Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

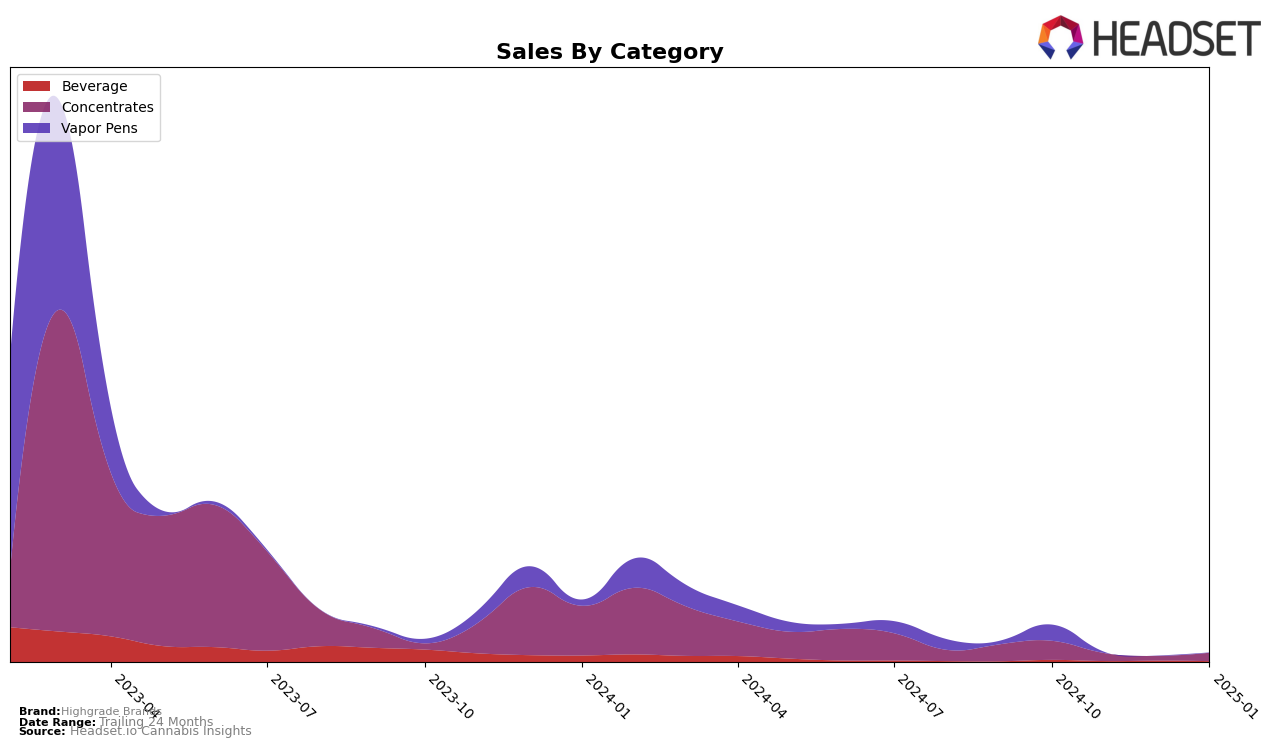

Highgrade Brands has shown fluctuating performance across various categories and states, with noteworthy movements particularly in the Concentrates category. In British Columbia, the brand was ranked 38th in October 2024 for Concentrates but did not make it into the top 30 in the following months. This drop from the rankings could suggest increased competition or a shift in consumer preferences within the category. It's important to note that not being in the top 30 across subsequent months indicates a significant area for potential improvement or strategic adjustment for Highgrade Brands.

The absence of Highgrade Brands from the top 30 in other states and categories during the analyzed period suggests potential challenges or opportunities for expansion and increased market penetration. While specific sales figures beyond the initial month are not disclosed, the initial sales figure of 10,382 CAD in October 2024 in British Columbia provides a benchmark for assessing future growth or decline. Monitoring these trends over subsequent months could offer deeper insights into the brand's market dynamics and help identify strategic areas for growth or realignment in the competitive landscape.

Competitive Landscape

In the competitive landscape of cannabis concentrates in British Columbia, Highgrade Brands has faced significant challenges in gaining a foothold. Notably, it did not make it into the top 20 ranks from October 2024 through January 2025, indicating a struggle to capture market share. In contrast, brands like Phyto Extractions and RAD (Really Awesome Dope) maintained a presence in the top 40, with Phyto Extractions experiencing a notable decline from 18th to 40th place by January 2025. Meanwhile, Nugz consistently outperformed others, remaining within the top 13 until December 2024. The sales trajectory for Highgrade Brands, while not explicitly ranked, suggests a need for strategic adjustments to compete with these established players, especially as competitors like Spinello Cannabis Co. also demonstrate fluctuating but persistent market presence.

Notable Products

In January 2025, Black Gas Resin (1g) from the Concentrates category maintained its top position for Highgrade Brands, continuing its consistent performance from previous months. Hawaiian Snow Live Resin (1g) rose to the second spot in the Concentrates category, with a notable increase in sales, reaching 50 units. Pineapple Rosin Syrup (100mg) in the Beverage category ranked third, dropping from its previous second position in December 2024. The Black Gas Indica Live Resin Cartridge (1g) and Peach Rosin Syrup (100mg) did not appear in the top rankings for January 2025, indicating a decline from their earlier standings. Overall, the Concentrates category showed strong performance, with Hawaiian Snow Live Resin seeing a significant boost in sales and ranking.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.