Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

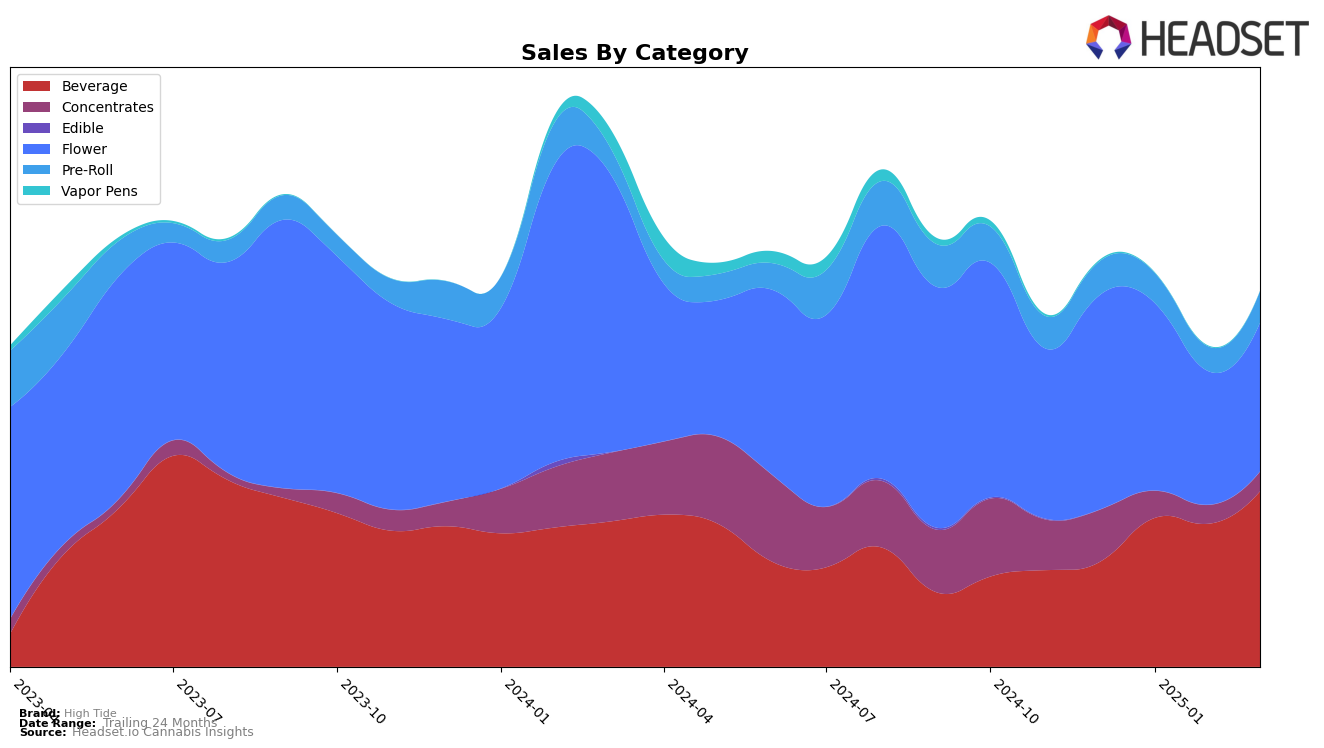

High Tide's performance in the Arizona beverage category has shown consistent strength, maintaining a solid third-place ranking from December 2024 through March 2025. This steady position highlights High Tide's strong market presence and consumer preference in Arizona's competitive beverage sector. Notably, there was a significant uptick in sales from December to March, indicating a positive growth trajectory in this category. This trend suggests that High Tide's beverage offerings are resonating well with consumers, potentially driven by effective product innovation or marketing strategies.

In contrast, High Tide's performance in Washington presents a more mixed picture across categories. Within the concentrates category, High Tide did not secure a position in the top 30 rankings for February and March 2025, which may indicate challenges in maintaining market share or increased competition. The flower category also reflects fluctuations, with High Tide dropping out of the top 30 in February before reappearing at the 97th position in March. This variability suggests potential volatility in consumer demand or competitive pressures that High Tide might need to address to stabilize and improve its market standing in Washington.

Competitive Landscape

In the competitive landscape of the beverage category in Arizona, High Tide consistently held the third rank from December 2024 to March 2025. Despite maintaining its position, High Tide faces significant competition from Keef Cola and Sip Elixirs, which have dominated the first and second ranks, respectively, throughout the same period. While High Tide's sales showed a positive upward trend, increasing from December to March, it still trails behind the top competitors by a considerable margin. Notably, Nebula and tonic have shown fluctuating ranks, with tonic making a significant leap to fifth place in March. This dynamic market environment suggests that while High Tide is stable in its position, there is potential for shifts in rank if it can capitalize on its sales growth momentum and differentiate itself further from its competitors.

Notable Products

In March 2025, the Raspberry Lemon THC Seltzer (10mg THC) maintained its position as the top-performing product for High Tide, with sales reaching 4,889 units. The Pineapple Passion Fruit THC Seltzer (10mg THC) experienced a notable rise, moving up from fourth place in previous months to secure the second rank. Black Cherry Seltzer (10mg) consistently held the third position, showing stable performance. Peach Mango Seltzer Beverage (10mg THC, 12oz) followed closely, ranking fourth in March, consistent with its performance over the past months. The CBD/CBC/THC 1:1:1 Black Cherry Seltzer (10mg CBD, 10mg CBC, 10mg THC) maintained its fifth place ranking, indicating steady demand for this product blend.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.