Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

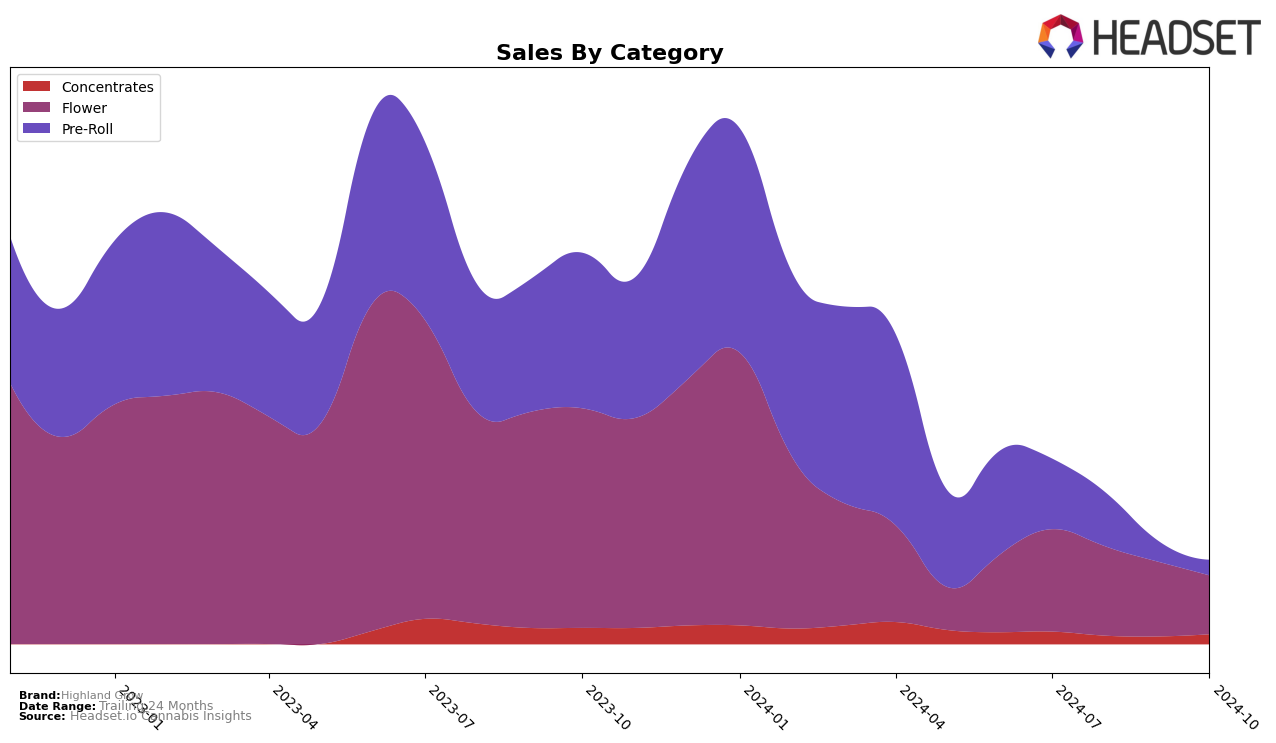

Highland Grow's performance in the Ontario market has shown some intriguing trends across different product categories. In the Concentrates category, Highland Grow did not make it into the top 30 rankings from July to October 2024, indicating a potential area for growth or increased competition in this segment. Meanwhile, their performance in the Flower category experienced a decline, dropping from 80th in July to 94th by September, before completely falling out of the top 30 by October. This downward trend could suggest challenges in maintaining market share or possibly a shift in consumer preferences. The Pre-Roll category also saw Highland Grow absent from the top 30 rankings, which may highlight a similar competitive pressure or other strategic considerations.

Despite the lack of top 30 presence in these categories, Highland Grow's raw sales figures in the Flower category reveal a downward trajectory, with sales decreasing from approximately $111,769 in July to $81,499 in September. This decline in sales aligns with their drop in rankings, suggesting a direct impact on their market position. It's important to note that while Highland Grow's presence in the Concentrates and Pre-Roll categories is not as prominent, there could be underlying factors influencing these outcomes, such as distribution strategies or product innovation. For those interested in a deeper dive into Highland Grow's strategies and market performance, further analysis would be required to uncover more nuanced insights.

Competitive Landscape

In the Ontario concentrates market, Highland Grow has experienced notable fluctuations in its competitive positioning. As of July 2024, Highland Grow was ranked 55th, but it did not maintain a top 20 position in subsequent months, indicating a potential decline in market visibility. In contrast, Daily Special and Stigma Grow also did not secure top 20 rankings, although Stigma Grow showed a positive trend, improving from 58th in August to 54th in October. Meanwhile, Greybeard and Carmel have maintained stronger market positions, with Carmel consistently ranking within the top 30, suggesting a more robust market presence. Greybeard's sales, while declining from July to August, still outpaced Highland Grow's, highlighting a competitive challenge. These dynamics suggest that Highland Grow may need to reassess its strategies to enhance its competitive edge and regain market share in the concentrates category in Ontario.

Notable Products

In October 2024, the top-performing product for Highland Grow was Frostbite Iced Infused Blunt (1g) in the Pre-Roll category, climbing to the number one rank with sales of 533 units. Paulander Purple (7g) in the Flower category held the second position, although it experienced a drop from its top rank in September. Dankarooz (3.5g), also in the Flower category, improved its position to third, showing a consistent upward trend from August. Rainbow Shades Pre-Roll 3-Pack (1.5g) fell to the fourth position, continuing its decline from the first position in July and August. Notably, Paulander Purple (14g) made its debut in the rankings at fifth place in October.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.