Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

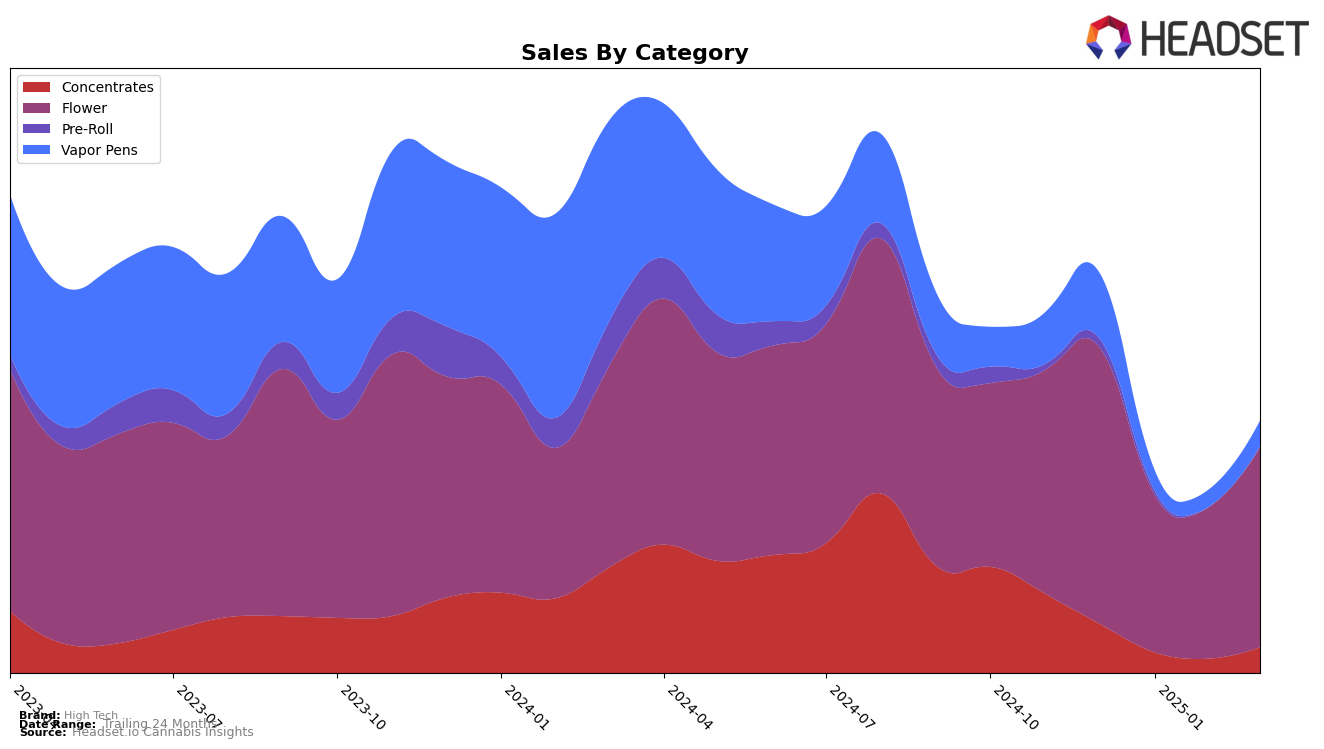

In Oregon, High Tech's performance across various product categories has shown a mix of stability and fluctuation. Notably, the brand's presence in the Flower category is significant, holding a strong position with a rank of 3 in December 2024, although experiencing a dip to rank 15 in January 2025 before recovering to rank 10 by March 2025. This indicates a resilient demand for their Flower products despite some competitive pressures. In contrast, the Concentrates category saw High Tech dropping out of the top 30 in February 2025, but the brand managed to climb back to rank 25 by March 2025, suggesting a volatile yet potentially promising market segment for future growth. The Pre-Roll category, however, presents a challenging landscape for High Tech, as the brand consistently ranked outside the top 50, indicating a need for strategic adjustments to enhance their market position.

High Tech's Vapor Pens category in Oregon reflects a steady but modest presence, with the brand maintaining a rank around the mid-40s from January to March 2025. This stability hints at a consistent customer base, although the brand's rank of 32 in December 2024 suggests there is potential to regain some lost ground. Sales trends indicate a recovery in March 2025, aligning with an upward movement in rankings across categories, except for Pre-Rolls. This mixed performance across categories highlights both opportunities and challenges for High Tech, as they navigate the complexities of the competitive cannabis market in Oregon. The fluctuations in rankings across different product categories underscore the importance of strategic focus and adaptability in maintaining and expanding market share.

Competitive Landscape

In the competitive landscape of the Oregon flower market, High Tech has experienced notable fluctuations in its ranking and sales performance from December 2024 to March 2025. Initially, High Tech held a strong position at rank 3 in December 2024, but faced a significant drop to rank 15 in January 2025, indicating potential challenges in maintaining its market share. However, the brand showed resilience by climbing back to rank 10 by March 2025. In comparison, Emerald Fields Cannabis demonstrated a remarkable recovery, moving from rank 22 in January 2025 to rank 8 by March 2025, suggesting a strong upward trend in sales. Meanwhile, Cannabis Nation INC maintained a relatively stable position, with a slight decline from rank 7 in December 2024 to rank 11 in March 2025. Deep Creek Gardens and Kaprikorn also showed varying degrees of rank changes, with Kaprikorn improving to rank 9 by March 2025. These dynamics suggest that while High Tech faces stiff competition, its ability to rebound in rankings highlights its potential to regain a stronger foothold in the market.

Notable Products

In March 2025, Lemon Pepper Pre-Roll (0.5g) emerged as the top-performing product for High Tech, climbing from the second position in February to the first, with notable sales of 2781 units. Fine Vintage Cured Resin (1g) made a significant debut, securing the second rank with impressive sales figures. Truffle Driver (Bulk) and Lambs Breath (3.5g) followed, ranking third and fourth, respectively, while Noti Skunk (3.5g) rounded out the top five. Notably, Lemon Pepper Pre-Roll (0.5g) showed a consistent upward trend, improving its rank from third in January to first in March. The introduction of Fine Vintage Cured Resin (1g) in March indicates a strategic expansion in the Concentrates category for High Tech.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.