Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

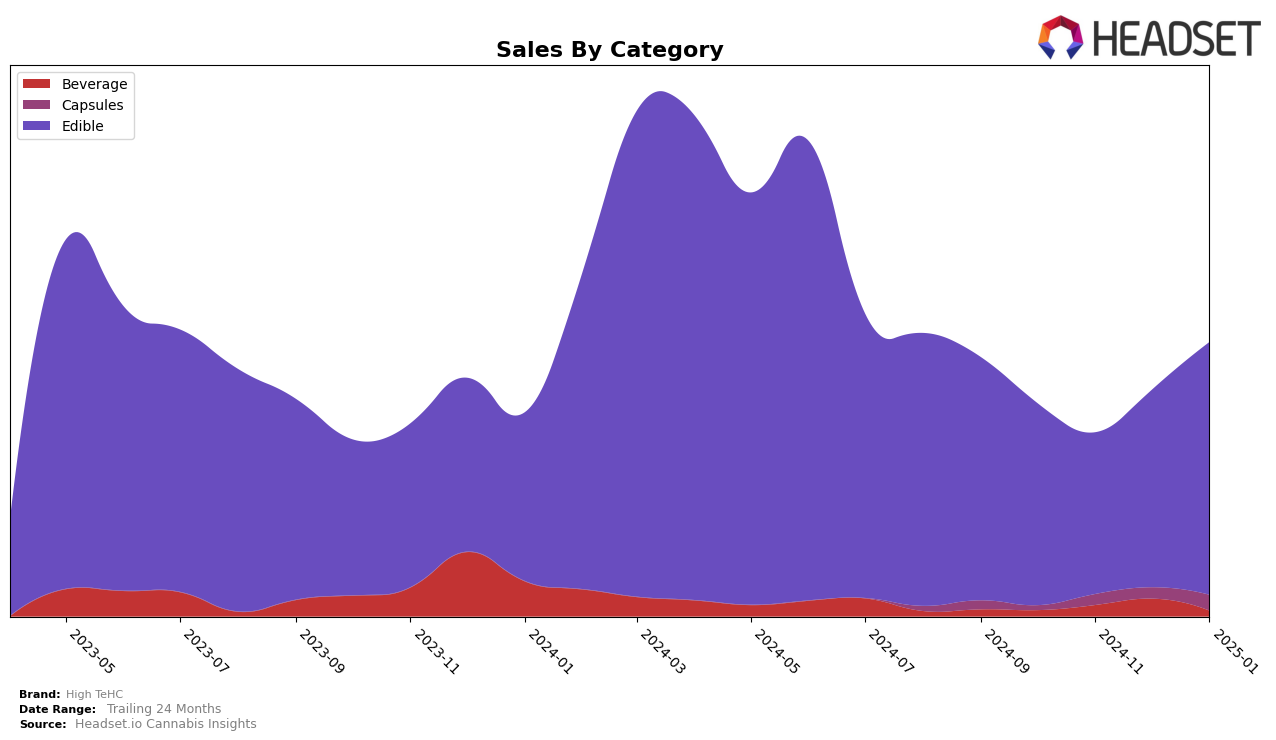

High TeHC has demonstrated notable fluctuations in its performance across different categories and states. In the Edible category within Michigan, the brand has shown a gradual improvement in its ranking, moving from 67th in October 2024 to 64th by January 2025. This upward trend is indicative of a positive reception among consumers, as reflected in the increase in sales from $38,459 in October to $48,103 in January. However, it's important to note that High TeHC has not yet broken into the top 30 brands in this category, suggesting there is still significant room for growth and increased market penetration.

Despite the progress in Michigan, High TeHC's absence from the top 30 brands in other states and categories could imply varying levels of brand recognition and market strategy effectiveness. The lack of presence in the top rankings outside Michigan might be seen as a challenge, but it also presents an opportunity for the brand to explore and expand its reach in other regions. Understanding the consumer preferences and competitive landscape in these areas could provide valuable insights for strategic planning and potential market entry. The brand's ability to adapt and innovate will be crucial in determining its future trajectory across different markets.

Competitive Landscape

In the Michigan edible cannabis market, High TeHC experienced notable fluctuations in its ranking and sales over the observed months. Starting at 67th place in October 2024, High TeHC dropped to 76th in November before recovering to 70th in December and further improving to 64th by January 2025. This recovery in rank coincided with a significant increase in sales from November to January, suggesting a successful strategy or product launch during this period. In comparison, Fresh Coast consistently outperformed High TeHC, maintaining a higher rank and showing strong sales, particularly in December. Meanwhile, Five Star Extracts and Traphouse Cannabis Co. showed less stability, with Traphouse Cannabis Co. missing from the top 20 in October and December, indicating potential volatility in their market presence. High TeHC's ability to climb back in rank and increase sales amidst competitive pressures highlights its resilience and potential for growth in the Michigan edible market.

Notable Products

In January 2025, High TeHC's top-performing product was the Sleep - THC/CBN 1:2 Wildberry Drift Chamomile Gummies 20-Pack, maintaining its position at rank 1 with notable sales of 868 units. The Boost - Lemon Delight Gummies 20-Pack climbed to the second spot, up from fourth place in the previous months, demonstrating a significant increase in popularity. The Kick - THC/THCV Berry Bomb Gummies held steady at rank 3, showing consistent performance over the months. Meri Melon Sugar Free Gummies saw a rise to fourth place, recovering from a dip to fifth in December. Meanwhile, the Now-N-Later - Pineapple Crush Hybrid Gummies dropped to fifth place, reflecting a decrease in sales momentum compared to its previous higher ranks.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.