Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

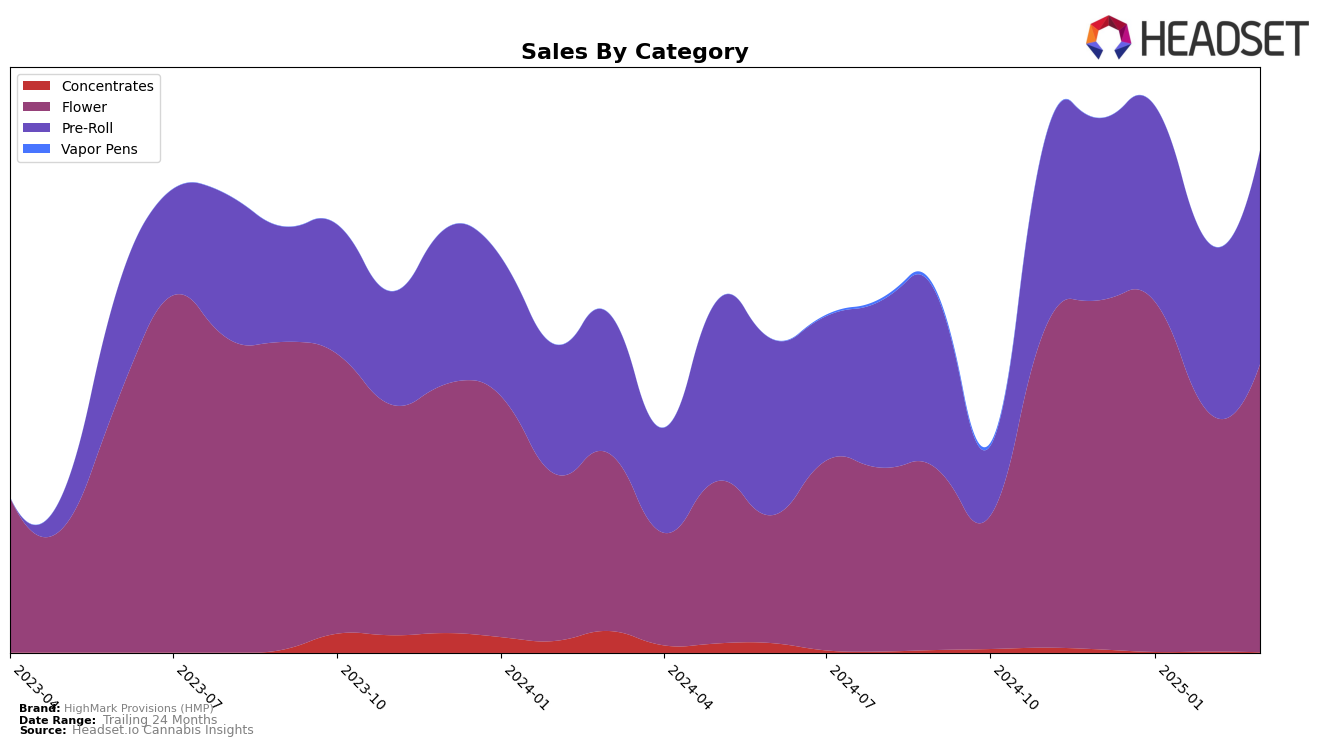

HighMark Provisions (HMP) has shown varied performance across different categories in Massachusetts. In the Flower category, HMP experienced a slight fluctuation in rankings, moving from 31st in December 2024 to 30th in January 2025, before dropping out of the top 30 in February and March 2025. This indicates a potential challenge in maintaining a competitive edge in the Flower market, especially as they were unable to secure a top 30 position in the latter months. Despite this, their sales figures show some resilience, with a notable recovery in March 2025 after a dip in February, suggesting that while their rank may have slipped, there is still a demand for their products.

In contrast, the Pre-Roll category presents a more consistent performance for HighMark Provisions (HMP) in Massachusetts. Starting from a 33rd position in December 2024, HMP improved to 26th in January 2025, and maintained a presence in the top 30 through March 2025. This positive trend indicates a strengthening foothold in the Pre-Roll market, with sales figures reflecting an upward trajectory, particularly in March 2025. The ability to maintain and slightly improve their ranking in this category suggests a strategic focus that could potentially be leveraged to regain ground in other categories as well.

Competitive Landscape

In the competitive landscape of the Massachusetts flower category, HighMark Provisions (HMP) experienced a fluctuating performance from December 2024 to March 2025. Starting at rank 31 in December 2024, HMP improved slightly to rank 30 in January 2025, but then saw a dip to rank 40 in February before recovering to rank 35 in March. This volatility in rank is mirrored in its sales trends, suggesting potential challenges in maintaining consistent market presence. In contrast, Grassroots showed a steady upward trajectory, moving from rank 39 to 32 over the same period, indicating a strengthening position in the market. Meanwhile, Mini Budz made a significant leap from being outside the top 20 to rank 36 by March, highlighting a rapid increase in market penetration. The Botanist also demonstrated notable improvement, climbing from rank 45 to 31, suggesting effective strategies in capturing consumer interest. Finally, Tower Three maintained a more stable presence, with minor fluctuations, ending at rank 37 in March. These dynamics indicate that while HMP remains a competitive player, it faces significant challenges from brands like Grassroots and The Botanist, which are gaining traction in the Massachusetts flower market.

Notable Products

In March 2025, the top-performing product from HighMark Provisions (HMP) was Purple Champagne Pre-Roll (1g), which reclaimed its top spot from December 2024 after slipping to third place in January and second in February. Grape Glaze Pre-Roll (1g) entered the rankings for the first time, securing the second position with notable sales figures of 1948 units. Cherry Octane Pre-Roll (1g) dropped from its leading position in February to third in March, indicating a slight decline in sales momentum. Cinderella Cream Pre-Roll (1g) maintained its fourth position from February to March, showing consistent performance. Black Ice Pre-Roll (1g) rounded out the top five, despite a slight drop from third place in February, reflecting a decrease in sales volume.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.