Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

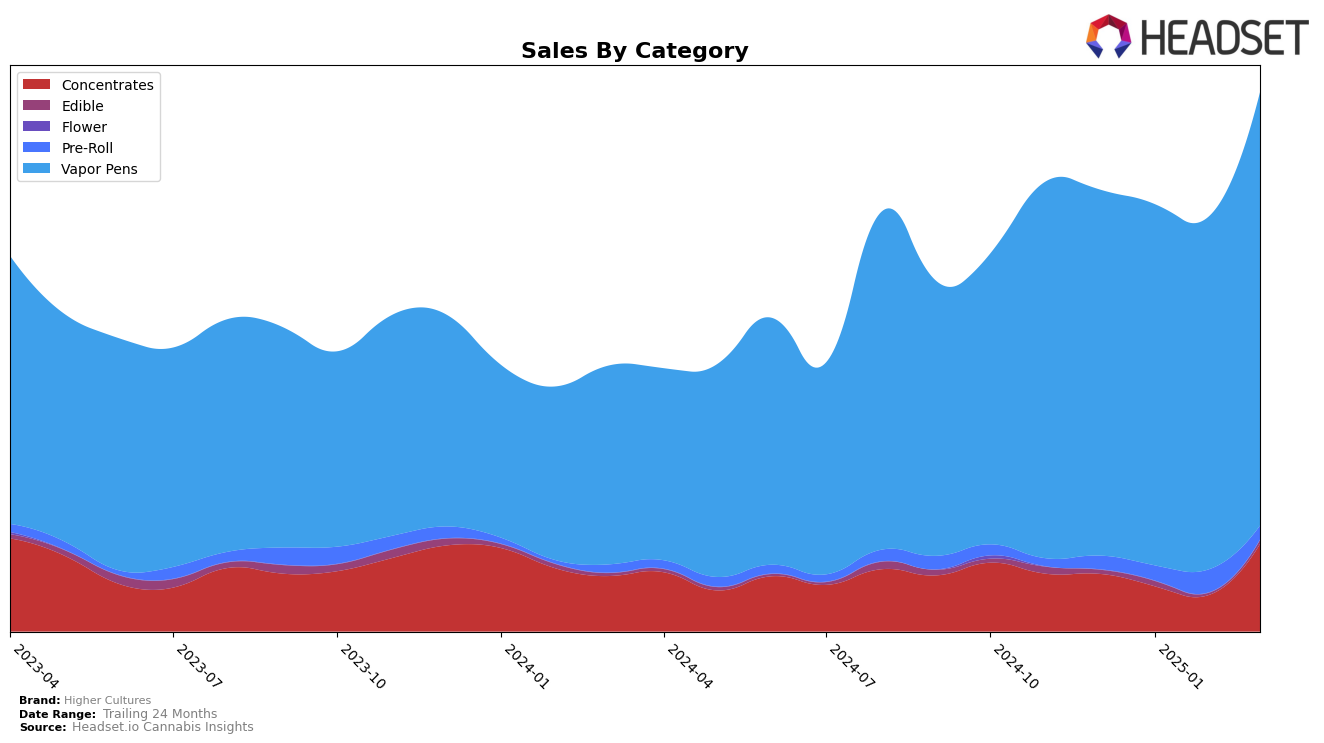

Higher Cultures has shown a notable performance in the state of Oregon across several product categories. In the Concentrates category, the brand experienced significant upward momentum, climbing from rank 23 in January 2025 to rank 12 by March 2025. This improvement is indicative of a strong market presence and possibly a strategic shift that bolstered their sales, which more than doubled from February to March 2025. Conversely, in the Pre-Roll category, Higher Cultures struggled to break into the top 30, with ranks fluctuating outside this range, peaking at 53 in February 2025 before dropping back to 69 in March. Such fluctuations might suggest challenges in maintaining a consistent consumer base for this product line.

In the Vapor Pens category, Higher Cultures maintained a steady performance, consistently ranking within the top 10 throughout the observed period. This stability, with ranks oscillating between 8 and 9, highlights a strong foothold in the market and suggests a loyal customer base. Interestingly, despite a slight dip in sales from December 2024 to February 2025, the brand rebounded strongly in March, indicating effective strategies in place to address any temporary setbacks. The consistency in rankings, coupled with the eventual sales boost, underscores the brand's resilience and potential for continued success in this category within Oregon.

Competitive Landscape

In the competitive landscape of vapor pens in Oregon, Higher Cultures has shown a consistent presence, maintaining a rank within the top 10 from December 2024 to March 2025. Despite a slight dip in January 2025, where it ranked 9th, Higher Cultures rebounded to 8th place by March 2025, indicating a positive trend in market performance. However, competitors like Hellavated and FRESHY have maintained stronger positions, with Hellavated consistently ranking 6th and FRESHY showing a steady improvement, securing the 6th position in January 2025. Farmer's Friend Extracts also poses a significant challenge, climbing to 7th place in January 2025 before settling at 9th in March 2025. The competitive pressure from these brands, particularly in terms of sales growth, suggests that Higher Cultures needs to strategize effectively to enhance its market share and improve its ranking in the coming months.

Notable Products

In March 2025, the top-performing product for Higher Cultures was the Blue Razz Flavoured Distillate Cartridge (1g) in the Vapor Pens category, which rose to the first rank with sales of 1412. The Pink Lemonade Flavored Distillate Cartridge (1g) ranked second, showing a decline from its top position in February. Wedding Cake Flavored Distillate Cartridge (1g) maintained its consistent third rank from the previous month. Strawnana Flavored Distillate Cartridge (1g) reappeared in the rankings at fourth, having been unranked in February. Rocket Pop Flavored Distillate Cartridge (1g) dropped to fifth place, a notable decline from its second rank in February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.