Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

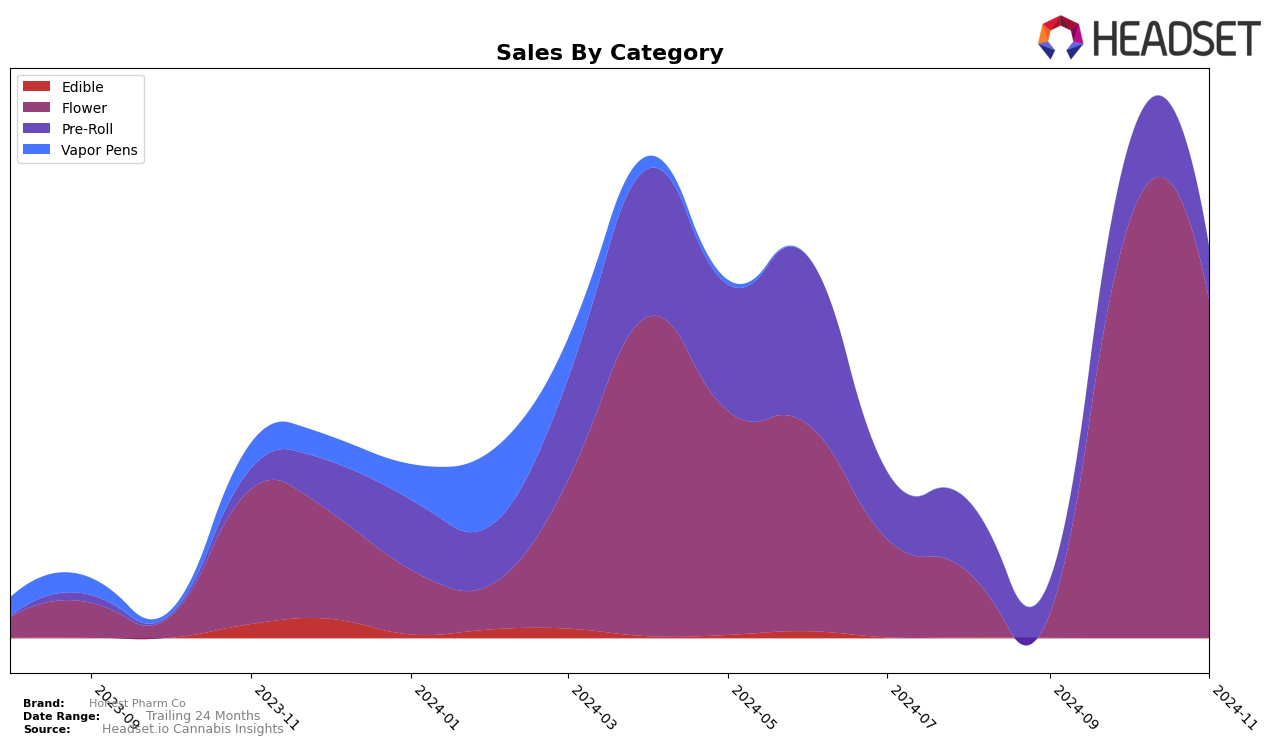

Honest Pharm Co has shown notable progress in the New York market, particularly in the Flower category. The brand made a significant leap in rankings from being outside the top 30 in August to securing the 28th position in both October and November. This upward trajectory indicates a strengthening presence in the Flower category, with sales peaking at over $250,000 in October. This consistent ranking suggests that Honest Pharm Co is gaining traction and possibly capturing a loyal customer base in New York.

In contrast, the performance of Honest Pharm Co in the Pre-Roll category in New York has been more volatile. The brand's ranking fluctuated, starting at 65th in August, dropping to 88th in September, and then improving to 62nd in October before slipping again to 71st in November. These shifts could indicate challenges in maintaining a steady market position or adapting to competitive pressures in the Pre-Roll segment. While the sales figures provide some insight into their market performance, the varying rankings suggest that Honest Pharm Co might need to strategize differently to stabilize and enhance its presence in this category.

Competitive Landscape

In the competitive landscape of the New York flower category, Honest Pharm Co has shown a notable improvement in its market position over recent months. After not ranking in the top 20 in August 2024, the brand made a significant leap to rank 28th in October and maintained this position in November. This upward trajectory in rank is indicative of a positive shift in sales performance, contrasting with brands like House of Sacci, which saw a decline from 24th to 29th place from October to November. Meanwhile, Gypsy Weed has shown a steady improvement, surpassing Honest Pharm Co by moving from 32nd to 27th place in November. Alchemy Pure remained stable at 26th place, slightly ahead of Honest Pharm Co. These dynamics suggest that while Honest Pharm Co is gaining traction, it faces stiff competition from both established and emerging brands in the New York market.

Notable Products

In November 2024, Honest Pharm Co's top-performing product was Forbidden Bliss 14g in the Flower category, maintaining its number one rank with sales of $1,498. Tropical Thunder Pre-Roll 1g climbed to the second position, improving from its previous third-place ranking. Forbidden Bliss 3.5g also showed a positive trend, moving up to the third spot from fourth. Gold Rush Blunt 1g experienced a decline, dropping from second to fourth place. Midnight Snack Kief Dusted Infused Pre-Roll 1g continued its downward trajectory, falling from the top position in August and September to fifth place by November.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.