Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

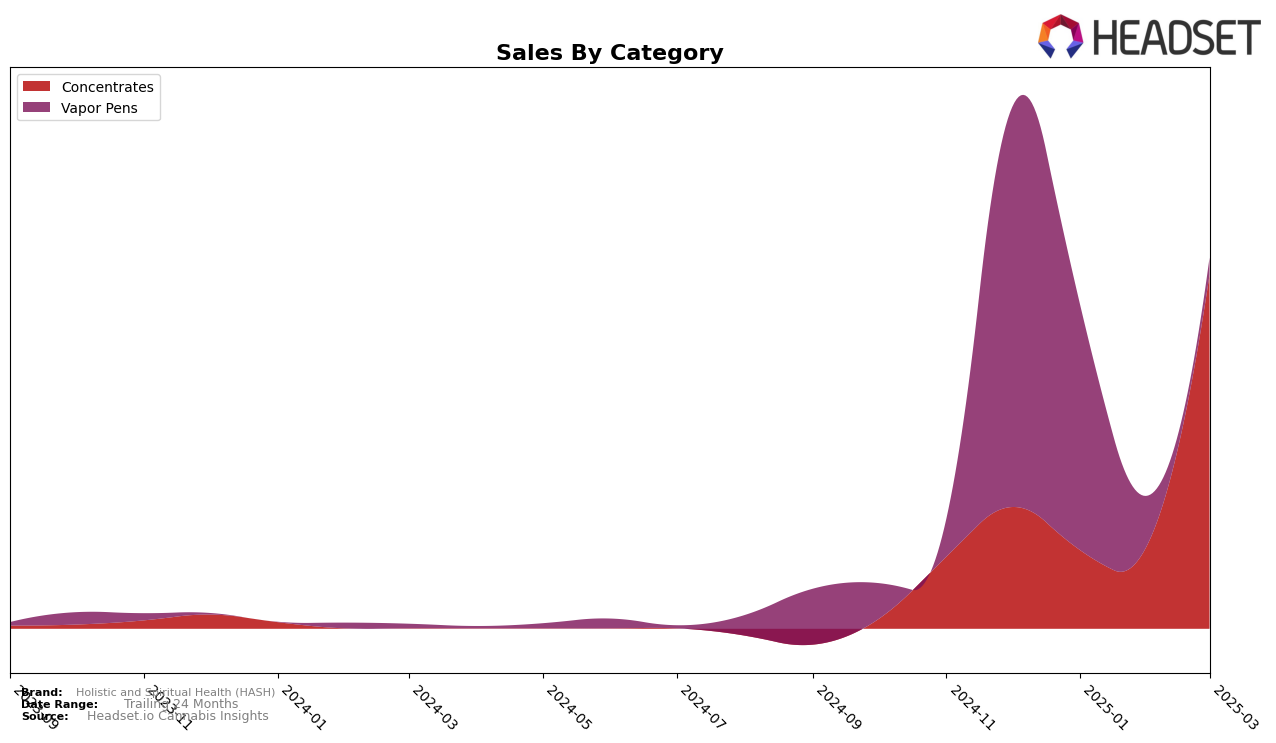

Holistic and Spiritual Health (HASH) has shown notable performance in the Ohio market, particularly in the Concentrates category. The brand's ranking improved significantly from 23rd in February 2025 to 11th in March 2025, reflecting a strategic push that resulted in a substantial increase in sales, climbing from $20,549 in February to $85,354 in March. This upward movement indicates a strong market presence and growing consumer preference for HASH's concentrate products. However, the brand's performance in the Vapor Pens category in Ohio has been less impressive, as it failed to make it into the top 30 rankings by March 2025, highlighting a potential area for improvement or strategic realignment.

The data suggests that while Holistic and Spiritual Health (HASH) has successfully capitalized on the Concentrates category in Ohio, there is a noticeable decline in the Vapor Pens category, where the brand dropped from 38th in December 2024 to outside the top 30 by March 2025. This shift could be attributed to intensified competition or changing consumer preferences in the vapor pen market segment. Despite this, the brand's ability to rebound in concentrates indicates a resilient market strategy that could be leveraged to address challenges in other categories. The contrasting performance across these categories provides a nuanced view of HASH's market dynamics and potential areas for growth and innovation.

Competitive Landscape

In the Ohio concentrates market, Holistic and Spiritual Health (HASH) has shown a dynamic shift in its competitive positioning from December 2024 to March 2025. Initially ranked 18th in December 2024, HASH experienced a dip, falling out of the top 20 in January and February 2025. However, by March 2025, HASH made a significant comeback, climbing to the 11th position. This resurgence in rank is indicative of a substantial increase in sales, more than quadrupling from February to March. In contrast, competitors like Superflux maintained a relatively stable presence, consistently ranking within the top 10, while Buckeye Relief re-entered the top 20 in March after missing the January and February rankings. Meanwhile, Hundred Percent Labs and HZ demonstrated gradual improvements, with HZ notably advancing from 23rd in December to 13th in March. These fluctuations highlight the competitive nature of the Ohio concentrates market and suggest that HASH's recent strategic initiatives may be effectively driving its market performance.

Notable Products

In March 2025, the top-performing product for Holistic and Spiritual Health (HASH) was Blueberry Muffin Live Resin Sugar (1g) in the Concentrates category, achieving the number one rank with notable sales of 804 units. Cake Crasher Live Rosin Badder (1g) held the second position, improving from its first-place rank in February. Frosted Enigma Live Rosin Badder (1g) climbed to third place from fourth in February, showing a positive sales trend. Cara Cookies Live Rosin Disposable (0.5g) in the Vapor Pens category advanced to fourth place, while Cara Cara Live Rosin Disposable (0.5g) maintained a consistent rank at fifth from January through March. Overall, the Concentrates category dominated the top ranks, indicating a strong preference shift from Vapor Pens in previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.