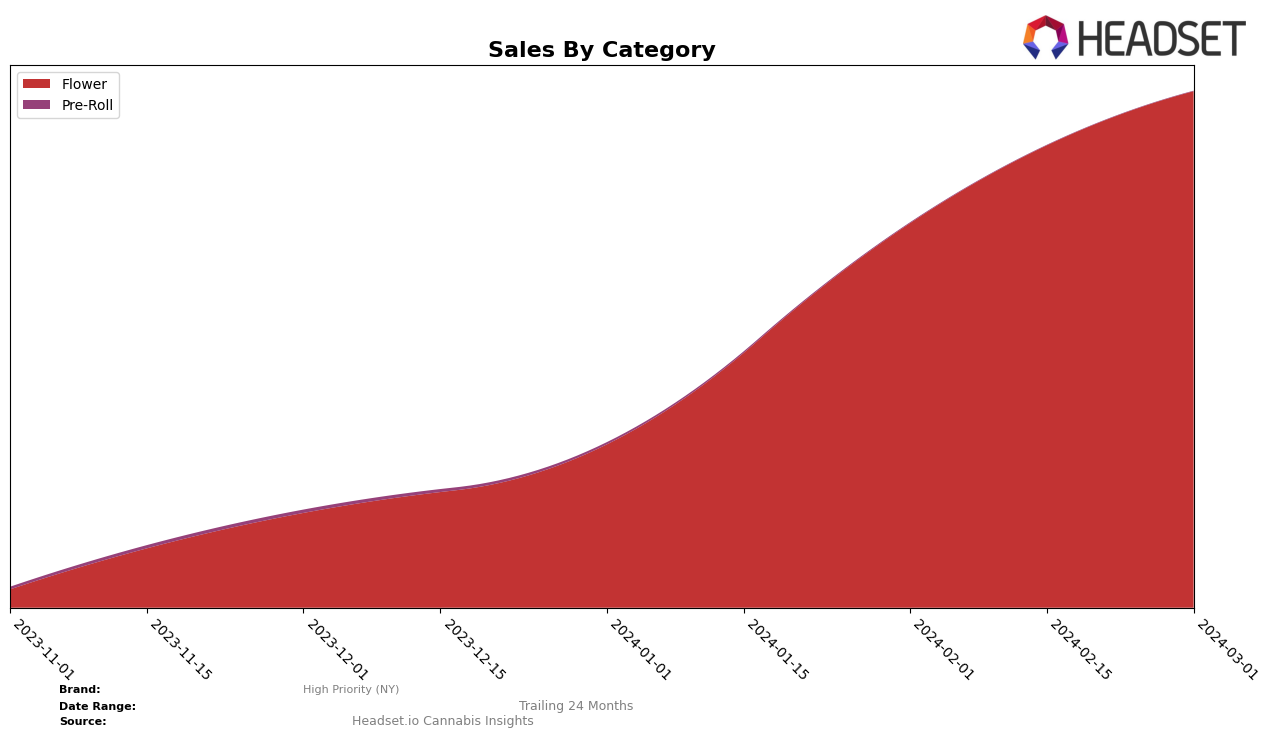

In the competitive cannabis market of New York, High Priority (NY) has shown notable performance in the Flower category, demonstrating a consistent upward trajectory over the recent months. Starting at rank 47 in December 2023 and improving each month to rank 28 by March 2024, this movement indicates a growing consumer preference and an increase in market share within this category. The sales figures underscore this positive trend, with sales jumping from 18,860 in December 2023 to an impressive 104,455 by March 2024. Such a significant increase not only highlights the brand's growing popularity but also its ability to scale operations and meet rising demand effectively.

Conversely, High Priority (NY)'s performance in the Pre-Roll category tells a different story. Initially ranked at 80 in December 2023, the brand experienced a slight dip to rank 88 in January 2024, after which it failed to make it into the top 30 brands for the subsequent months. This drop-off from the rankings can be considered a setback, indicating either a decrease in consumer interest or increased competition within the Pre-Roll category. The sales figures, decreasing from 570 in December 2023 to 346 in January 2024, further reflect the challenges faced by High Priority (NY) in maintaining its market position in this segment. This contrasting performance across categories highlights the brand's current strengths in the Flower market while underscoring areas for potential improvement in the Pre-Roll category.

Competitive Landscape

In the competitive landscape of the Flower category within New York's cannabis market, High Priority (NY) has shown a notable upward trajectory in both rank and sales, moving from not being in the top 20 in December 2023 to securing the 28th rank by March 2024. This growth trajectory places it ahead of Honest Pharm Co in the latest rankings, despite Honest Pharm Co's significant sales increase in March. However, High Priority (NY) still trails behind Aeterna, which climbed to the 26th position with a consistent increase in sales, and Aster Farms, which rebounded to the 27th rank with a notable sales jump in March. The performance of these brands, along with Old Pal which has seen a decline both in rank and sales, highlights the dynamic nature of New York's cannabis market. High Priority (NY)'s significant sales growth and improvement in rank underscore its potential and competitiveness in the market, despite the strong performances and fluctuations among its competitors.

Notable Products

In Mar-2024, High Priority (NY) saw Gastro Pop (3.5g) maintaining its top position in the Flower category with impressive sales of 930 units, marking a consistent lead across previous months. Cherry Ghost (3.5g) emerged as the second top-performing product, showing a notable rise to the second rank in February and maintaining it in March. Hawaiian Spice (3.5g) was ranked third, displaying a slight fluctuation in its sales performance but managing to climb back up from the fourth position in February. Slurricane (3.5g) secured the fourth spot, indicating a steady improvement in its rank since January. The fifth position was held by MMXX (3.5g), which saw a decline from its earlier third position in February, suggesting a shift in consumer preferences within the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.